What Is $9.99 Euros In Dollars & How To Convert?

$9.99 Euros In Dollars is approximately $10.70 USD, as of October 26, 2023, but this fluctuates constantly. Are you curious about the current exchange rate and the easiest way to convert euros to dollars? At euro2.net, we provide up-to-the-minute exchange rates, historical data, and powerful conversion tools to help you stay informed and make smart financial decisions. Explore real-time rates, currency trends, and gain insights into currency valuation today.

1. Understanding Currency Exchange

What exactly is currency exchange, and why is it essential in today’s globalized world?

Currency exchange is the process of converting one currency into another. In essence, it’s the mechanism that facilitates international trade, investment, and tourism. Since each country typically has its own currency, currency exchange becomes necessary when you engage in transactions that involve different currencies. Whether you’re purchasing goods from a foreign vendor or traveling abroad, currency exchange allows you to pay in the local currency. Financial institutions, such as banks and currency exchange services, act as intermediaries in this process, buying and selling currencies to facilitate these transactions. These services often charge a conversion fee to cover their operational costs and generate profit. According to a report by the Bank for International Settlements (BIS), the global foreign exchange market sees trillions of dollars changing hands daily, highlighting the sheer scale and importance of currency exchange in the global economy.

1.1. Why Is Currency Exchange Important?

Why should anyone care about currency exchange rates?

Currency exchange is crucial for a multitude of reasons, impacting individuals, businesses, and even entire economies. For individuals, it enables international travel and allows for purchasing goods and services from foreign countries. Imagine planning a vacation to Europe; you’d need to exchange your dollars for euros to pay for accommodation, meals, and transportation. Businesses rely on currency exchange to conduct international trade, import raw materials, and export finished products. Fluctuations in exchange rates can significantly impact their profitability, making it essential to manage currency risk effectively. From an economic perspective, currency exchange plays a vital role in determining a country’s balance of payments and influencing its competitiveness in the global market. A weaker currency can boost exports by making them cheaper for foreign buyers, while a stronger currency can increase imports.

1.2. Factors Affecting Currency Exchange Rates

What factors cause exchange rates to fluctuate?

Exchange rates are influenced by a complex interplay of economic, political, and even psychological factors. Economic factors, such as inflation rates, interest rates, economic growth, and trade balances, play a significant role in determining the relative value of currencies. For example, a country with higher inflation rates may see its currency depreciate as its purchasing power declines. Political factors, such as political stability, government policies, and geopolitical events, can also impact exchange rates. Political uncertainty or instability can lead to capital flight and a weakening of the currency. Psychological factors, such as market sentiment and investor confidence, can also influence exchange rates, especially in the short term. News events, rumors, and even speculation can trigger significant currency movements. According to research from the International Monetary Fund (IMF), expectations about future economic conditions and policy changes play a crucial role in determining exchange rates.

1.3. Common Currency Pairs

What are the most actively traded currency pairs in the foreign exchange market?

The foreign exchange (forex) market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Several currency pairs dominate forex trading, accounting for a significant portion of the overall volume. The most actively traded currency pair is the EUR/USD, which represents the exchange rate between the euro and the US dollar. Other popular currency pairs include USD/JPY (US dollar/Japanese yen), GBP/USD (British pound/US dollar), AUD/USD (Australian dollar/US dollar), and USD/CHF (US dollar/Swiss franc). These currency pairs are favored by traders due to their high liquidity, tight spreads, and relative stability. Additionally, they often serve as barometers of global economic sentiment, reflecting the relative strength or weakness of major economies.

EURUSD Forex History Data

EURUSD Forex History Data

2. The Purpose of a Currency Converter

Why should you use a currency converter when you can do the math yourself?

A currency converter is an invaluable tool that simplifies the process of converting one currency to another, like euros to US dollars. While manual calculations are possible, a currency converter offers speed, accuracy, and convenience. It automatically retrieves the latest exchange rates from financial data providers, ensuring that your conversions are based on the most up-to-date information. Moreover, currency converters often include additional features, such as historical exchange rates, charts, and the ability to convert multiple currencies simultaneously. This makes them ideal for travelers, businesses, and anyone who needs to deal with foreign currencies regularly. Using euro2.net’s currency converter ensures you get the most accurate and timely conversions, saving you time and effort.

2.1. Benefits of Using a Currency Converter

What are the specific advantages of using a currency converter?

Using a currency converter offers several distinct benefits, including accuracy, speed, convenience, and access to historical data.

| Benefit | Description |

|---|---|

| Accuracy | Currency converters use real-time exchange rates from financial data providers, ensuring that your conversions are precise and up-to-date. |

| Speed | Currency converters perform calculations instantly, saving you time and effort compared to manual calculations. |

| Convenience | Currency converters are readily available online or as mobile apps, allowing you to convert currencies anytime, anywhere. |

| Historical Data | Many currency converters provide access to historical exchange rates, enabling you to track currency trends and make informed decisions. |

| Additional Features | Some currency converters offer additional features, such as charts, multiple currency conversions, and the ability to calculate conversion fees. |

These advantages make currency converters essential tools for anyone dealing with foreign currencies, whether for travel, business, or investment purposes.

2.2. Features to Look for in a Currency Converter

What should you consider when choosing a currency converter?

When selecting a currency converter, several key features should be considered to ensure it meets your specific needs. Look for a converter that provides real-time exchange rates from reliable data sources, supports a wide range of currencies, and offers a user-friendly interface. Additional features to consider include historical exchange rates, charts, the ability to convert multiple currencies simultaneously, and the option to calculate conversion fees. It’s also important to check whether the converter is available on multiple platforms, such as web, iOS, and Android, to ensure accessibility across your devices. Euro2.net’s currency converter offers all these features, making it a comprehensive and convenient tool for all your currency conversion needs.

2.3. Common Mistakes to Avoid When Using Currency Converters

What are some common pitfalls to avoid when using currency converters?

While currency converters are generally reliable, it’s essential to be aware of some common mistakes that can lead to inaccurate conversions. One common mistake is relying on outdated exchange rates. Exchange rates fluctuate constantly, so it’s crucial to use a converter that provides real-time data. Another mistake is failing to factor in conversion fees or commissions charged by banks or currency exchange services. These fees can significantly impact the final amount you receive, so it’s important to include them in your calculations. Additionally, be careful when converting large amounts, as even small discrepancies in exchange rates can result in significant differences. Always double-check your conversions and compare rates from multiple sources to ensure accuracy.

3. How to Convert Currencies: Euros to US Dollars

What’s the simplest way to convert euros to US dollars?

To convert euros to US dollars, you need to know the current exchange rate between the two currencies. The exchange rate represents the value of one euro in terms of US dollars. For example, if the current exchange rate is 1.10, it means that one euro is equal to 1.10 US dollars. To convert a specific amount of euros to dollars, you simply multiply the amount by the exchange rate. For instance, if you want to convert 100 euros to dollars and the exchange rate is 1.10, you would multiply 100 by 1.10, resulting in 110 US dollars. Conversely, to convert US dollars to euros, you would divide the amount by the exchange rate. Euro2.net provides a user-friendly currency converter that automatically performs these calculations for you, ensuring accuracy and convenience.

3.1. Understanding Exchange Rate Quotes

How are exchange rates typically quoted?

Exchange rates are typically quoted as a ratio of two currencies, with one currency serving as the base currency and the other as the quote currency. The base currency is the currency being valued, while the quote currency is the currency used to express its value. For example, in the EUR/USD exchange rate, the euro is the base currency and the US dollar is the quote currency. An exchange rate of 1.10 means that one euro is worth 1.10 US dollars. Exchange rates are typically quoted to four decimal places, reflecting the precision of the foreign exchange market. Additionally, exchange rates can be quoted in two ways: direct and indirect. A direct quote expresses the value of a foreign currency in terms of the domestic currency (e.g., USD/EUR in the US), while an indirect quote expresses the value of the domestic currency in terms of the foreign currency (e.g., EUR/USD in the US).

3.2. Step-by-Step Guide to Converting Euros to Dollars

Let’s walk through a practical example of converting euros to dollars.

Here’s a step-by-step guide to converting euros to dollars:

- Find the current EUR/USD exchange rate: Visit a reliable source, such as euro2.net, to find the latest exchange rate between the euro and the US dollar.

- Determine the amount of euros you want to convert: Decide how many euros you want to convert to dollars.

- Multiply the euro amount by the exchange rate: Multiply the amount of euros by the exchange rate to calculate the equivalent amount in dollars.

- Factor in any fees or commissions: Consider any fees or commissions charged by your bank or currency exchange service, and subtract them from the converted amount.

- Double-check your calculations: Always double-check your calculations to ensure accuracy.

For example, let’s say you want to convert 500 euros to dollars and the current EUR/USD exchange rate is 1.12. Multiplying 500 by 1.12 gives you 560 US dollars. If your bank charges a 2% commission, you would subtract 2% of 560 (which is 11.20) from 560, resulting in a final amount of 548.80 US dollars.

3.3. Using Online Currency Converters

How can online currency converters simplify the conversion process?

Online currency converters streamline the conversion process by automating the calculations and providing real-time exchange rates. These converters typically feature a user-friendly interface where you can enter the amount you want to convert, select the currencies involved, and instantly see the converted amount. Additionally, many online currency converters offer advanced features, such as historical exchange rates, charts, and the ability to convert multiple currencies simultaneously. They also eliminate the need for manual calculations, reducing the risk of errors. Euro2.net’s currency converter is a prime example of an online tool that simplifies currency conversions, providing accurate and up-to-date information at your fingertips.

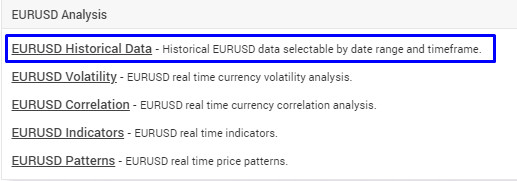

4. Finding Historical Forex Data

Why is historical forex data important, and where can you find it?

Historical forex data is valuable for traders, investors, and researchers who want to analyze past currency movements and identify trends. It provides insights into how exchange rates have fluctuated over time, allowing you to assess the volatility of different currency pairs and make informed predictions about future movements. Historical data can also be used to backtest trading strategies and evaluate their performance under different market conditions. Several sources provide historical forex data, including financial data providers, online brokers, and websites like euro2.net.

4.1. Sources of Historical Forex Data

Where can you reliably access historical forex data?

You can access historical forex data from various sources, each with its own advantages and disadvantages. Financial data providers, such as Bloomberg and Reuters, offer comprehensive historical data feeds that are widely used by professional traders and institutions. However, these data feeds can be expensive. Online brokers often provide historical data to their clients as part of their trading platforms. While this data may be limited in scope or depth, it can be a convenient option for individual traders. Websites like euro2.net offer free historical forex data, making it accessible to a wider audience. When choosing a data source, consider the coverage, accuracy, and cost of the data, as well as the format in which it is provided.

4.2. How to Analyze Historical Data

What techniques can you use to analyze historical forex data?

Analyzing historical forex data involves using various technical and statistical techniques to identify patterns, trends, and potential trading opportunities. Some common techniques include:

| Technique | Description |

|---|---|

| Trend Analysis | Identifying the direction and strength of long-term currency movements. |

| Support and Resistance Levels | Determining price levels where the currency has historically found support or resistance. |

| Moving Averages | Calculating the average exchange rate over a specific period to smooth out short-term fluctuations. |

| Technical Indicators | Using mathematical formulas to generate trading signals based on price and volume data. |

| Statistical Analysis | Applying statistical methods, such as regression analysis and correlation analysis, to identify relationships between currency movements and other economic variables. |

By combining these techniques, you can gain a deeper understanding of currency behavior and make more informed trading decisions.

4.3. Using Historical Data for Trading Strategies

How can you incorporate historical data into your trading strategies?

Historical forex data can be a valuable tool for developing and testing trading strategies. By analyzing past currency movements, you can identify patterns and trends that may repeat in the future. For example, you might notice that a particular currency pair tends to rally after a specific economic announcement or that it consistently bounces off a certain support level. You can then incorporate these observations into your trading rules, using historical data to backtest your strategy and evaluate its performance under different market conditions. However, it’s important to remember that past performance is not necessarily indicative of future results. Market conditions can change, and patterns that have held true in the past may not continue to do so in the future. Therefore, it’s essential to continuously monitor your strategies and adapt them as needed.

5. Factors Influencing the Euro to Dollar Exchange Rate

What are the key factors that drive the EUR/USD exchange rate?

The euro to dollar (EUR/USD) exchange rate is influenced by a wide range of factors, reflecting the complex interplay of economic, political, and psychological forces. Economic factors, such as interest rate differentials, inflation rates, economic growth, and trade balances, play a significant role in determining the relative value of the euro and the dollar. Political factors, such as political stability, government policies, and geopolitical events, can also impact the exchange rate. Psychological factors, such as market sentiment, investor confidence, and risk appetite, can also influence short-term currency movements. According to a report by the European Central Bank (ECB), monetary policy decisions, economic data releases, and global risk events are among the key drivers of the EUR/USD exchange rate.

5.1. Economic Indicators

Which economic indicators should you monitor to understand the EUR/USD exchange rate?

Several economic indicators can provide valuable insights into the EUR/USD exchange rate. Key indicators to watch include:

| Indicator | Description |

|---|---|

| Interest Rate Decisions | Decisions by the European Central Bank (ECB) and the Federal Reserve (Fed) on interest rates can significantly impact the EUR/USD exchange rate. Higher interest rates in one currency tend to attract foreign investment, leading to appreciation. |

| Inflation Rates | Inflation rates can affect a currency’s purchasing power and its relative value. Higher inflation in one currency can lead to depreciation as its purchasing power declines. |

| Economic Growth | Strong economic growth in one region can boost demand for its currency, leading to appreciation. Conversely, weak economic growth can weigh on a currency. |

| Trade Balances | Trade surpluses (exports exceeding imports) can strengthen a currency, while trade deficits (imports exceeding exports) can weaken it. |

| Unemployment Rates | Unemployment rates can reflect the overall health of an economy. Lower unemployment rates can indicate a stronger economy, potentially leading to currency appreciation. |

| Purchasing Managers’ Indices (PMIs) | PMIs are leading indicators of economic activity, reflecting the sentiment of purchasing managers in the manufacturing and service sectors. Higher PMIs can suggest stronger economic growth. |

By monitoring these economic indicators, you can gain a better understanding of the factors driving the EUR/USD exchange rate.

5.2. Political and Geopolitical Events

How can political and geopolitical events impact the EUR/USD exchange rate?

Political and geopolitical events can significantly influence the EUR/USD exchange rate by creating uncertainty and affecting investor sentiment. Political instability, such as government changes, elections, or social unrest, can lead to capital flight and currency depreciation. Geopolitical events, such as wars, conflicts, or trade disputes, can also impact the exchange rate by disrupting trade flows and increasing risk aversion. For example, the Brexit referendum in 2016 caused significant volatility in the EUR/USD exchange rate as investors reacted to the uncertainty surrounding the UK’s future relationship with the European Union. Similarly, trade tensions between the US and China have periodically impacted the exchange rate by affecting global trade and economic growth.

5.3. Central Bank Policies

What role do central banks play in influencing the EUR/USD exchange rate?

Central banks, such as the European Central Bank (ECB) and the Federal Reserve (Fed), play a crucial role in influencing the EUR/USD exchange rate through their monetary policies. These policies include setting interest rates, managing the money supply, and intervening in the foreign exchange market. By raising or lowering interest rates, central banks can influence the attractiveness of their currencies to foreign investors. Higher interest rates tend to attract foreign capital, leading to currency appreciation, while lower interest rates can discourage investment and weaken the currency. Central banks can also intervene directly in the foreign exchange market by buying or selling their own currencies to influence the exchange rate. For example, the ECB may intervene to support the euro if it believes the currency is undervalued. According to research from the Bank for International Settlements (BIS), central bank interventions can have a significant impact on exchange rates, especially in the short term.

6. Strategies for Trading the EUR/USD Pair

What are some common strategies for trading the EUR/USD currency pair?

Trading the EUR/USD currency pair involves using various technical and fundamental analysis techniques to identify potential trading opportunities. Some common strategies include:

| Strategy | Description |

|---|---|

| Trend Following | Identifying the direction of the long-term trend and trading in the same direction. |

| Range Trading | Identifying price levels where the currency pair tends to trade within a specific range and buying at the lower end of the range and selling at the upper end. |

| Breakout Trading | Identifying price levels where the currency pair is likely to break out of a consolidation pattern and trading in the direction of the breakout. |

| News Trading | Trading based on the release of economic data or political news that is likely to impact the exchange rate. |

| Carry Trading | Borrowing a currency with a low interest rate and investing in a currency with a high interest rate to profit from the interest rate differential. |

These strategies can be used in combination with technical indicators and risk management techniques to create a comprehensive trading plan.

6.1. Technical Analysis Techniques

What technical analysis tools can you use to trade the EUR/USD pair?

Technical analysis involves using historical price and volume data to identify patterns and trends that can be used to predict future price movements. Several technical indicators are commonly used to trade the EUR/USD pair, including:

- Moving Averages: Smoothing out price data to identify the direction of the trend.

- Relative Strength Index (RSI): Measuring the magnitude of recent price changes to identify overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Identifying changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

- Fibonacci Retracement Levels: Identifying potential support and resistance levels based on Fibonacci ratios.

- Bollinger Bands: Measuring the volatility of the price and identifying potential breakout or breakdown levels.

By combining these technical indicators, you can gain a more comprehensive view of the market and identify potential trading opportunities.

6.2. Fundamental Analysis Techniques

How can you use fundamental analysis to trade the EUR/USD pair?

Fundamental analysis involves analyzing economic, political, and social factors to assess the intrinsic value of a currency. When trading the EUR/USD pair, it’s important to monitor key economic indicators in both the Eurozone and the United States, such as GDP growth, inflation rates, unemployment rates, and trade balances. Additionally, you should follow political developments and central bank policies in both regions. For example, if the Eurozone economy is growing faster than the US economy and the ECB is raising interest rates while the Fed is holding them steady, this could be a bullish signal for the euro and a bearish signal for the dollar. By combining fundamental analysis with technical analysis, you can develop a more well-rounded trading strategy.

6.3. Risk Management Strategies

What risk management techniques should you use when trading the EUR/USD pair?

Risk management is an essential part of any trading strategy, and it’s especially important when trading a volatile currency pair like the EUR/USD. Some common risk management techniques include:

- Setting Stop-Loss Orders: Placing an order to automatically close your position if the price moves against you by a certain amount.

- Using Leverage Wisely: Avoiding excessive leverage, which can amplify both your profits and your losses.

- Diversifying Your Portfolio: Spreading your investments across multiple currency pairs and asset classes to reduce your overall risk.

- Calculating Your Position Size: Determining the appropriate amount of capital to allocate to each trade based on your risk tolerance and account size.

- Monitoring Your Positions Regularly: Keeping a close eye on your open positions and adjusting your stop-loss orders as needed.

By implementing these risk management techniques, you can protect your capital and minimize your potential losses.

7. The Eurozone Economy and Its Impact on the Euro

How does the health of the Eurozone economy affect the euro’s value?

The health of the Eurozone economy is a major factor influencing the value of the euro. A strong and growing Eurozone economy tends to support the euro, while a weak or struggling economy can weigh on the currency. Key indicators of the Eurozone’s economic health include GDP growth, inflation rates, unemployment rates, and trade balances. Additionally, political stability and government policies within the Eurozone can also impact the euro’s value. According to a report by the International Monetary Fund (IMF), structural reforms, fiscal policies, and monetary policy coordination are essential for promoting sustainable economic growth and stability in the Eurozone.

7.1. Key Economic Indicators in the Eurozone

Which economic indicators should you track to assess the Eurozone economy?

Several economic indicators can provide valuable insights into the health of the Eurozone economy. Key indicators to watch include:

| Indicator | Description |

|---|---|

| GDP Growth | Measures the rate at which the Eurozone economy is expanding or contracting. |

| Inflation Rates | Measures the rate at which prices are rising in the Eurozone. |

| Unemployment Rates | Measures the percentage of the Eurozone workforce that is unemployed. |

| Government Debt Levels | Measures the amount of debt owed by Eurozone governments. |

| Purchasing Managers’ Indices (PMIs) | Leading indicators of economic activity, reflecting the sentiment of purchasing managers in the manufacturing and service sectors. |

| Consumer Confidence Index | Measures the level of optimism or pessimism among Eurozone consumers. |

| Industrial Production | Measures the output of the Eurozone’s industrial sector. |

| Trade Balance | Measures the difference between the Eurozone’s exports and imports. |

By tracking these economic indicators, you can gain a better understanding of the factors driving the Eurozone economy and its impact on the euro.

7.2. The Role of the European Central Bank (ECB)

How does the ECB influence the Eurozone economy and the euro’s value?

The European Central Bank (ECB) plays a central role in managing the Eurozone economy and influencing the value of the euro. The ECB’s primary mandate is to maintain price stability in the Eurozone, which it defines as an inflation rate of close to, but below, 2% over the medium term. To achieve this goal, the ECB uses a variety of monetary policy tools, including setting interest rates, managing the money supply, and conducting open market operations. By raising or lowering interest rates, the ECB can influence borrowing costs and economic activity in the Eurozone. The ECB can also provide liquidity to banks and purchase government bonds to support the economy. The ECB’s monetary policy decisions can have a significant impact on the euro’s value, as changes in interest rates and liquidity conditions can affect the attractiveness of the euro to foreign investors.

7.3. Challenges Facing the Eurozone Economy

What are some of the key challenges facing the Eurozone economy today?

The Eurozone economy faces several challenges that could impact the value of the euro. These challenges include:

- Sovereign Debt Crisis: High levels of government debt in some Eurozone countries could lead to a sovereign debt crisis, potentially destabilizing the entire region.

- Banking Sector Problems: Weaknesses in the Eurozone’s banking sector could hinder economic growth and increase financial instability.

- Structural Reforms: The need for structural reforms in some Eurozone countries to improve competitiveness and boost economic growth.

- Political Fragmentation: Political fragmentation and rising populism could make it difficult to implement necessary reforms and coordinate economic policies.

- Demographic Challenges: Aging populations and declining birth rates could put a strain on Eurozone economies and social welfare systems.

Addressing these challenges will be crucial for ensuring the long-term stability and prosperity of the Eurozone and supporting the value of the euro.

8. The US Economy and Its Impact on the Dollar

How does the health of the US economy affect the dollar’s value?

The health of the US economy is a major factor influencing the value of the dollar. A strong and growing US economy tends to support the dollar, while a weak or struggling economy can weigh on the currency. Key indicators of the US economy’s health include GDP growth, inflation rates, unemployment rates, and trade balances. Additionally, political stability and government policies in the US can also impact the dollar’s value. According to a report by the Federal Reserve, monetary policy decisions, economic data releases, and global risk events are among the key drivers of the dollar’s exchange rate.

8.1. Key Economic Indicators in the US

Which economic indicators should you track to assess the US economy?

Several economic indicators can provide valuable insights into the health of the US economy. Key indicators to watch include:

| Indicator | Description |

|---|---|

| GDP Growth | Measures the rate at which the US economy is expanding or contracting. |

| Inflation Rates | Measures the rate at which prices are rising in the US. |

| Unemployment Rates | Measures the percentage of the US workforce that is unemployed. |

| Federal Reserve Policy | Decisions by the Federal Reserve (Fed) on interest rates and monetary policy can significantly impact the dollar’s value. |

| Government Debt Levels | Measures the amount of debt owed by the US government. |

| Purchasing Managers’ Indices (PMIs) | Leading indicators of economic activity, reflecting the sentiment of purchasing managers in the manufacturing and service sectors. |

| Consumer Confidence Index | Measures the level of optimism or pessimism among US consumers. |

| Retail Sales | Measures the total value of sales at retail stores in the US. |

| Housing Market Data | Includes data on housing starts, new home sales, and existing home sales, which can provide insights into the health of the US economy. |

By tracking these economic indicators, you can gain a better understanding of the factors driving the US economy and its impact on the dollar.

8.2. The Role of the Federal Reserve (Fed)

How does the Fed influence the US economy and the dollar’s value?

The Federal Reserve (Fed) plays a central role in managing the US economy and influencing the value of the dollar. The Fed’s primary mandate is to promote maximum employment and stable prices in the US. To achieve these goals, the Fed uses a variety of monetary policy tools, including setting interest rates, managing the money supply, and conducting open market operations. By raising or lowering interest rates, the Fed can influence borrowing costs and economic activity in the US. The Fed can also provide liquidity to banks and purchase government bonds to support the economy. The Fed’s monetary policy decisions can have a significant impact on the dollar’s value, as changes in interest rates and liquidity conditions can affect the attractiveness of the dollar to foreign investors.

8.3. Challenges Facing the US Economy

What are some of the key challenges facing the US economy today?

The US economy faces several challenges that could impact the value of the dollar. These challenges include:

- High Levels of Debt: High levels of government and consumer debt could weigh on economic growth and increase financial instability.

- Inflationary Pressures: Rising inflation could erode purchasing power and force the Fed to raise interest rates, potentially slowing down the economy.

- Trade Tensions: Trade tensions with other countries could disrupt global trade flows and hurt US businesses.

- Political Uncertainty: Political uncertainty and government gridlock could make it difficult to implement necessary reforms and address economic challenges.

- Demographic Challenges: An aging population and declining labor force participation rate could put a strain on the US economy and social welfare systems.

Addressing these challenges will be crucial for ensuring the long-term stability and prosperity of the US and supporting the value of the dollar.

9. Tips for Getting the Best Exchange Rate

How can you maximize your returns when exchanging euros for dollars?

Getting the best exchange rate when exchanging euros for dollars requires careful planning and research. Here are some tips to help you maximize your returns:

- Shop Around for the Best Rates: Compare exchange rates from different banks, currency exchange services, and online platforms to find the most favorable rate.

- Avoid Airport Exchange Services: Airport exchange services typically offer the worst exchange rates due to their convenience and captive audience.

- Use a Credit or Debit Card with Low Foreign Transaction Fees: When traveling abroad, use a credit or debit card with low or no foreign transaction fees to avoid excessive charges.

- Consider Using a Prepaid Travel Card: Prepaid travel cards can offer competitive exchange rates and allow you to lock in a specific rate before you travel.

- Be Aware of Hidden Fees and Commissions: Always ask about any hidden fees or commissions before exchanging currency.

- Time Your Exchange Wisely: Exchange rates can fluctuate, so try to time your exchange when the rate is most favorable.

- Use a Currency Converter to Track Exchange Rates: Use a currency converter like euro2.net to track exchange rates and identify potential opportunities to exchange currency.

By following these tips, you can increase your chances of getting the best exchange rate and minimizing your costs when exchanging euros for dollars.

9.1. Comparing Exchange Rate Providers

How do you evaluate different currency exchange services?

Comparing exchange rate providers is crucial for finding the best deal when exchanging euros for dollars. Consider the following factors when evaluating different services:

| Factor | Description |

|---|---|

| Exchange Rates | Compare the exchange rates offered by different providers to see which one is the most favorable. |

| Fees and Commissions | Inquire about any fees or commissions charged by the provider. Some providers may advertise attractive exchange rates but then charge high fees, so it’s important to factor in the total cost. |

| Convenience | Consider the convenience of the service. Some providers offer online exchanges, while others require you to visit a physical location. |

| Reputation | Check the reputation of the provider. Look for reviews and ratings from other customers to see if they have a good track record of providing reliable and transparent service. |

| Minimum and Maximum Exchange Amounts | Check the minimum and maximum exchange amounts allowed by the provider. Some providers may have restrictions on the amount of currency you can exchange. |

| Payment Options | Check the payment options offered by the provider. Some providers may accept cash, while others may require you to use a credit or debit card. |

By comparing these factors, you can make an informed decision and choose the exchange rate provider that best meets your needs.

9.2. Avoiding Hidden Fees

How can you protect yourself from unexpected charges when exchanging currency?

Hidden fees can significantly reduce your returns when exchanging currency. Here are some tips to help you avoid unexpected charges:

- Ask About All Fees Upfront: Before exchanging currency, ask the provider to disclose all fees and commissions associated with the transaction.

- Read the Fine Print: Carefully read the terms and conditions of the exchange to identify any hidden fees or charges.

- Be Wary of “Zero Commission” Offers: Some providers may advertise “zero commission” exchanges but then charge higher exchange rates or other fees to compensate.

- Compare the Total Cost: Focus on the total cost of the exchange, including all fees and commissions, rather than just the exchange rate.

- Use a Reputable Provider: Choose a reputable and transparent provider that is upfront about its fees and charges.

By being proactive and informed, you can protect yourself from hidden fees and ensure that you get the best possible deal when exchanging currency.

9.3. Timing Your Exchange

Is there an ideal time to exchange euros for dollars?

Timing your exchange can potentially improve your returns, but it’s important to remember that exchange rates are difficult to predict. However, here are some general guidelines to consider:

- Monitor Exchange Rate Trends: Track the EUR/USD exchange rate over time to identify potential patterns and trends.

- Be Aware of Economic News: Pay attention to economic news releases and political events that could impact the exchange rate.

- Consider Seasonal Factors: Some currencies may exhibit seasonal patterns due to tourism or trade flows.

- Avoid Exchanging Currency Right Before or After Major Events: Exchange rates can be more volatile around major economic or political events.

- Use a Limit Order: Place a limit order with your bank or exchange service to