**What Is 34 EUR to USD and Why Does It Matter?**

Are you curious about converting 34 EUR to USD and how it impacts your financial decisions? At euro2.net, we provide real-time exchange rates and expert analysis to help you navigate the complexities of currency conversion. We’ll explore the current rate, factors influencing it, and tools for seamless transactions.

1. Understanding the 34 EUR to USD Exchange Rate

Want to know the real-time value of 34 EUR in USD? The exchange rate between the Euro (EUR) and the United States Dollar (USD) is constantly fluctuating due to a variety of market forces, and you should know how to determine the current rate and where to find updated information.

What Is the Current 34 EUR to USD Exchange Rate?

The current exchange rate between EUR and USD is dynamic and changes continuously. As of November 7, 2024, 34 EUR is approximately equal to 36.50 USD. However, this rate can fluctuate throughout the day based on market conditions. To get the most accurate and up-to-date conversion, you should check a reliable currency converter like the one available on euro2.net.

Where Can You Find Real-Time Exchange Rates?

Real-time exchange rates are readily available from various sources:

- Online Currency Converters: euro2.net offers a user-friendly currency converter that provides the latest exchange rates.

- Financial News Websites: Reputable financial news sites such as Bloomberg, Reuters, and the Wall Street Journal provide up-to-date currency information.

- Forex Trading Platforms: Platforms like MetaTrader and FXCM offer real-time exchange rates for traders.

- Bank Websites: Most major banks, including Bank of America and Citibank, provide currency exchange rates on their websites.

Why Do Exchange Rates Fluctuate?

Exchange rates are influenced by a multitude of factors, including:

- Economic Indicators: Economic data releases, such as GDP growth, inflation rates, and unemployment figures, can significantly impact currency values.

- Interest Rates: Central bank decisions on interest rates can attract or deter foreign investment, affecting currency demand.

- Geopolitical Events: Political instability, trade agreements, and global events can create uncertainty and volatility in currency markets.

- Market Sentiment: Investor confidence and risk appetite can drive currency movements as traders react to news and trends.

- Supply and Demand: The basic economic principle of supply and demand plays a crucial role in determining exchange rates.

According to research from the European Central Bank (ECB), changes in monetary policy can lead to significant fluctuations in exchange rates, highlighting the importance of staying informed about central bank decisions.

2. Key Factors Influencing the EUR/USD Exchange Rate

What factors play a significant role in the EUR/USD exchange rate? These factors include economic indicators, central bank policies, and geopolitical events.

Economic Indicators: How Do They Affect EUR/USD?

Economic indicators provide insights into the health and performance of an economy. Key indicators that influence the EUR/USD exchange rate include:

- GDP Growth: Higher GDP growth in the Eurozone relative to the United States can strengthen the EUR.

- Inflation Rates: Higher inflation in the Eurozone can weaken the EUR as it reduces the currency’s purchasing power.

- Unemployment Rates: Lower unemployment in the Eurozone can strengthen the EUR, indicating a healthier economy.

- Trade Balance: A trade surplus in the Eurozone can increase demand for the EUR, strengthening its value.

For instance, if the Eurozone reports stronger-than-expected GDP growth while the United States reports weaker growth, the EUR/USD exchange rate is likely to increase, reflecting greater confidence in the Eurozone economy.

Central Bank Policies: ECB vs. Federal Reserve

The policies of the European Central Bank (ECB) and the Federal Reserve (Fed) play a crucial role in shaping the EUR/USD exchange rate. Key policy tools include:

- Interest Rates: Higher interest rates in the Eurozone can attract foreign investment, increasing demand for the EUR and strengthening its value.

- Quantitative Easing (QE): QE involves a central bank injecting liquidity into the economy by purchasing assets. QE in the Eurozone can weaken the EUR by increasing the money supply.

- Forward Guidance: Central banks communicate their intentions, what conditions would cause them to maintain the course, and what conditions would cause them to change course.

According to a study by the International Monetary Fund (IMF), diverging monetary policies between the ECB and the Fed can lead to significant fluctuations in the EUR/USD exchange rate, highlighting the importance of monitoring central bank announcements and policy decisions.

Geopolitical Events: What Is Their Impact?

Geopolitical events can introduce uncertainty and volatility into currency markets, affecting the EUR/USD exchange rate. Key events include:

- Political Instability: Political crises or instability in the Eurozone or the United States can weaken their respective currencies.

- Trade Wars: Trade disputes and tariffs can disrupt global trade flows, impacting currency values.

- Brexit: The United Kingdom’s decision to leave the European Union has created uncertainty and volatility in the EUR, affecting the EUR/USD exchange rate.

- Global Pandemics: Events such as the COVID-19 pandemic can disrupt global economies and financial markets, leading to currency fluctuations.

For example, during periods of heightened political uncertainty in Italy or Greece, the EUR may weaken against the USD as investors seek safer assets.

Euro banknotes and US dollar bills

Euro banknotes and US dollar bills

How Market Sentiment Influences EUR/USD

Market sentiment, or the overall attitude of investors towards a currency, can significantly influence the EUR/USD exchange rate. Factors that drive market sentiment include:

- Risk Appetite: During periods of high-risk appetite, investors may favor riskier assets, potentially weakening the USD as capital flows to higher-yielding currencies.

- Safe-Haven Demand: During times of economic uncertainty or geopolitical tensions, investors may seek safe-haven currencies like the USD, increasing demand and strengthening its value.

- Speculative Positioning: Large-scale speculative positions in the currency market can amplify price movements and contribute to volatility.

- News and Rumors: News headlines, economic data releases, and market rumors can quickly shift market sentiment, leading to rapid changes in the EUR/USD exchange rate.

Keeping an eye on market sentiment through financial news and expert analysis can provide valuable insights into potential currency movements.

3. Using Currency Converters for 34 EUR to USD

How can currency converters simplify the process of converting 34 EUR to USD? Currency converters offer convenience, accuracy, and additional features for informed decision-making.

Benefits of Using Online Currency Converters

Online currency converters provide numerous benefits for individuals and businesses:

- Convenience: Currency converters are available 24/7 and can be accessed from any device with an internet connection.

- Accuracy: Reputable currency converters use real-time exchange rate data to provide accurate conversions.

- Speed: Currency conversions are performed instantly, saving time and effort.

- Ease of Use: Currency converters are designed to be user-friendly, with simple interfaces and clear instructions.

- Additional Features: Many currency converters offer additional features, such as historical exchange rates, currency charts, and the ability to convert multiple currencies at once.

euro2.net offers a reliable and user-friendly currency converter that provides real-time exchange rates and additional features to assist with your currency conversion needs.

How to Choose a Reliable Currency Converter

When selecting a currency converter, consider the following factors:

- Data Source: Ensure the currency converter uses a reputable data source that provides real-time exchange rates.

- Accuracy: Verify the accuracy of the conversions by comparing the results with other sources.

- User Interface: Choose a currency converter with a user-friendly interface that is easy to navigate.

- Additional Features: Consider whether the currency converter offers additional features that are useful for your needs, such as historical exchange rates or currency charts.

- Reviews and Ratings: Check reviews and ratings from other users to gauge the reliability and performance of the currency converter.

Step-by-Step Guide to Converting 34 EUR to USD

Here’s a step-by-step guide to converting 34 EUR to USD using an online currency converter:

- Visit euro2.net: Go to the euro2.net website on your computer or mobile device.

- Find the Currency Converter: Look for the currency converter tool, usually located on the homepage or in the “Tools” section.

- Select Currencies: Choose EUR as the “From” currency and USD as the “To” currency.

- Enter Amount: Enter “34” in the amount field for EUR.

- View Result: The currency converter will instantly display the equivalent amount in USD based on the current exchange rate.

- Review and Verify: Double-check the conversion result and compare it with other sources if necessary.

- Additional Features: Explore any additional features offered by the currency converter, such as historical exchange rates or currency charts.

By following these steps, you can quickly and accurately convert 34 EUR to USD using euro2.net’s currency converter.

4. Historical Trends of EUR/USD Exchange Rate

What can we learn from the historical trends of the EUR/USD exchange rate? Examining past performance can provide insights into potential future movements and inform financial strategies.

Overview of Past EUR/USD Performance

The EUR/USD exchange rate has experienced significant fluctuations over the years, influenced by various economic and political events. Key trends include:

- Early Years (1999-2008): The EUR/USD exchange rate initially struggled after the introduction of the Euro in 1999 but gradually strengthened, reaching a peak in 2008.

- Global Financial Crisis (2008-2009): The global financial crisis led to increased volatility in the EUR/USD exchange rate as investors sought safe-haven currencies.

- Eurozone Debt Crisis (2010-2012): The Eurozone debt crisis put downward pressure on the EUR as concerns about the stability of the Eurozone economy grew.

- Post-Crisis Recovery (2013-2019): The EUR/USD exchange rate gradually recovered as the Eurozone economy stabilized and monetary policy eased.

- Recent Years (2020-Present): The COVID-19 pandemic and subsequent economic recovery have led to renewed volatility in the EUR/USD exchange rate.

Significant Events Affecting EUR/USD

Several significant events have influenced the EUR/USD exchange rate over the years:

- Introduction of the Euro (1999): The launch of the Euro created a new major currency and altered the dynamics of the global currency market.

- Global Financial Crisis (2008-2009): The crisis led to increased risk aversion and safe-haven demand, affecting currency values.

- Eurozone Debt Crisis (2010-2012): The crisis highlighted the vulnerabilities of the Eurozone economy and put downward pressure on the EUR.

- ECB Monetary Policy Actions: The ECB’s decisions on interest rates and quantitative easing have influenced the EUR/USD exchange rate.

- Federal Reserve Monetary Policy Actions: The Fed’s decisions on interest rates and quantitative easing have also influenced the EUR/USD exchange rate.

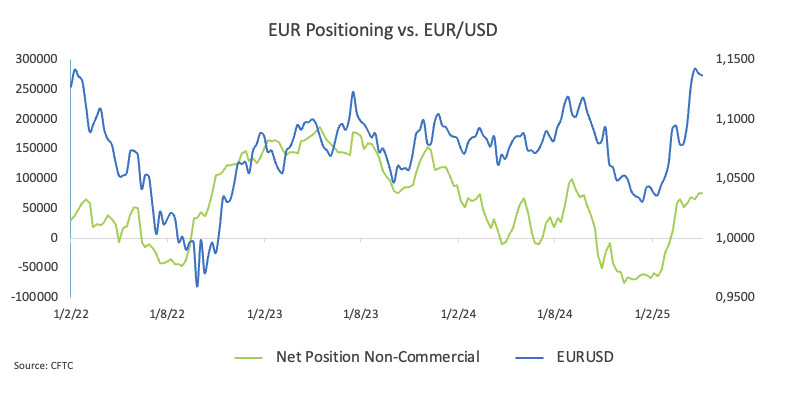

Analyzing Charts and Graphs of EUR/USD

Analyzing historical charts and graphs of the EUR/USD exchange rate can provide valuable insights:

- Trend Identification: Charts can help identify long-term trends, such as uptrends, downtrends, and sideways movements.

- Support and Resistance Levels: Charts can reveal key support and resistance levels that may act as barriers to price movements.

- Volatility Assessment: Charts can show periods of high and low volatility, indicating the degree of risk associated with trading the EUR/USD pair.

- Pattern Recognition: Charts can reveal patterns, such as head and shoulders, double tops, and double bottoms, which can provide clues about potential future price movements.

Technical analysts use various tools and indicators to analyze EUR/USD charts, including moving averages, trendlines, and oscillators.

5. Factors to Consider When Converting Currency

What should you keep in mind when converting currency? Understanding fees, timing, and alternative options can help you optimize your currency exchange.

Understanding Exchange Rate Fees and Commissions

When converting currency, be aware of potential fees and commissions:

- Exchange Rate Markup: Banks and currency exchange services often add a markup to the interbank exchange rate, which is the rate at which banks trade with each other.

- Commission Fees: Some services charge a commission fee on top of the exchange rate markup.

- Transaction Fees: Additional fees may apply for certain transaction types, such as wire transfers or credit card payments.

- Hidden Fees: Be cautious of hidden fees, such as minimum transaction amounts or inactivity fees.

Always compare fees and commissions from different providers to find the most cost-effective option.

Timing Your Currency Conversion for Better Rates

Timing your currency conversion can potentially save you money:

- Monitor Exchange Rate Trends: Keep an eye on exchange rate trends and try to convert currency when the rate is favorable.

- Avoid Peak Demand Periods: Exchange rates may be less favorable during peak demand periods, such as holidays or weekends.

- Consider Economic News Releases: Economic data releases and central bank announcements can cause significant fluctuations in exchange rates, so time your conversion accordingly.

- Use Limit Orders: Place limit orders with your bank or currency exchange service to automatically convert currency when your desired exchange rate is reached.

Alternatives to Traditional Currency Exchange

Consider alternative options to traditional currency exchange:

- Online Currency Exchange Services: Services like Wise (formerly TransferWise) and Revolut offer competitive exchange rates and low fees.

- Peer-to-Peer Currency Exchange: Platforms like CurrencyFair connect individuals looking to exchange currencies directly, potentially offering better rates than traditional services.

- Credit Cards with No Foreign Transaction Fees: Use a credit card that does not charge foreign transaction fees when traveling abroad.

- ATMs: Withdraw local currency from ATMs when you arrive at your destination, but be aware of potential ATM fees and exchange rate markups.

6. How the 34 EUR to USD Exchange Rate Affects You

How does the 34 EUR to USD exchange rate impact different groups? From travelers to businesses, the exchange rate can have significant financial implications.

For Travelers: Budgeting and Expenses

For travelers, the EUR/USD exchange rate affects budgeting and expenses:

- Trip Planning: When planning a trip to the United States from the Eurozone, the exchange rate determines the cost of accommodations, meals, and activities.

- Currency Conversion: Converting EUR to USD for travel expenses can be more or less expensive depending on the exchange rate.

- Budgeting: A favorable exchange rate can stretch your travel budget further, while an unfavorable rate can reduce your purchasing power.

- Credit Card Usage: Using a credit card with no foreign transaction fees can help avoid additional costs when making purchases in the United States.

For Businesses: International Trade and Pricing

For businesses engaged in international trade, the EUR/USD exchange rate affects pricing and profitability:

- Export Pricing: A stronger EUR can make Eurozone exports more expensive for U.S. buyers, potentially reducing demand.

- Import Pricing: A weaker EUR can make U.S. imports cheaper for Eurozone buyers, potentially increasing demand.

- Profit Margins: Fluctuations in the exchange rate can impact profit margins on international sales.

- Hedging Strategies: Businesses can use hedging strategies, such as forward contracts or currency options, to mitigate the risk of exchange rate fluctuations.

For Investors: Portfolio Diversification

For investors, the EUR/USD exchange rate affects portfolio diversification and returns:

- International Investments: Investing in Eurozone assets can provide diversification benefits for U.S. investors, but the EUR/USD exchange rate can impact returns.

- Currency Risk: Fluctuations in the EUR/USD exchange rate can affect the value of Eurozone investments when converted back to USD.

- Hedging Strategies: Investors can use currency hedging strategies to protect their portfolios from currency risk.

- Asset Allocation: The EUR/USD exchange rate can influence asset allocation decisions, as investors may shift their investments based on currency expectations.

7. Predicting Future EUR/USD Exchange Rate Movements

Can we predict future EUR/USD exchange rate movements? While it’s impossible to predict with certainty, analyzing factors like economic forecasts and expert opinions can offer insights.

Economic Forecasts and EUR/USD Predictions

Economic forecasts can provide clues about potential future movements in the EUR/USD exchange rate:

- GDP Growth Forecasts: Higher GDP growth in the Eurozone relative to the United States can strengthen the EUR against the USD.

- Inflation Forecasts: Higher inflation in the Eurozone can weaken the EUR against the USD.

- Interest Rate Expectations: Expectations of interest rate hikes in the Eurozone can strengthen the EUR against the USD.

- Unemployment Rate Forecasts: Lower unemployment in the Eurozone can strengthen the EUR against the USD.

Monitor economic forecasts from reputable sources, such as the IMF, the World Bank, and major investment banks, to stay informed about potential currency movements.

Expert Opinions and Analyst Forecasts

Expert opinions and analyst forecasts can provide valuable insights into the EUR/USD exchange rate:

- Investment Bank Analysts: Analysts at major investment banks regularly publish forecasts and recommendations on currency movements.

- Independent Research Firms: Independent research firms offer in-depth analysis and forecasts on economic and financial trends.

- Financial News Outlets: Financial news outlets often feature interviews and commentary from currency experts.

- Central Bank Communications: Pay attention to communications from the ECB and the Fed, as their statements can provide clues about future policy decisions.

However, remember that forecasts are not guarantees, and it’s essential to consider a range of opinions and analysis when making financial decisions.

Tools and Resources for Forex Trading

For those interested in forex trading, numerous tools and resources are available:

- Forex Trading Platforms: Platforms like MetaTrader and FXCM provide tools for analyzing currency charts, placing trades, and managing risk.

- Technical Analysis Software: Software like TradingView offers advanced charting tools and indicators for technical analysis.

- Economic Calendars: Economic calendars provide a schedule of upcoming economic data releases and central bank announcements.

- Forex News Websites: Websites like Forex Factory and DailyFX provide up-to-date news and analysis on currency markets.

- Educational Resources: Numerous books, articles, and online courses are available to help you learn about forex trading.

8. Common Mistakes to Avoid When Converting Currency

What are some common mistakes to avoid when converting currency? Being aware of these pitfalls can help you make informed decisions and save money.

Ignoring Exchange Rate Fees and Commissions

One of the most common mistakes is ignoring exchange rate fees and commissions:

- Hidden Costs: Many currency exchange services charge hidden fees or commissions that can significantly increase the cost of converting currency.

- Markup on Exchange Rate: Be aware that banks and currency exchange services often add a markup to the interbank exchange rate.

- Comparison Shopping: Always compare fees and commissions from different providers to find the most cost-effective option.

- Read the Fine Print: Read the fine print carefully to understand all potential fees and charges.

Waiting Until the Last Minute to Convert Currency

Waiting until the last minute to convert currency can be costly:

- Unfavorable Exchange Rates: Exchange rates can fluctuate rapidly, and waiting until the last minute may result in an unfavorable exchange rate.

- Limited Options: Last-minute currency conversion options may be limited, reducing your ability to shop around for the best rates.

- Stress and Anxiety: Waiting until the last minute can create stress and anxiety, potentially leading to poor decision-making.

- Plan Ahead: Plan your currency conversion in advance to allow time to monitor exchange rates and shop around for the best deals.

Not Considering Alternative Currency Exchange Options

Not considering alternative currency exchange options can result in higher costs:

- Traditional Banks: Traditional banks often offer less competitive exchange rates and higher fees than alternative options.

- Online Currency Exchange Services: Services like Wise and Revolut offer competitive exchange rates and low fees.

- Peer-to-Peer Currency Exchange: Platforms like CurrencyFair connect individuals looking to exchange currencies directly, potentially offering better rates than traditional services.

- Explore Your Options: Explore all available currency exchange options to find the most cost-effective solution for your needs.

9. Tips for Maximizing Your Currency Exchange

How can you maximize your currency exchange? Planning ahead, monitoring exchange rates, and using the right tools can help you get the most value for your money.

Plan Ahead and Monitor Exchange Rates

Planning ahead and monitoring exchange rates is essential for maximizing your currency exchange:

- Track Exchange Rate Trends: Keep an eye on exchange rate trends and try to convert currency when the rate is favorable.

- Set Exchange Rate Alerts: Set up exchange rate alerts to receive notifications when your desired exchange rate is reached.

- Use a Currency Converter: Use a reliable currency converter to monitor real-time exchange rates.

- Research Different Options: Research different currency exchange options and compare fees and commissions.

Use Limit Orders and Forward Contracts

Using limit orders and forward contracts can help you lock in favorable exchange rates:

- Limit Orders: Place limit orders with your bank or currency exchange service to automatically convert currency when your desired exchange rate is reached.

- Forward Contracts: Use forward contracts to lock in a specific exchange rate for a future transaction.

- Hedging Strategies: Consider using hedging strategies to mitigate the risk of exchange rate fluctuations.

- Consult a Financial Advisor: Consult a financial advisor to discuss your currency exchange needs and develop a suitable strategy.

Take Advantage of Rewards Programs and Discounts

Take advantage of rewards programs and discounts to save money on currency exchange:

- Credit Card Rewards: Use a credit card with rewards points or cashback on foreign transactions.

- Loyalty Programs: Join loyalty programs offered by currency exchange services to earn discounts and other benefits.

- Promotional Offers: Look for promotional offers and discounts on currency exchange services.

- Negotiate Rates: Negotiate rates with your bank or currency exchange service, especially for large transactions.

10. Euro2.net: Your Resource for EUR/USD Information

Why should you choose euro2.net for your EUR/USD information needs? We offer real-time data, expert analysis, and user-friendly tools to help you navigate the world of currency exchange.

Real-Time EUR/USD Exchange Rates and Tools

euro2.net provides real-time EUR/USD exchange rates and tools to assist with your currency conversion needs:

- Currency Converter: Use our user-friendly currency converter to quickly and accurately convert EUR to USD.

- Historical Exchange Rates: Access historical exchange rate data to analyze past trends and patterns.

- Currency Charts: View interactive currency charts to track EUR/USD movements over time.

- Exchange Rate Alerts: Set up exchange rate alerts to receive notifications when your desired exchange rate is reached.

Expert Analysis and Insights

euro2.net offers expert analysis and insights to help you understand the factors driving the EUR/USD exchange rate:

- Economic News and Analysis: Stay informed about the latest economic news and analysis affecting the EUR/USD exchange rate.

- Central Bank Commentary: Monitor communications from the ECB and the Fed to gain insights into future policy decisions.

- Market Sentiment Analysis: Keep an eye on market sentiment and investor confidence to anticipate potential currency movements.

- Expert Opinions: Read commentary from currency experts and analysts to gain different perspectives on the EUR/USD exchange rate.

User-Friendly Interface and Accessibility

euro2.net features a user-friendly interface and is accessible on all devices:

- Easy Navigation: Our website is easy to navigate, allowing you to quickly find the information you need.

- Mobile-Friendly Design: Access euro2.net on your computer, tablet, or smartphone.

- Clear and Concise Information: We provide clear and concise information to help you understand complex currency concepts.

- Customer Support: Contact our customer support team for assistance with any questions or issues.

Ready to make smart financial decisions with the Euro? Visit euro2.net now to track the latest EUR/USD exchange rate, read in-depth analysis, and use our currency conversion tools.

Address: 33 Liberty Street, New York, NY 10045, United States.

Phone: +1 (212) 720-5000.

Website: euro2.net.

Frequently Asked Questions (FAQ) About 34 EUR to USD

1. What is the current exchange rate for 34 EUR to USD?

The exchange rate fluctuates, but you can find the real-time rate on euro2.net’s currency converter.

2. How do economic indicators affect the EUR/USD exchange rate?

GDP growth, inflation rates, and unemployment figures influence the EUR/USD exchange rate.

3. What role do central banks play in the EUR/USD exchange rate?

The policies of the ECB and the Federal Reserve, including interest rates and quantitative easing, significantly impact the exchange rate.

4. How can geopolitical events impact the EUR/USD exchange rate?

Political instability, trade wars, and global events can create volatility and affect currency values.

5. Why is it important to use a reliable currency converter?

A reliable currency converter ensures accuracy and provides additional features for informed decision-making.

6. What are some common mistakes to avoid when converting currency?

Ignoring fees, waiting until the last minute, and not exploring alternative options are common mistakes.

7. How can I maximize my currency exchange?

Plan ahead, monitor exchange rates, use limit orders, and take advantage of rewards programs.

8. How does the EUR/USD exchange rate affect travelers?

It impacts budgeting, expenses, and the cost of converting EUR to USD for travel.

9. What tools and resources are available for forex trading?

Forex trading platforms, technical analysis software, and economic calendars are valuable resources.

10. How can euro2.net help with EUR/USD information?

euro2.net provides real-time data, expert analysis, and user-friendly tools for currency exchange.