What Is 21 Euro To Us And How To Convert It?

21 Euro To Us conversion is a common query, and euro2.net provides a comprehensive solution with real-time exchange rates and tools. At euro2.net, we aim to keep you updated on currency conversion and provide the most accurate exchange rate information so you can make the most of your currency exchange journey. Explore historical data, forecasts, and expert insights for informed financial decisions, enhanced by currency converter accuracy, euro exchange strength, and real-time market data.

1. Understanding the Basics of Currency Conversion

Currency conversion is the process of changing money from one currency to another. It’s essential for international trade, travel, and investment. Let’s delve into the mechanics of currency conversion and why it’s important for various sectors.

1.1. What is Currency Conversion?

Currency conversion involves determining the equivalent value of one currency in terms of another. For example, converting Euros (EUR) to US Dollars (USD) tells you how many US Dollars you will receive for a given amount of Euros. According to the International Monetary Fund (IMF), currency conversion plays a vital role in facilitating international transactions and economic activities.

1.2. Why is Currency Conversion Important?

Currency conversion is crucial for several reasons:

- International Trade: Businesses need to convert currencies to pay for goods and services from other countries.

- Travel: Travelers need to convert their money to the local currency of their destination.

- Investment: Investors convert currencies to buy assets in foreign markets.

- Global Finance: Multinational corporations manage currency risk by converting large sums of money.

1.3. Key Factors Affecting Exchange Rates

Several factors influence exchange rates, including:

- Economic Indicators: Inflation rates, GDP growth, and unemployment figures.

- Interest Rates: Higher interest rates can attract foreign investment, increasing demand for a currency.

- Political Stability: Political uncertainty can weaken a currency.

- Market Sentiment: Speculation and investor confidence can cause fluctuations in exchange rates.

- Central Bank Policies: Actions taken by central banks, such as the European Central Bank (ECB) or the Federal Reserve, significantly impact currency values.

1.4. Types of Exchange Rates

There are two primary types of exchange rates:

- Spot Rate: The current exchange rate for immediate transactions.

- Forward Rate: An exchange rate agreed upon today for a transaction that will occur in the future.

1.5. How to Find the Most Accurate Exchange Rate

To find the most accurate exchange rate, consider the following:

- Use Reputable Sources: Check rates from major financial institutions or reliable online converters like euro2.net.

- Compare Rates: Different providers may offer slightly different rates, so compare to find the best deal.

- Check for Fees: Be aware of any fees or commissions charged by the conversion service.

- Real-Time Data: Look for services that provide real-time exchange rate updates.

2. Converting 21 Euro to US Dollars: A Step-by-Step Guide

Converting 21 Euro to US Dollars involves a simple calculation using the current exchange rate. Here’s a detailed guide on how to do it:

2.1. Finding the Current EUR/USD Exchange Rate

The first step is to find the current exchange rate between the Euro (EUR) and the US Dollar (USD). You can find this information on euro2.net, financial websites like Bloomberg, Reuters, or directly from major banks.

2.2. Using Online Currency Converters

Online currency converters are a quick and easy way to convert EUR to USD. Here’s how to use them:

- Go to euro2.net: Navigate to the currency conversion tool.

- Enter the Amount: Type “21” in the EUR field.

- Select Currencies: Choose EUR as the source currency and USD as the target currency.

- View the Result: The converter will display the equivalent amount in USD based on the current exchange rate.

2.3. Manual Calculation

If you prefer to calculate manually, follow these steps:

- Find the Exchange Rate: Let’s assume the current exchange rate is 1 EUR = 1.08 USD.

- Multiply: Multiply 21 EUR by the exchange rate (1.08).

- Calculate: 21 EUR * 1.08 USD/EUR = 22.68 USD.

Therefore, 21 Euro is approximately equal to 22.68 US Dollars, if the current exchange rate is 1 EUR = 1.08 USD.

2.4. Factors Affecting the Conversion Result

Several factors can affect the final conversion result:

- Exchange Rate Fluctuations: Exchange rates change constantly, so the result will vary depending on when the conversion is done.

- Fees and Commissions: Banks and exchange services may charge fees, reducing the amount you receive.

- Hidden Costs: Some services may offer a less favorable exchange rate to increase their profit margin.

2.5. Tips for Getting the Best Conversion Rate

To get the best conversion rate:

- Monitor Exchange Rates: Keep an eye on the EUR/USD exchange rate to find a favorable time to convert.

- Use a Credit or Debit Card Wisely: Be aware of foreign transaction fees. Some cards offer better rates and lower fees than others.

- Consider Using a Forex Broker: If you need to convert large amounts, a forex broker may offer better rates than a traditional bank.

3. The Euro and Its Role in the Global Economy

The Euro (EUR) is the official currency of the Eurozone, which comprises 19 of the 27 member states of the European Union. Understanding the Euro’s role in the global economy is vital for anyone dealing with currency conversion.

3.1. History of the Euro

The Euro was introduced on January 1, 1999, as an accounting currency, and Euro banknotes and coins were first circulated on January 1, 2002. The introduction of the Euro aimed to promote economic integration and stability within the European Union.

3.2. The Eurozone: Member States and Economic Significance

The Eurozone includes countries such as Germany, France, Italy, and Spain. These countries collectively represent a significant portion of the global economy. The European Central Bank (ECB) is responsible for the monetary policy of the Eurozone.

3.3. Factors Influencing the Value of the Euro

Several factors can influence the value of the Euro:

- Economic Performance of the Eurozone: Strong economic growth in the Eurozone can increase the value of the Euro.

- Monetary Policy of the ECB: The ECB’s decisions on interest rates and quantitative easing can impact the Euro.

- Political Stability in Europe: Political events, such as elections or referendums, can create uncertainty and affect the Euro.

- Global Economic Conditions: Global economic trends and events can influence the Euro’s value.

3.4. The Euro as a Reserve Currency

The Euro is one of the world’s major reserve currencies, held by central banks and financial institutions worldwide. Its status as a reserve currency reflects the economic importance of the Eurozone.

3.5. How the Euro Impacts International Trade and Finance

The Euro facilitates trade within the Eurozone by eliminating exchange rate risk and reducing transaction costs. It also plays a significant role in international finance, with many cross-border transactions denominated in Euros.

4. The US Dollar and Its Global Influence

The US Dollar (USD) is the world’s primary reserve currency and plays a central role in international trade and finance. Understanding its influence is crucial for anyone involved in currency conversion.

4.1. History and Significance of the US Dollar

The US Dollar has been the world’s dominant currency since the mid-20th century. Its strength is supported by the size and stability of the US economy.

4.2. Factors Influencing the Value of the US Dollar

Several factors can influence the value of the US Dollar:

- Economic Performance of the United States: Strong economic growth in the US can increase the value of the US Dollar.

- Monetary Policy of the Federal Reserve: The Federal Reserve’s decisions on interest rates and quantitative easing can impact the US Dollar.

- Global Economic Conditions: Global economic trends and events can influence the US Dollar’s value.

- Geopolitical Events: Geopolitical tensions and conflicts can affect the US Dollar’s value.

4.3. The US Dollar as the World’s Reserve Currency

The US Dollar is held by central banks worldwide as part of their foreign exchange reserves. Its status as a reserve currency gives the US significant economic and political influence. According to the Federal Reserve, the US Dollar accounts for a substantial portion of global foreign exchange reserves.

4.4. How the US Dollar Impacts International Trade and Finance

The US Dollar is used in many international transactions, including the pricing of commodities such as oil and gold. Its widespread use makes it essential for global trade and finance.

4.5. The Relationship Between the Euro and the US Dollar

The Euro and the US Dollar are the world’s two most important currencies. Their exchange rate is closely watched by investors and policymakers. Factors such as interest rate differentials and economic growth prospects can influence the EUR/USD exchange rate.

5. Factors Affecting the EUR/USD Exchange Rate

The EUR/USD exchange rate is influenced by a variety of economic, political, and market factors. Understanding these factors can help you make informed decisions about currency conversion.

5.1. Economic Indicators in the Eurozone and the US

Economic indicators such as GDP growth, inflation rates, and unemployment figures can impact the EUR/USD exchange rate. Strong economic data in the US can strengthen the US Dollar, while strong data in the Eurozone can strengthen the Euro.

5.2. Interest Rate Differentials

Interest rate differentials between the Eurozone and the US can influence the EUR/USD exchange rate. Higher interest rates in the US can attract foreign investment, increasing demand for the US Dollar and strengthening it against the Euro.

5.3. Political Stability and Geopolitical Events

Political stability and geopolitical events can also affect the EUR/USD exchange rate. Political uncertainty in Europe or the US can weaken their respective currencies. Geopolitical tensions, such as trade wars or military conflicts, can also impact the exchange rate.

5.4. Market Sentiment and Investor Confidence

Market sentiment and investor confidence can play a significant role in the EUR/USD exchange rate. Positive market sentiment can boost the Euro or the US Dollar, while negative sentiment can weaken them.

5.5. The Role of Central Banks

The European Central Bank (ECB) and the Federal Reserve play a crucial role in influencing the EUR/USD exchange rate. Their monetary policies, such as interest rate decisions and quantitative easing, can have a significant impact on the exchange rate.

6. Practical Tips for Currency Exchange

Exchanging currency can be a complex process, but with the right knowledge and strategies, you can minimize costs and maximize value.

6.1. When to Exchange Currency

The best time to exchange currency depends on your individual circumstances and risk tolerance. However, there are some general guidelines to follow:

- Monitor Exchange Rates: Keep an eye on the EUR/USD exchange rate and exchange when it is favorable.

- Avoid Exchanging at Airports: Airport exchange services typically offer less favorable rates and higher fees.

- Consider Using a Forex Broker: If you need to exchange large amounts, a forex broker may offer better rates.

6.2. Where to Exchange Currency

There are several options for exchanging currency:

- Banks: Banks typically offer competitive exchange rates, but they may charge fees.

- Currency Exchange Services: Currency exchange services, such as those found in airports and tourist areas, may offer less favorable rates and higher fees.

- Online Currency Converters: Online currency converters, such as euro2.net, offer a convenient way to exchange currency, often with competitive rates and lower fees.

- Credit and Debit Cards: Using a credit or debit card for international transactions can be convenient, but be aware of foreign transaction fees.

6.3. Avoiding Fees and Commissions

Fees and commissions can significantly reduce the amount you receive when exchanging currency. Here are some tips for avoiding them:

- Shop Around: Compare rates and fees from different providers.

- Use a Credit or Debit Card Wisely: Some cards offer better rates and lower fees than others.

- Consider Using a Forex Broker: Forex brokers may offer lower fees than traditional banks.

- Avoid Airport Exchange Services: Airport exchange services typically charge higher fees.

6.4. Using Credit and Debit Cards Abroad

Using credit and debit cards abroad can be convenient, but it’s essential to be aware of foreign transaction fees and exchange rates.

- Check for Foreign Transaction Fees: Some cards charge a fee for each international transaction.

- Be Aware of Exchange Rates: The exchange rate used by your card issuer may not be the most favorable.

- Inform Your Bank: Let your bank know your travel plans to avoid having your card blocked.

6.5. Using ATMs Abroad

Using ATMs abroad can be a convenient way to access local currency, but be aware of fees and exchange rates.

- Check for ATM Fees: Some ATMs charge a fee for withdrawals.

- Be Aware of Exchange Rates: The exchange rate used by the ATM may not be the most favorable.

- Use ATMs at Reputable Banks: To avoid fraud, use ATMs at reputable banks.

7. Tools and Resources for Currency Conversion

Several tools and resources can help you with currency conversion, including online converters, mobile apps, and financial news websites.

7.1. Online Currency Converters

Online currency converters, such as euro2.net, offer a quick and easy way to convert currencies. These tools typically provide real-time exchange rates and allow you to convert multiple currencies at once.

7.2. Mobile Apps for Currency Conversion

Mobile apps for currency conversion offer a convenient way to convert currencies on the go. These apps often include features such as real-time exchange rates, historical data, and currency charts.

7.3. Financial News Websites

Financial news websites, such as Bloomberg, Reuters, and the Wall Street Journal, provide up-to-date information on exchange rates and economic news that can impact currency values.

7.4. Currency Charts and Historical Data

Currency charts and historical data can help you track exchange rate trends and identify favorable times to convert currency. These resources are available on many financial websites and currency conversion tools.

7.5. Forex Brokers and Trading Platforms

Forex brokers and trading platforms offer advanced tools and resources for currency conversion, including real-time charts, technical analysis, and trading signals. These platforms are typically used by experienced traders and investors.

8. Understanding Currency Fluctuations and Their Impact

Currency fluctuations can have a significant impact on international trade, investment, and travel. Understanding these fluctuations is essential for managing currency risk.

8.1. What Causes Currency Fluctuations?

Currency fluctuations are caused by a variety of factors, including economic indicators, interest rates, political stability, and market sentiment.

8.2. How Economic Events Impact Exchange Rates

Economic events, such as GDP releases, inflation reports, and employment data, can significantly impact exchange rates. Positive economic data can strengthen a currency, while negative data can weaken it.

8.3. The Impact of Political Events on Currency Values

Political events, such as elections, referendums, and policy changes, can also affect currency values. Political uncertainty can weaken a currency, while political stability can strengthen it.

8.4. Managing Currency Risk

Managing currency risk involves taking steps to protect your assets from the adverse effects of currency fluctuations. Strategies for managing currency risk include:

- Hedging: Using financial instruments, such as futures and options, to offset currency risk.

- Diversification: Spreading your investments across multiple currencies.

- Natural Hedging: Matching your assets and liabilities in the same currency.

8.5. Strategies for Businesses and Individuals

Businesses and individuals can use different strategies for managing currency risk. Businesses may use hedging strategies to protect their profits, while individuals may diversify their investments or use currency conversion tools to minimize costs.

9. Common Mistakes to Avoid When Converting Currency

Converting currency can be tricky, and it’s easy to make mistakes that can cost you money. Here are some common mistakes to avoid:

9.1. Not Checking Exchange Rates

One of the biggest mistakes is not checking exchange rates before converting currency. Exchange rates can vary significantly, so it’s essential to shop around and find the best rate.

9.2. Ignoring Fees and Commissions

Fees and commissions can significantly reduce the amount you receive when converting currency. Be sure to factor in all fees and commissions when comparing different providers.

9.3. Exchanging at Airports

Airport exchange services typically offer less favorable rates and higher fees. Avoid exchanging currency at airports if possible.

9.4. Using Unreliable Sources

Using unreliable sources for currency conversion can lead to inaccurate results and costly mistakes. Always use reputable sources, such as major financial institutions or reliable online converters.

9.5. Waiting Until the Last Minute

Waiting until the last minute to convert currency can leave you vulnerable to unfavorable exchange rates. Plan ahead and convert currency when the rate is favorable.

10. The Future of the Euro and the US Dollar

The future of the Euro and the US Dollar is subject to ongoing debate and speculation. Several factors could influence their future value and role in the global economy.

10.1. Economic Trends and Forecasts

Economic trends and forecasts can provide insights into the future of the Euro and the US Dollar. Factors such as economic growth, inflation, and unemployment can impact their value.

10.2. Policy Changes and Their Potential Impact

Policy changes by the European Central Bank (ECB) and the Federal Reserve can have a significant impact on the Euro and the US Dollar. Changes in interest rates, quantitative easing, and other policies can influence their value.

10.3. The Role of Technology in Currency Conversion

Technology is playing an increasingly important role in currency conversion. Online converters, mobile apps, and blockchain technology are making it easier and more efficient to convert currencies.

10.4. Potential Challenges and Opportunities

Potential challenges and opportunities could impact the future of the Euro and the US Dollar. Challenges include economic instability, political uncertainty, and competition from other currencies. Opportunities include economic growth, technological innovation, and increased global trade.

10.5. Expert Opinions and Predictions

Expert opinions and predictions can provide valuable insights into the future of the Euro and the US Dollar. Economists, analysts, and other experts offer different perspectives on their future value and role in the global economy.

11. Frequently Asked Questions (FAQs) About Converting 21 Euro to US Dollars

Here are some frequently asked questions about converting 21 Euro to US Dollars:

11.1. What is the current exchange rate for EUR to USD?

The current exchange rate for EUR to USD varies depending on the market. You can find the most up-to-date rate on euro2.net or other financial websites.

11.2. How much is 21 Euro in US Dollars today?

The exact amount of 21 Euro in US Dollars depends on the current exchange rate. Use a currency converter on euro2.net to find the exact amount.

11.3. Where can I get the best EUR to USD exchange rate?

You can often find the best EUR to USD exchange rate at banks, credit unions, and online currency exchange services. Compare rates and fees to find the best deal.

11.4. Are there any fees for converting EUR to USD?

Yes, many banks and currency exchange services charge fees for converting EUR to USD. Be sure to factor in these fees when comparing different providers.

11.5. Is it better to exchange currency online or in person?

Exchanging currency online can often be more convenient and offer better rates than exchanging in person. However, be sure to use a reputable online service.

11.6. How do I avoid foreign transaction fees when using my credit card abroad?

To avoid foreign transaction fees, use a credit card that doesn’t charge these fees or consider using a travel credit card with no foreign transaction fees.

11.7. What factors influence the EUR/USD exchange rate?

The EUR/USD exchange rate is influenced by factors such as economic indicators, interest rates, political stability, and market sentiment.

11.8. Is it a good time to convert EUR to USD?

Whether it’s a good time to convert EUR to USD depends on your individual circumstances and risk tolerance. Monitor the exchange rate and convert when it is favorable.

11.9. Can I use a debit card to withdraw USD from an ATM abroad?

Yes, you can use a debit card to withdraw USD from an ATM abroad, but be aware of ATM fees and exchange rates.

11.10. How can I track the EUR/USD exchange rate over time?

You can track the EUR/USD exchange rate over time using currency charts and historical data available on financial websites and currency conversion tools.

12. Conclusion: Making Informed Decisions About Currency Conversion

Converting currency can be a complex process, but with the right knowledge and strategies, you can make informed decisions and minimize costs. Always check exchange rates, factor in fees, and use reputable sources for currency conversion.

Remember that the value of 21 Euro in US Dollars depends on the current exchange rate, which can fluctuate due to various economic and political factors. By staying informed and using the tools and resources available on euro2.net, you can make the most of your currency exchange journey.

For the most up-to-date information and tools for converting currencies, visit euro2.net today. Whether you are a traveler, investor, or business owner, euro2.net provides the resources you need to navigate the world of currency conversion with confidence. Stay informed, make smart financial decisions, and explore the possibilities with euro2.net.

Address: 33 Liberty Street, New York, NY 10045, United States.

Phone: +1 (212) 720-5000.

Website: euro2.net.

13. Real-World Examples of EUR to USD Conversion Impacts

Understanding the impact of EUR to USD conversion extends beyond simple calculations. It affects various real-world scenarios, influencing decisions for travelers, businesses, and investors alike.

13.1. Impact on US Tourists Traveling to Europe

For US tourists planning a trip to Europe, the EUR/USD exchange rate significantly affects their budget. A stronger dollar means their money goes further, making travel more affordable. Conversely, a weaker dollar increases the cost of their trip.

For example, if a hotel room in Paris costs 100 EUR, a US tourist would pay $108 if the exchange rate is 1 EUR = 1.08 USD. However, if the exchange rate shifts to 1 EUR = 1.15 USD, the same room would cost $115, increasing the overall cost of the trip.

13.2. Impact on US Businesses Importing Goods from the Eurozone

US businesses importing goods from the Eurozone also feel the effects of currency conversion. A stronger dollar reduces the cost of imported goods, increasing profitability. A weaker dollar, however, makes imports more expensive, potentially squeezing profit margins.

Consider a US company importing wine from Italy. If a case of wine costs 50 EUR, the company would pay $54 if the exchange rate is 1 EUR = 1.08 USD. If the exchange rate increases to 1 EUR = 1.15 USD, the same case of wine would cost $57.50, increasing the cost of goods sold.

13.3. Impact on US Investors Holding Euro-Denominated Assets

US investors holding Euro-denominated assets, such as stocks or bonds, are exposed to currency risk. If the Euro depreciates against the dollar, the value of their investments decreases when converted back to USD.

For instance, if a US investor owns Euro-denominated bonds worth 1,000 EUR, the investment would be worth $1,080 if the exchange rate is 1 EUR = 1.08 USD. If the Euro weakens to 1 EUR = 1.00 USD, the same bonds would be worth only $1,000, resulting in a loss for the investor.

13.4. Case Study: Impact on a US Exporter

Let’s consider a US company exporting machinery to Germany. The contract is priced in Euros. If the Euro strengthens against the US Dollar between the time the contract is signed and when payment is received, the US exporter will receive more dollars than anticipated, increasing their revenue.

Conversely, if the Euro weakens, they will receive fewer dollars, reducing their revenue. This underscores the importance of monitoring currency fluctuations and potentially using hedging strategies to mitigate risk.

13.5. Example: A Digital Nomad Converting Earnings

A digital nomad living in the US and earning money in Euros from freelance work needs to convert their earnings regularly. The EUR/USD exchange rate directly impacts their income. They benefit when the Euro is strong, maximizing their earnings in USD. Conversely, a weaker Euro reduces their income.

14. Advanced Strategies for Managing Currency Conversion

Beyond basic conversion, several advanced strategies can help individuals and businesses manage currency risk and optimize their financial outcomes.

14.1. Currency Hedging

Currency hedging involves using financial instruments, such as futures, options, and forward contracts, to protect against adverse currency movements. This strategy can help stabilize revenues and costs for businesses engaged in international trade.

14.2. Forward Contracts

A forward contract is an agreement to buy or sell a specific amount of currency at a predetermined exchange rate on a future date. This can provide certainty for businesses by locking in an exchange rate, eliminating the risk of currency fluctuations.

14.3. Options Contracts

An option contract gives the holder the right, but not the obligation, to buy or sell currency at a specific exchange rate on or before a future date. This can provide flexibility, allowing businesses to benefit from favorable currency movements while protecting against adverse ones.

14.4. Currency Swaps

A currency swap involves exchanging principal and interest payments on debt denominated in different currencies. This can help businesses manage currency risk and interest rate risk simultaneously.

14.5. Natural Hedging

Natural hedging involves structuring business operations to minimize currency exposure. For example, a company could match its revenues and expenses in the same currency to reduce the impact of currency fluctuations.

15. The Role of Euro2.net in Simplifying Currency Conversion

Euro2.net is designed to simplify currency conversion and provide users with the tools and information they need to make informed decisions.

15.1. Real-Time Exchange Rates

Euro2.net provides real-time exchange rates for a wide range of currencies, including EUR to USD. This ensures users have access to the most up-to-date information.

15.2. User-Friendly Currency Converter

The euro2.net currency converter is easy to use and provides quick and accurate conversions. Users can simply enter the amount they want to convert, select the currencies, and view the result.

15.3. Historical Data and Charts

Euro2.net offers historical data and charts for various currency pairs, allowing users to track exchange rate trends and identify favorable times to convert currency.

15.4. Expert Analysis and Insights

Euro2.net provides expert analysis and insights on currency markets, helping users understand the factors that influence exchange rates.

15.5. Educational Resources

Euro2.net offers educational resources on currency conversion and risk management, empowering users to make informed decisions.

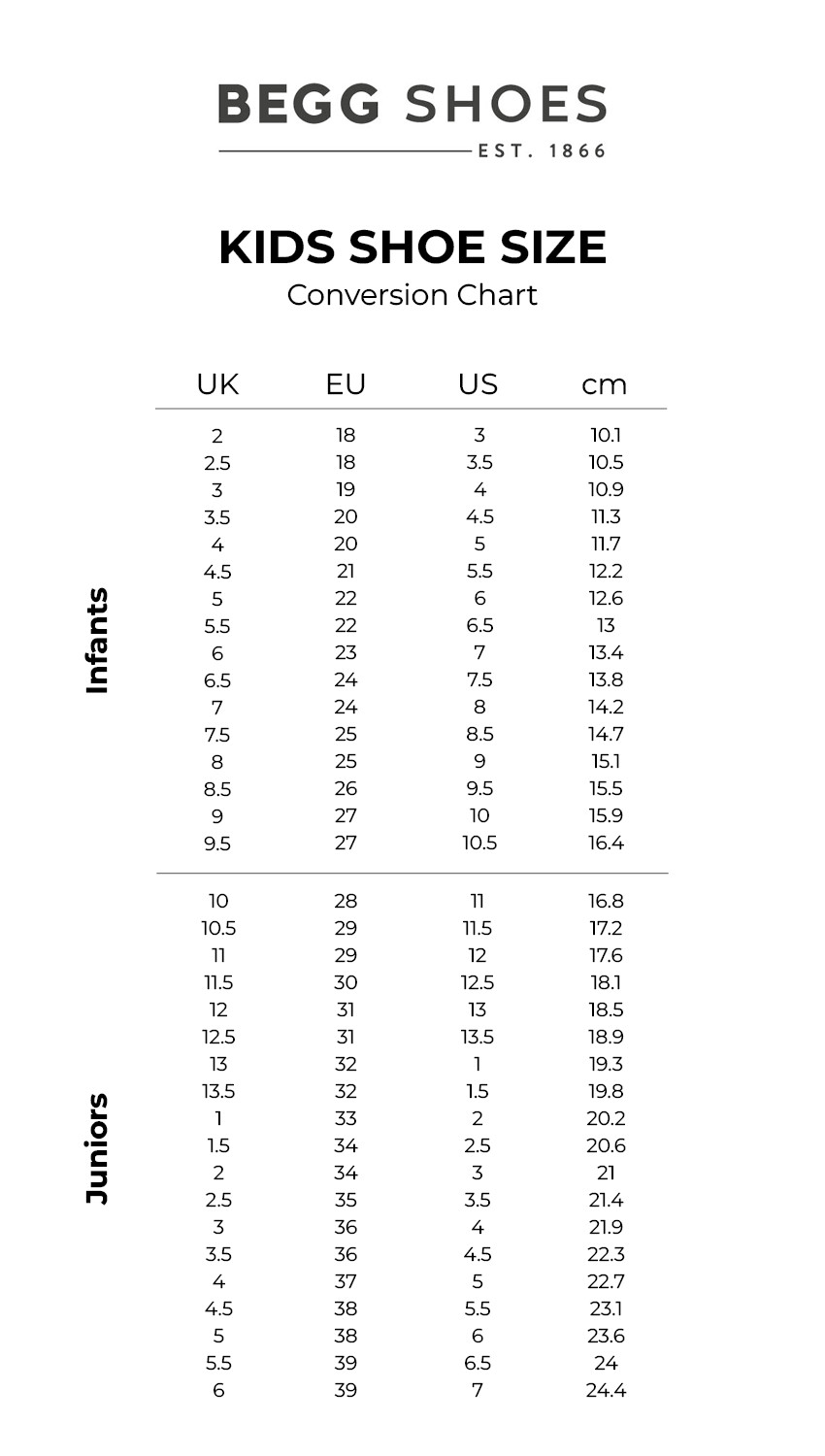

Kids Shoe Size Conversion Chart

Kids Shoe Size Conversion Chart

16. Navigating the Complexities of International Finance

International finance involves complexities that require careful consideration and planning.

16.1. Understanding International Payment Systems

International payment systems, such as SWIFT, facilitate cross-border transactions. Understanding these systems is essential for businesses engaged in international trade.

16.2. Regulatory Compliance

Businesses must comply with various regulations when conducting international financial transactions, including anti-money laundering (AML) and sanctions regulations.

16.3. Tax Implications

International financial transactions can have complex tax implications. Businesses and individuals should seek professional advice to ensure compliance with tax laws.

16.4. Cross-Border Investment

Cross-border investment involves investing in assets located in other countries. This can offer opportunities for diversification and higher returns, but also involves risks such as currency risk and political risk.

16.5. Risk Management

Effective risk management is essential for navigating the complexities of international finance. This includes identifying, assessing, and mitigating various risks, such as currency risk, credit risk, and operational risk.

17. The Intersection of Currency Conversion and Travel Planning

For many, currency conversion is most relevant when planning international travel. Smart planning can lead to significant savings.

17.1. Budgeting for International Trips

Accurate currency conversion is crucial for budgeting international trips. Travelers need to estimate the cost of accommodation, food, transportation, and activities in the local currency.

17.2. Finding the Best Exchange Rates for Travel

Travelers can find the best exchange rates by comparing different providers, such as banks, credit unions, and online currency exchange services.

17.3. Using Local Currency vs. Credit Cards

It’s often beneficial to have some local currency for small purchases and in situations where credit cards are not accepted. However, using credit cards can be convenient and may offer better exchange rates.

17.4. Avoiding Traveler’s Checks

Traveler’s checks are becoming less common and may be difficult to cash in some countries. It’s generally better to use a combination of local currency and credit cards.

17.5. Travel Insurance and Currency Fluctuations

Travel insurance can protect against various risks, including currency fluctuations. Some policies offer coverage for losses due to currency movements.

18. Currency Conversion and Online Shopping from International Retailers

Online shopping from international retailers has become increasingly popular, making currency conversion a routine part of the shopping experience.

18.1. Understanding the Total Cost in Your Local Currency

When shopping online from international retailers, it’s important to understand the total cost in your local currency, including shipping, taxes, and duties.

18.2. Payment Options and Currency Conversion Fees

Different payment options may involve different currency conversion fees. Compare the fees and exchange rates offered by different providers to find the best deal.

18.3. Return Policies and Currency Fluctuations

If you need to return an item purchased from an international retailer, currency fluctuations can affect the amount you receive as a refund.

18.4. Avoiding Unexpected Charges

To avoid unexpected charges, carefully review the terms and conditions of the transaction, including shipping costs, taxes, and duties.

18.5. Using Currency Conversion Tools for Online Shopping

Currency conversion tools, such as the one offered by euro2.net, can help you quickly and accurately convert prices from foreign currencies to your local currency.

19. The Psychology of Currency Conversion: Anchoring and Framing Effects

Currency conversion is not just a mathematical process; it can also be influenced by psychological factors.

19.1. Anchoring Bias

Anchoring bias is the tendency to rely too heavily on an initial piece of information (the “anchor”) when making decisions. In currency conversion, people may anchor on a previous exchange rate, even if it’s no longer relevant.

19.2. Framing Effects

Framing effects refer to how the way information is presented can influence decisions. For example, people may be more likely to convert currency if the benefits are framed positively (e.g., “get more for your money”) rather than negatively (e.g., “avoid losing money”).

19.3. Loss Aversion

Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains. People may be more motivated to convert currency to avoid a potential loss due to currency fluctuations.

19.4. Cognitive Biases in Financial Decision-Making

Cognitive biases can affect financial decision-making in various ways, including currency conversion. Being aware of these biases can help you make more rational decisions.

19.5. Overcoming Psychological Barriers

Overcoming psychological barriers to currency conversion involves being aware of cognitive biases and taking steps to mitigate their influence. This can include seeking objective information, consulting with experts, and using decision-making tools.

20. Innovations in Currency Conversion Technology

Technology continues to transform the landscape of currency conversion, making it more efficient, accessible, and transparent.

20.1. Blockchain and Cryptocurrency

Blockchain and cryptocurrency technologies have the potential to disrupt traditional currency conversion methods by offering faster, cheaper, and more secure transactions.

20.2. Mobile Payment Systems

Mobile payment systems, such as PayPal and Venmo, are increasingly used for international transactions, offering convenient and cost-effective currency conversion options.

20.3. AI and Machine Learning

AI and machine learning technologies can be used to predict currency fluctuations and optimize currency conversion strategies.

20.4. API Integration

API integration allows businesses to seamlessly integrate currency conversion tools into their websites and applications, providing a better user experience.

20.5. The Future of Fintech and Currency Conversion

The future of fintech is likely to bring even more innovations in currency conversion technology, making it easier and more efficient to convert currencies.

By offering comprehensive tools and up-to-date information, euro2.net remains committed to helping users navigate the complexities of currency conversion with confidence. Whether you are tracking 21 Euro to US Dollars or exploring advanced financial strategies, euro2.net provides the resources you need to succeed in the global economy.

Remember to visit euro2.net for the latest exchange rates, expert analysis, and user-friendly currency conversion tools. Stay informed, make smart financial decisions, and explore the possibilities with euro2.net.