Euro in Yuan

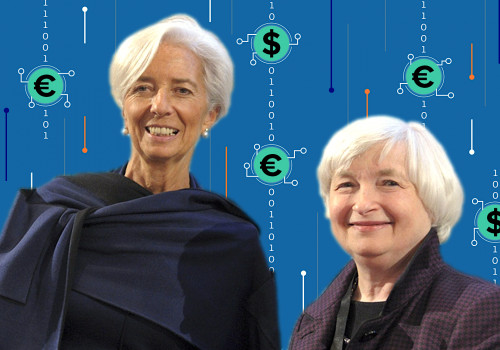

The burgeoning development of Central Bank Digital Currencies (CBDCs) globally brings into sharp focus the contrasting approaches of two major players: the People’s Bank of China (PBOC) with its digital yuan and the European Central Bank (ECB) with its digital euro. While both currencies share the goal of modernizing financial systems, their intended roles and underlying philosophies differ significantly. The PBOC envisions the digital yuan as a potential replacement for physical cash, aiming for a cashless society. Conversely, the ECB positions the digital euro as a complement to existing physical currency, emphasizing choice and gradual integration.

Both institutions are exploring a two-tiered system, leveraging existing digital payment infrastructures like Alipay and WeChat Pay in China, rather than relying on distributed ledger technology. This approach aims for interoperability with current systems and wider adoption. Digital wallets accessible via user-friendly apps are central to both the digital yuan and euro strategies, providing a convenient platform for holding and transacting with the digital currencies. The inherent properties of CBDCs and digital wallets enable central banks to implement remunerative policies on holdings, a feature not possible with traditional cash. Furthermore, these digital currencies promise increased financial inclusion, particularly for unbanked populations.

The implementation of CBDCs raises crucial legal, political, and regulatory questions. Potential challenges to traditional banking intermediation and financial stability need careful consideration. Concerns surrounding user anonymity in transactions and holdings require robust solutions. The future role of physical currencies and their impact on the ability of central banks to impose negative interest rates on CBDC holdings remains uncertain. Finally, the design and scope of capital controls to mitigate potential capital flight require in-depth analysis.

Beyond CBDCs, privately developed digital currencies like Diem introduce another layer of complexity. Diem leverages distributed ledger technology and utilizes a basket of base currencies to ensure stability against volatile cryptocurrencies like Bitcoin. However, the emergence of CBDCs raises questions about the long-term viability and widespread adoption of private digital currencies. The competition between state-backed and private digital currencies will likely shape the future of finance.

European Central Bank headquarters at sunset

European Central Bank headquarters at sunset

The contrasting approaches of China and the European Union towards digital currencies underscore the diverse global landscape of CBDC development. The digital yuan’s ambition to replace cash contrasts with the digital euro’s complementary role. These differing strategies reflect varying economic priorities and highlight the complex considerations surrounding the future of money. The interplay between CBDCs and existing financial systems, the balance between innovation and regulation, and the long-term implications for global finance remain open questions as the digital currency era unfolds.