165 Euro to USD

In recent months, the U.S. dollar has surged to historic highs, a phenomenon with significant implications for developing countries. Driven by aggressive interest rate hikes by the Federal Reserve in response to persistent inflation, the dollar’s strength is impacting economies worldwide. The relative stability of the U.S. economy, coupled with global uncertainties stemming from the Ukraine conflict and China’s economic slowdown, has fueled demand for the dollar as a safe haven asset. This trend translates to higher import costs, inflationary pressures, and escalating debt burdens for developing nations, hindering their post-pandemic recovery.

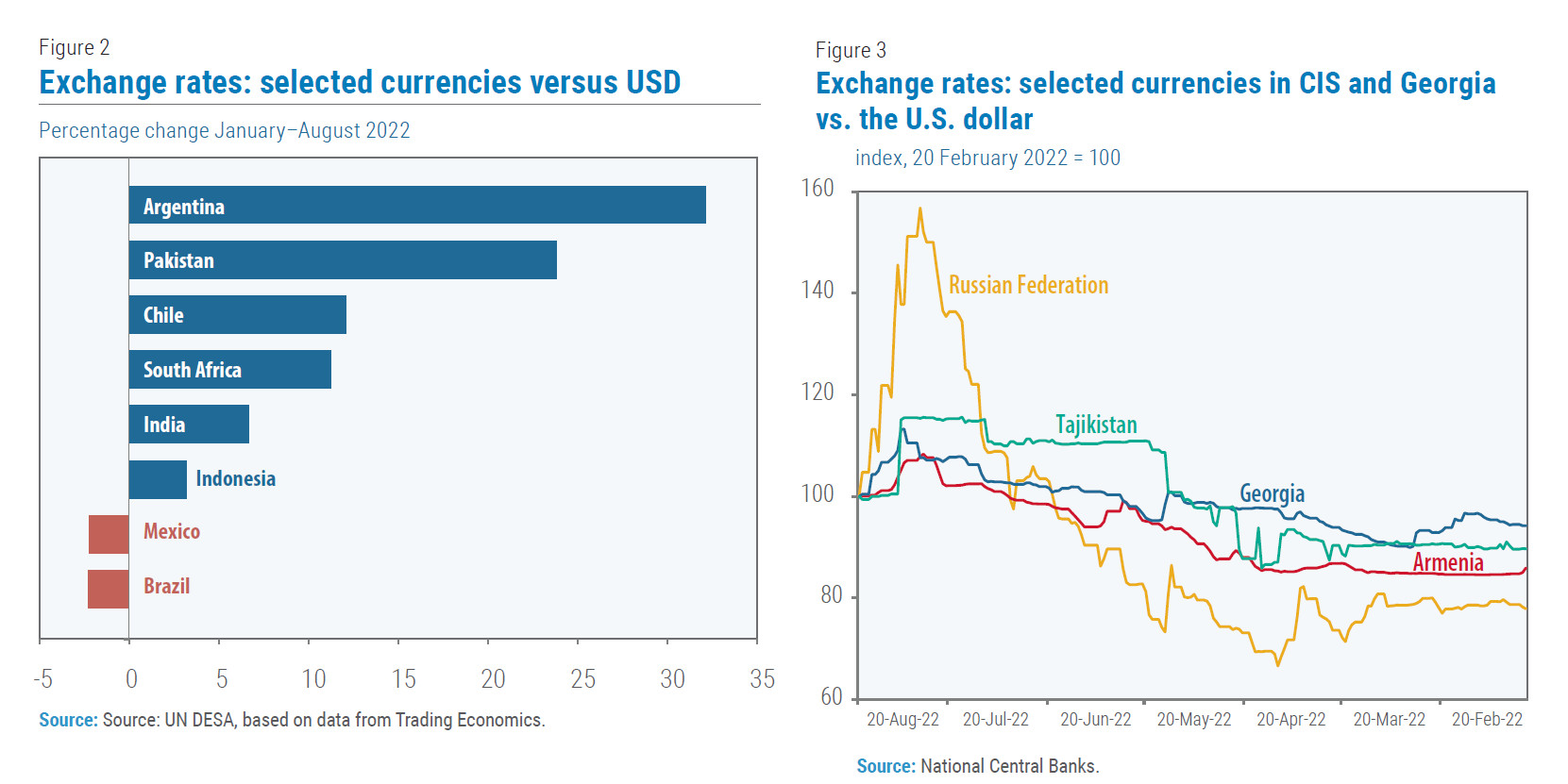

The U.S. dollar index has appreciated significantly against other major currencies, reflecting the dollar’s dominance in the global financial landscape. This surge has triggered capital flight from developing markets, as investors seek higher returns and safer investments in advanced economies. Consequently, many developing countries have experienced substantial currency depreciation against the dollar.

While most developing economies grapple with currency depreciation, a few countries have defied the trend. Notably, the Russian ruble has experienced a surprising appreciation despite economic sanctions and internal challenges. This unusual performance can be attributed to a combination of factors, including stringent capital controls, mandatory foreign exchange sales by exporters, and shifts in global energy markets. However, the long-term sustainability of this trend remains uncertain.

The strong dollar poses a significant threat to the external debt sustainability of developing countries, as a substantial portion of their debt is denominated in U.S. dollars. Debt servicing costs rise sharply as local currencies weaken, straining national budgets and hindering economic growth. The situation is particularly precarious for countries with high levels of dollar-denominated debt and limited foreign exchange reserves.

Furthermore, a strong dollar dampens economic growth in developing countries by raising the cost of capital and discouraging investment. Higher interest rates, implemented to combat inflation and stabilize currencies, make borrowing more expensive for both public and private sectors, leading to reduced investment and slower economic activity. The rising cost of imports, particularly essential food and energy resources, further exacerbates inflationary pressures and undermines economic stability.

The Federal Reserve’s commitment to further interest rate hikes signals a continuation of the strong dollar trend, with potentially severe consequences for developing countries. The confluence of slowing global growth, high inflation, and rising debt burdens presents a formidable challenge for these nations, jeopardizing their ability to achieve sustainable development goals. The long-term impact of the dollar’s strength on the global economy remains a critical concern.