Why Is The Euro Stronger Than The Dollar? A Comprehensive Analysis

The euro’s strength versus the dollar is a complex interplay of economic policies, interest rates, and market sentiment; euro2.net delivers the latest exchange rates and in-depth analysis to navigate this dynamic. Our comprehensive guide explores the factors influencing the euro’s valuation and how you can stay informed. Discover real-time exchange rates, expert insights, and tools at euro2.net.

1. Understanding the Euro-Dollar Relationship

Is the euro stronger than the dollar? While historically the euro has often been stronger, it’s not always the case. The exchange rate fluctuates based on various economic factors, making it essential to stay informed with resources like euro2.net. Let’s dive into what influences this dynamic.

The euro-dollar relationship is influenced by a multitude of factors that determine the strength and stability of both currencies. These factors range from economic policies implemented by central banks to geopolitical events that can impact market sentiment. Understanding these dynamics is crucial for investors, businesses, and individuals who engage in international transactions or are simply interested in the global economy.

1.1. Key Factors Influencing the Euro-Dollar Exchange Rate

The euro-dollar exchange rate is influenced by a complex web of economic factors. Here’s a breakdown:

| Factor | Description |

|---|---|

| Interest Rates | Higher interest rates in the Eurozone can attract foreign investment, increasing demand for the euro. Conversely, higher U.S. interest rates can strengthen the dollar. |

| Economic Growth | Stronger economic growth in the Eurozone tends to support the euro, while robust U.S. growth can bolster the dollar. |

| Inflation Rates | Lower inflation in the Eurozone can make the euro more attractive, while lower U.S. inflation can strengthen the dollar. |

| Government Debt | High levels of government debt in Eurozone countries can weaken the euro, while high U.S. debt can weaken the dollar. |

| Political Stability | Political stability in the Eurozone can strengthen the euro, while political stability in the U.S. can bolster the dollar. |

| Trade Balance | A trade surplus in the Eurozone (exporting more than importing) can increase demand for the euro, while a U.S. trade surplus can strengthen the dollar. |

| Market Sentiment | Overall market sentiment and investor confidence in the Eurozone and the U.S. can significantly impact currency values. |

| Geopolitical Events | Events such as Brexit, trade wars, or political instability can create uncertainty and volatility, influencing the relative strength of the euro and the dollar. |

| Monetary Policy | Policies set by the European Central Bank (ECB) and the Federal Reserve (the Fed) play a crucial role in influencing the euro-dollar exchange rate. These policies include setting interest rates, implementing quantitative easing, and managing inflation. |

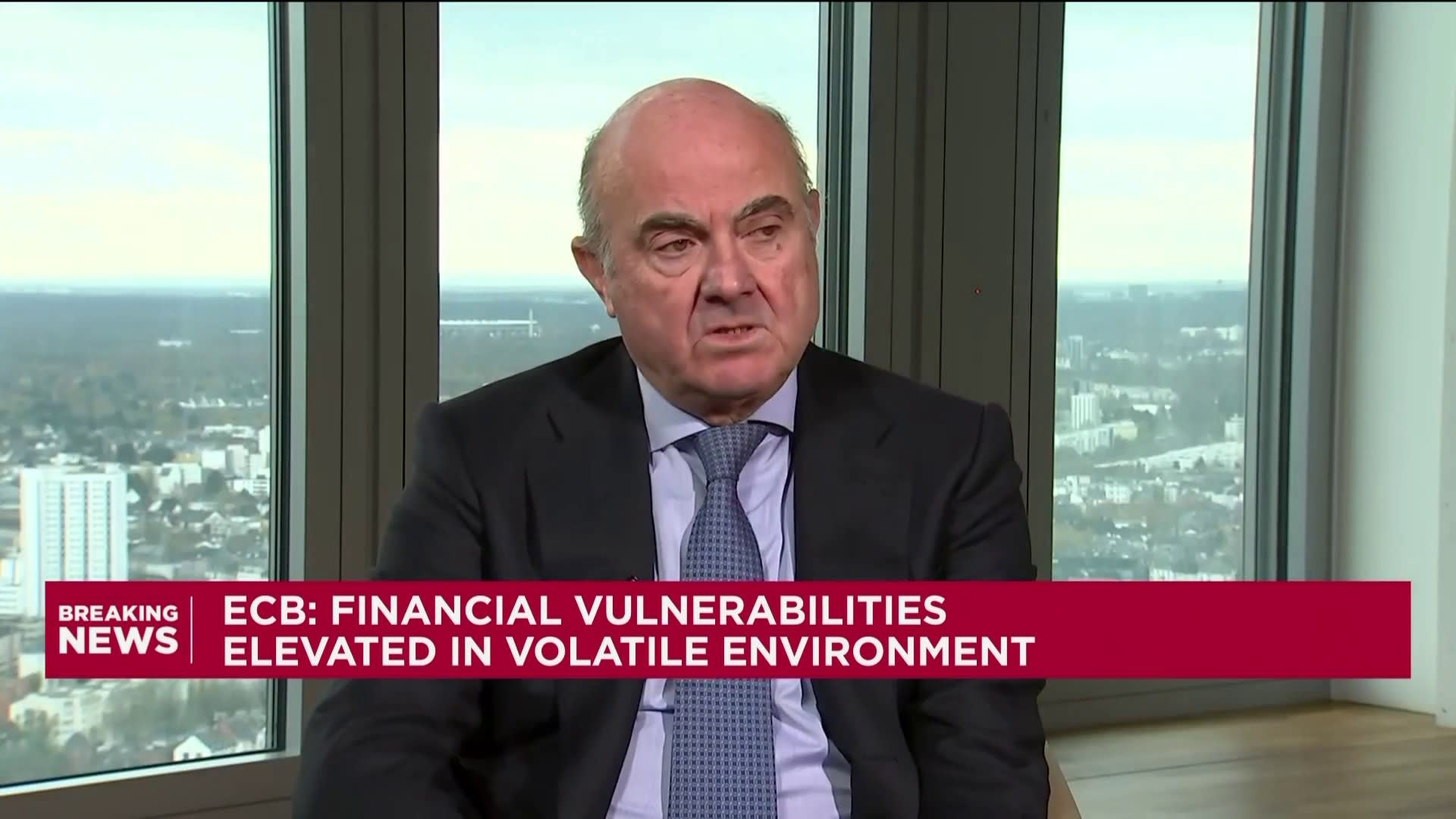

1.2. The Role of Central Banks: ECB vs. Federal Reserve

The European Central Bank (ECB) and the Federal Reserve (the Fed) are pivotal in shaping the euro-dollar exchange rate through their monetary policies.

- European Central Bank (ECB): The ECB’s primary goal is to maintain price stability in the Eurozone. It influences the euro’s value by setting interest rates, managing the money supply, and implementing quantitative easing programs.

- Federal Reserve (the Fed): The Fed aims to promote maximum employment and price stability in the United States. It impacts the dollar’s value by adjusting the federal funds rate, managing the balance sheet, and providing forward guidance on future monetary policy.

1.3. Historical Trends in Euro-Dollar Exchange Rates

Historically, the euro has often been stronger than the dollar, but there have been periods of parity or near parity. For instance, in 2022, the euro briefly hit parity with the dollar for the first time in two decades. Understanding these historical trends provides context for current and future exchange rate movements.

- Early Years (1999-2008): The euro was introduced in 1999 and gradually gained strength against the dollar.

- Global Financial Crisis (2008-2009): The financial crisis led to increased volatility, but the euro remained relatively strong.

- European Debt Crisis (2010-2012): The euro weakened due to sovereign debt issues in several Eurozone countries.

- Post-Crisis Recovery (2013-2020): The euro gradually recovered as the Eurozone economy stabilized.

- COVID-19 Pandemic (2020-2021): The pandemic initially caused uncertainty, but the euro remained resilient.

- Recent Volatility (2022-Present): Factors such as inflation, interest rate hikes, and geopolitical tensions have contributed to significant fluctuations.

Alt: Euro coins and banknotes symbolizing the Eurozone economy and currency.

2. Economic Factors Supporting the Euro’s Strength

What economic factors contribute to the euro’s strength? Factors like the Eurozone’s economic performance, trade balance, and political stability all play a role, but the picture is always evolving. Let’s explore these factors in more detail.

Several economic factors support the euro’s strength, including the Eurozone’s economic performance, trade balance, political stability, and monetary policies.

2.1. Eurozone Economic Performance

The economic performance of the Eurozone significantly impacts the euro’s value. Key indicators include GDP growth, employment rates, and industrial production.

- GDP Growth: Strong GDP growth in the Eurozone boosts investor confidence and demand for the euro.

- Employment Rates: Low unemployment rates indicate a healthy economy, supporting the euro’s strength.

- Industrial Production: Increased industrial production signals economic activity, enhancing the euro’s attractiveness.

2.2. Trade Balance and Current Account Surplus

The Eurozone’s trade balance, particularly its current account surplus, plays a crucial role in supporting the euro.

- Trade Surplus: A trade surplus (exporting more than importing) increases demand for the euro, as foreign buyers need euros to purchase Eurozone goods and services.

- Current Account Surplus: A current account surplus, which includes trade in goods, services, and investment income, further strengthens the euro.

2.3. Political Stability in the Eurozone

Political stability within the Eurozone is crucial for maintaining investor confidence and supporting the euro’s value.

- Stable Governments: Countries with stable governments and consistent policies attract more foreign investment.

- Economic Integration: The Eurozone’s economic integration promotes stability and reduces currency risk.

- Policy Coordination: Coordinated fiscal and monetary policies among Eurozone members enhance stability.

2.4. Inflation and Interest Rate Dynamics

Inflation and interest rate dynamics significantly influence the euro-dollar exchange rate.

- Inflation: Lower inflation in the Eurozone can make the euro more attractive to investors, as it preserves the currency’s purchasing power.

- Example: According to the European Central Bank (ECB), maintaining price stability is the primary objective of the ECB’s monetary policy.

- Interest Rates: Higher interest rates in the Eurozone can attract foreign capital, increasing demand for the euro.

- Example: The ECB’s decisions on interest rates are closely watched by investors, as they can significantly impact the euro’s value.

3. US Economic Factors and Their Impact on the Dollar

What US economic factors affect the dollar’s value? Factors like economic growth, interest rates set by the Federal Reserve, and fiscal policy all have a significant impact. We’ll delve into these aspects.

US economic factors significantly influence the dollar’s value, including economic growth, interest rates set by the Federal Reserve, fiscal policy, and inflation rates.

3.1. US Economic Growth and Employment

The strength of the US economy, as reflected in GDP growth and employment figures, significantly influences the dollar’s value.

- GDP Growth: Robust GDP growth in the US boosts investor confidence and demand for the dollar.

- Example: According to the Bureau of Economic Analysis (BEA), US GDP growth is a key indicator of economic health.

- Employment Rates: Low unemployment rates indicate a healthy economy, supporting the dollar’s strength.

- Example: The US Bureau of Labor Statistics (BLS) releases monthly employment reports that are closely watched by markets.

3.2. Federal Reserve’s Monetary Policy

The Federal Reserve’s monetary policy, particularly its decisions on interest rates and quantitative easing, plays a crucial role in shaping the dollar’s value.

- Interest Rates: Higher interest rates in the US can attract foreign capital, increasing demand for the dollar.

- Example: The Federal Open Market Committee (FOMC) sets the federal funds rate, which influences borrowing costs throughout the economy.

- Quantitative Easing (QE): QE involves the Fed purchasing government bonds and other assets to inject liquidity into the economy, which can weaken the dollar.

- Example: During periods of economic stress, the Fed has used QE to lower long-term interest rates and stimulate economic activity.

3.3. US Fiscal Policy and Government Debt

US fiscal policy, including government spending, taxation, and debt levels, can impact the dollar’s value.

- Government Spending: Increased government spending can stimulate economic growth but may also lead to higher debt levels.

- Example: The US Congress and the President determine the federal budget, which outlines government spending priorities.

- Taxation: Tax policies can influence business investment and consumer spending, affecting economic growth and the dollar’s value.

- Example: Changes in tax rates can impact corporate profits and individual incomes, influencing economic activity.

- Government Debt: High levels of government debt can raise concerns about the long-term sustainability of the US economy, potentially weakening the dollar.

- Example: The US Treasury Department manages the national debt, which is the total amount of money owed by the federal government.

3.4. Inflation Rates in the US

Inflation rates in the US can significantly impact the dollar’s value.

- Low Inflation: Low and stable inflation can make the dollar more attractive to investors, as it preserves the currency’s purchasing power.

- Example: The Federal Reserve aims to maintain inflation at around 2% per year.

- High Inflation: High inflation can erode the dollar’s value, leading to a decrease in its purchasing power and potentially weakening it against other currencies.

- Example: The Consumer Price Index (CPI) is a key measure of inflation in the US, tracked by the Bureau of Labor Statistics.

4. Geopolitical Factors Affecting Currency Values

How do geopolitical events influence currency values? Events like political instability, trade wars, and global crises can all have a significant impact. Let’s examine these factors.

Geopolitical factors play a significant role in shaping currency values, as political instability, trade wars, and global crises can create uncertainty and volatility in financial markets.

4.1. Political Instability and Uncertainty

Political instability and uncertainty can significantly impact currency values.

- Political Crises: Political crises in the Eurozone or the US can lead to a decline in investor confidence, weakening the euro or the dollar.

- Example: Political turmoil in countries like Greece or Italy has historically impacted the euro’s value.

- Elections: Major elections can create uncertainty, leading investors to move their capital to safer havens.

- Example: The outcome of US presidential elections can significantly influence the dollar’s value.

- Policy Changes: Unexpected policy changes can disrupt markets and impact currency values.

- Example: Changes in trade policies or regulatory frameworks can affect the attractiveness of a currency.

4.2. Trade Wars and Protectionism

Trade wars and protectionist policies can have a significant impact on currency values.

- Tariffs: Imposing tariffs on imports can reduce demand for a country’s currency, as foreign buyers need less of that currency to purchase goods.

- Example: The US-China trade war led to increased tariffs and retaliatory measures, impacting both the dollar and the yuan.

- Trade Agreements: Trade agreements can boost economic activity and increase demand for a country’s currency.

- Example: The European Union’s trade agreements with other countries can enhance the euro’s value.

- Protectionist Measures: Protectionist policies can disrupt global trade flows and negatively impact currency values.

- Example: Measures such as import quotas and subsidies can distort markets and create uncertainty.

4.3. Global Crises and Safe-Haven Currencies

Global crises, such as financial meltdowns or pandemics, can drive investors to seek safe-haven currencies.

- Safe-Haven Currencies: During times of crisis, investors often flock to currencies like the US dollar, Swiss franc, and Japanese yen, which are considered safe havens due to their stability and liquidity.

- Example: During the 2008 financial crisis, the US dollar strengthened as investors sought refuge in US assets.

- Economic Downturns: Economic downturns can lead to a decline in risk appetite, increasing demand for safe-haven currencies.

- Example: The COVID-19 pandemic led to a surge in demand for the US dollar as investors sought safety and stability.

- Geopolitical Tensions: Geopolitical tensions, such as conflicts or political instability, can also drive investors to safe-haven currencies.

- Example: Increased tensions in the Middle East can lead to a rise in demand for the US dollar.

Alt: Travelers choosing Europe as a holiday destination, impacting Euro-Dollar exchange rates.

5. Market Sentiment and Speculation

How does market sentiment affect currency strength? Investor confidence and speculative trading can drive significant fluctuations. Let’s explore the influence of market sentiment.

Market sentiment and speculation play a crucial role in shaping currency values, as investor confidence and speculative trading can drive significant fluctuations in the foreign exchange market.

5.1. Investor Confidence and Risk Appetite

Investor confidence and risk appetite are key drivers of currency values.

- Positive Sentiment: Positive economic data, favorable policy announcements, and geopolitical stability can boost investor confidence, leading to increased demand for a currency.

- Example: Strong economic growth in the Eurozone can increase investor confidence in the euro.

- Risk Appetite: Higher risk appetite can lead investors to move their capital into riskier assets, such as emerging market currencies.

- Example: During periods of economic expansion, investors may be more willing to invest in emerging market currencies.

- Negative Sentiment: Negative economic data, policy uncertainty, and geopolitical tensions can erode investor confidence, leading to decreased demand for a currency.

- Example: Political instability in the US can decrease investor confidence in the dollar.

5.2. Speculative Trading and Currency Movements

Speculative trading, driven by hedge funds, institutional investors, and individual traders, can significantly impact currency movements.

- Hedge Funds: Hedge funds often engage in speculative trading strategies, such as currency carry trades, which can influence currency values.

- Example: Currency carry trades involve borrowing a low-interest-rate currency and investing in a high-interest-rate currency.

- Institutional Investors: Institutional investors, such as pension funds and mutual funds, can move large amounts of capital, impacting currency values.

- Example: Large-scale investments in Eurozone bonds by institutional investors can increase demand for the euro.

- Individual Traders: Individual traders also participate in speculative trading, contributing to currency volatility.

- Example: Online trading platforms have made it easier for individuals to trade currencies, increasing market participation.

5.3. News and Expectations

News and expectations about future economic conditions, policy changes, and geopolitical events can drive currency movements.

- Economic Data Releases: Economic data releases, such as GDP growth, employment figures, and inflation rates, can trigger significant currency movements.

- Example: A stronger-than-expected US GDP report can boost the dollar’s value.

- Policy Announcements: Policy announcements by central banks and governments can impact currency values.

- Example: An unexpected interest rate hike by the Federal Reserve can strengthen the dollar.

- Geopolitical Events: Geopolitical events, such as conflicts or political crises, can create uncertainty and lead to currency volatility.

- Example: Increased tensions in the Middle East can lead to a flight to safe-haven currencies like the US dollar.

6. How Tariffs Influence the Euro-Dollar Exchange Rate

Can tariffs affect the euro-dollar exchange rate? Yes, tariffs can impact trade balances and interest rates, influencing currency values. Let’s explore the connection.

Tariffs can significantly influence the euro-dollar exchange rate by impacting trade balances, interest rates, and overall economic conditions.

6.1. Impact on Trade Balances

Tariffs can alter trade balances, leading to changes in currency demand.

- Reduced Exports: Tariffs imposed on Eurozone exports by the US can reduce demand for those goods, decreasing the need for euros and potentially weakening the euro.

- Example: If the US imposes tariffs on German automobiles, US importers will need fewer euros to pay for those cars.

- Increased Imports: Conversely, tariffs imposed on US exports by the Eurozone can reduce demand for those goods, decreasing the need for dollars and potentially weakening the dollar.

- Example: If the Eurozone imposes tariffs on US agricultural products, Eurozone importers will need fewer dollars to pay for those products.

- Trade Deficits: Tariffs can exacerbate trade deficits, putting downward pressure on the currency of the deficit country.

- Example: If the US has a large trade deficit with the Eurozone, tariffs may not fully correct the imbalance, and the dollar could weaken further.

6.2. Effects on Interest Rates

Tariffs can influence interest rate decisions by central banks, impacting currency values.

- Inflation: Tariffs can lead to higher prices for imported goods, potentially causing inflation.

- Example: If the US imposes tariffs on steel imports, the cost of steel-using products in the US may increase, leading to inflation.

- Central Bank Response: Central banks may respond to tariff-induced inflation by raising interest rates, which can attract foreign capital and strengthen the currency.

- Example: If the Federal Reserve raises interest rates to combat inflation caused by tariffs, the dollar may strengthen.

- Economic Slowdown: Tariffs can also lead to an economic slowdown, prompting central banks to lower interest rates to stimulate growth, which can weaken the currency.

- Example: If the European Central Bank lowers interest rates to counteract an economic slowdown caused by tariffs, the euro may weaken.

6.3. Market Sentiment and Investment Flows

Tariffs can impact market sentiment and investment flows, influencing currency values.

- Uncertainty: Tariffs can create uncertainty in financial markets, leading investors to move their capital to safer havens.

- Example: If a trade war between the US and the Eurozone escalates, investors may seek refuge in safe-haven currencies like the Swiss franc or Japanese yen.

- Investment Decisions: Tariffs can affect investment decisions, as businesses may reconsider investments in countries subject to tariffs.

- Example: If the US imposes tariffs on goods from a specific Eurozone country, businesses may reduce investments in that country.

- Currency Volatility: Tariffs can increase currency volatility, making it more difficult for businesses to manage their foreign exchange risk.

- Example: The euro-dollar exchange rate may become more volatile during periods of trade tensions.

7. Interest Rate Differentials and Currency Valuation

How do interest rate differentials affect currency values? Higher interest rates can attract foreign investment, impacting currency demand. Let’s break it down.

Interest rate differentials play a crucial role in currency valuation, as higher interest rates can attract foreign investment, increasing demand for a currency.

7.1. Carry Trade and Currency Demand

The carry trade, which involves borrowing a low-interest-rate currency and investing in a high-interest-rate currency, can significantly impact currency demand.

- Attracting Capital: Higher interest rates in a country can attract foreign capital, increasing demand for that country’s currency.

- Example: If the Eurozone offers higher interest rates than the US, investors may borrow dollars and invest in euro-denominated assets.

- Currency Appreciation: Increased demand for a currency can lead to its appreciation against other currencies.

- Example: If there is strong demand for the euro due to higher interest rates, the euro may appreciate against the dollar.

- Risk Factors: The carry trade is not without risk, as currency values can fluctuate, potentially offsetting the interest rate gains.

- Example: A sudden depreciation of the euro could wipe out the profits from a carry trade.

7.2. Central Bank Policies and Interest Rates

Central bank policies, particularly decisions on interest rates, play a crucial role in shaping currency values.

- Monetary Policy: Central banks use monetary policy to influence interest rates and manage inflation.

- Example: The Federal Reserve and the European Central Bank use interest rates to control inflation and stimulate economic growth.

- Interest Rate Hikes: Raising interest rates can attract foreign capital and strengthen the currency.

- Example: If the Federal Reserve raises interest rates, the dollar may strengthen against other currencies.

- Interest Rate Cuts: Lowering interest rates can stimulate economic growth but may also weaken the currency.

- Example: If the European Central Bank lowers interest rates, the euro may weaken against other currencies.

7.3. Impact on Investment Flows

Interest rate differentials can influence investment flows, impacting currency values.

- Foreign Direct Investment (FDI): Higher interest rates can attract FDI, increasing demand for a country’s currency.

- Example: If the Eurozone offers attractive interest rates, foreign companies may invest in Eurozone businesses, increasing demand for the euro.

- Portfolio Investment: Higher interest rates can also attract portfolio investment, such as investments in stocks and bonds.

- Example: If Eurozone bonds offer higher yields than US bonds, investors may shift their investments to Eurozone bonds.

- Capital Flight: Conversely, lower interest rates can lead to capital flight, as investors seek higher returns elsewhere.

- Example: If the US lowers interest rates significantly, investors may move their capital to countries with higher rates.

8. Predictions for the Future: Euro vs. Dollar

What are the future predictions for the euro versus the dollar? Economic forecasts and expert opinions vary, but understanding potential scenarios is vital. We’ll explore these predictions.

Predictions for the future of the euro versus the dollar vary, but understanding potential economic scenarios and expert opinions is crucial for making informed financial decisions.

8.1. Economic Forecasts and Expert Opinions

Economic forecasts and expert opinions provide valuable insights into the potential future trajectory of the euro-dollar exchange rate.

- Consensus Forecasts: Consensus forecasts, which aggregate the predictions of multiple economists and analysts, can provide a balanced view of the likely future scenario.

- Example: Major financial institutions like Goldman Sachs, JP Morgan, and Barclays regularly publish forecasts for the euro-dollar exchange rate.

- Expert Opinions: Expert opinions from leading economists and currency strategists can offer deeper insights into the factors driving currency movements.

- Example: Economists at think tanks like the Peterson Institute for International Economics and the European Centre for Economic Policy Research often provide valuable perspectives.

- Diverging Views: It’s important to note that economic forecasts and expert opinions can vary, and there is no guarantee that any prediction will be accurate.

- Example: Some analysts may predict that the euro will strengthen against the dollar, while others may forecast the opposite.

8.2. Potential Scenarios and Factors to Watch

Several potential scenarios could impact the future of the euro versus the dollar, and it’s important to monitor key factors that could influence currency values.

- Interest Rate Differentials: Changes in interest rate differentials between the US and the Eurozone could significantly impact the euro-dollar exchange rate.

- Example: If the Federal Reserve raises interest rates more aggressively than the European Central Bank, the dollar may strengthen.

- Economic Growth: Relative economic growth rates in the US and the Eurozone could also influence currency values.

- Example: If the US economy grows faster than the Eurozone economy, the dollar may strengthen.

- Geopolitical Events: Geopolitical events, such as trade wars, political instability, or global crises, could create volatility and impact currency values.

- Example: An escalation of trade tensions between the US and the Eurozone could lead to a decline in both currencies.

- Policy Changes: Unexpected policy changes by central banks or governments could disrupt markets and impact currency values.

- Example: A surprise announcement by the European Central Bank could trigger significant currency movements.

8.3. Long-Term Trends and Predictions

Long-term trends and predictions can offer a broader perspective on the potential future of the euro versus the dollar.

- Demographic Trends: Demographic trends, such as aging populations and declining birth rates, could impact long-term economic growth and currency values.

- Example: An aging population in the Eurozone could lead to slower economic growth and a weaker euro.

- Technological Innovation: Technological innovation could drive productivity growth and impact currency values.

- Example: Advances in artificial intelligence and automation could boost productivity in the US, leading to a stronger dollar.

- Global Power Shifts: Shifts in global economic and political power could also influence currency values.

- Example: The rise of China as a global economic power could lead to a decline in the relative importance of the US dollar and the euro.

9. Practical Implications for Investors and Businesses

What are the practical implications of euro-dollar fluctuations for investors and businesses? Managing currency risk and making informed decisions are critical. Let’s discuss strategies.

Euro-dollar fluctuations have significant practical implications for investors and businesses, and managing currency risk and making informed financial decisions is critical.

9.1. Managing Currency Risk

Managing currency risk is essential for businesses that operate internationally or have exposure to foreign exchange markets.

- Hedging: Hedging involves using financial instruments to reduce or eliminate currency risk.

- Example: Businesses can use forward contracts, options, or currency swaps to hedge against adverse currency movements.

- Natural Hedge: A natural hedge involves matching assets and liabilities in the same currency to reduce exposure.

- Example: A US company with operations in the Eurozone can borrow euros to finance its Eurozone operations, creating a natural hedge.

- Diversification: Diversifying investments across different currencies and asset classes can help reduce overall currency risk.

- Example: Investors can allocate their portfolios to include both US and Eurozone assets.

9.2. Investment Strategies and Currency Exposure

Investment strategies should take into account currency exposure and the potential impact of currency fluctuations on returns.

- Currency Overlay: A currency overlay strategy involves actively managing currency exposure to enhance returns.

- Example: Fund managers can use currency forwards or options to profit from expected currency movements.

- Passive Hedging: A passive hedging strategy involves hedging a fixed percentage of currency exposure to reduce risk.

- Example: Investors can hedge 50% of their Eurozone equity holdings to protect against a decline in the euro.

- Unhedged Exposure: Some investors may choose to leave their currency exposure unhedged, betting that currency movements will be favorable.

- Example: Investors who believe that the euro will appreciate against the dollar may choose not to hedge their Eurozone investments.

9.3. Import/Export Considerations

Currency fluctuations can significantly impact import and export businesses.

- Pricing Strategies: Importers and exporters need to adjust their pricing strategies to account for currency fluctuations.

- Example: Exporters may need to lower their prices in foreign markets if their currency appreciates.

- Sourcing Decisions: Currency fluctuations can influence sourcing decisions, as businesses may shift production to countries with more favorable exchange rates.

- Example: A US company may choose to source components from the Eurozone if the euro weakens against the dollar.

- Payment Terms: Negotiating favorable payment terms with suppliers and customers can help mitigate currency risk.

- Example: Businesses can negotiate to pay or receive payment in their home currency to avoid currency risk.

10. Tools and Resources for Monitoring Euro-Dollar Exchange Rates

What tools and resources can help monitor euro-dollar exchange rates? Real-time data, expert analysis, and economic calendars are invaluable. We’ll explore these resources.

Several tools and resources are available for monitoring euro-dollar exchange rates, including real-time data, expert analysis, and economic calendars.

10.1. Real-Time Data Sources

Real-time data sources provide up-to-the-minute information on euro-dollar exchange rates.

- Financial News Websites: Websites such as Bloomberg, Reuters, and CNBC provide real-time currency quotes and news.

- Example: Bloomberg offers a comprehensive suite of financial data and analytics tools.

- Online Forex Brokers: Online forex brokers offer real-time currency quotes and trading platforms.

- Example: Platforms like MetaTrader 4 and TradingView provide real-time data and charting tools.

- Currency Converter Tools: Currency converter tools, such as those provided by Google Finance and XE.com, offer quick and easy currency conversions.

- Example: XE.com provides historical exchange rate data and currency charts.

10.2. Expert Analysis and Commentary

Expert analysis and commentary can provide valuable insights into the factors driving euro-dollar exchange rates.

- Financial News Websites: Websites such as The Wall Street Journal, Financial Times, and MarketWatch offer expert analysis and commentary on currency markets.

- Example: The Financial Times provides in-depth coverage of global financial markets.

- Research Reports: Investment banks and research firms publish research reports on currency markets, offering forecasts and trading recommendations.

- Example: Goldman Sachs and JP Morgan regularly publish research reports on currency markets.

- Economic Blogs: Economic blogs, such as those maintained by economists and financial analysts, offer commentary on currency markets and economic trends.

- Example: Blogs like Calculated Risk and The Big Picture provide insightful analysis of economic and financial developments.

10.3. Economic Calendars and Event Tracking

Economic calendars and event tracking tools can help investors anticipate market-moving events and data releases.

- Financial News Websites: Websites such as Bloomberg, Reuters, and CNBC provide economic calendars that list upcoming data releases and events.

- Example: Bloomberg’s economic calendar provides a comprehensive list of global economic events.

- Forex Brokers: Online forex brokers offer economic calendars that are integrated into their trading platforms.

- Example: Forex brokers like FXCM and OANDA provide economic calendars with real-time updates.

- Central Bank Websites: Central bank websites, such as the Federal Reserve and the European Central Bank, provide information on upcoming policy meetings and announcements.

- Example: The Federal Reserve’s website provides minutes of FOMC meetings and policy statements.

Navigating the complexities of the euro-dollar exchange rate requires staying informed and utilizing the right tools. At euro2.net, we provide the latest exchange rates, expert analysis, and tools to help you make informed decisions.

Stay ahead of the curve by visiting euro2.net for real-time exchange rates, in-depth analysis, and tools to convert currencies. Make smart financial decisions today with euro2.net.

For more information or assistance, contact us at:

Address: 33 Liberty Street, New York, NY 10045, United States

Phone: +1 (212) 720-5000

Website: euro2.net

FAQ: Understanding the Euro and Its Strength

1. Why is the euro sometimes stronger than the dollar?

The euro’s strength stems from various factors, including the Eurozone’s economic stability, trade surpluses, and monetary policies set by the European Central Bank (ECB). Strong economic performance and investor confidence in the Eurozone can boost the euro’s value compared to the dollar.

2. How do interest rates affect the euro-dollar exchange rate?

Higher interest rates in the Eurozone can attract foreign investment, increasing demand for the euro and strengthening its value against the dollar. Conversely, higher U.S. interest rates can strengthen the dollar.

3. What role do central banks play in currency valuation?

Central banks like the ECB and the Federal Reserve influence currency values through monetary policies, such as setting interest rates and implementing quantitative easing. These policies impact inflation, economic growth, and investor sentiment, affecting currency demand.

4. Can political instability impact the euro-dollar exchange rate?

Yes, political instability in either the Eurozone or the United States can lead to uncertainty and decreased investor confidence, weakening the respective currency. Stable governments and consistent policies attract more foreign investment.

5. How do trade wars influence currency values?

Trade wars can disrupt global trade flows and impact currency values. Tariffs and protectionist measures can reduce demand for a country’s currency, leading to a decline in its value.

6. What are safe-haven currencies, and how do they affect the euro and dollar?

Safe-haven currencies like the US dollar, Swiss franc, and Japanese yen tend to attract investors during times of global crisis. Increased demand for safe-haven currencies can strengthen them against riskier currencies like the euro.

7. How can I monitor euro-dollar exchange rates in real-time?

You can monitor euro-dollar exchange rates through financial news websites like Bloomberg, Reuters, and CNBC, as well as online forex brokers that offer real-time currency quotes and trading platforms.

8. What is the carry trade, and how does it affect currency demand?

The carry trade involves borrowing a low-interest-rate currency and investing in a high-interest-rate currency. This strategy can significantly impact currency demand, as investors seek higher returns in specific currencies.

9. How can businesses manage currency risk when dealing with euro-dollar fluctuations?

Businesses can manage currency risk through hedging strategies, natural hedges, and diversification. Hedging involves using financial instruments to reduce or eliminate currency risk, while natural hedges match assets and liabilities in the same currency.

10. Where can I find expert analysis on the euro-dollar exchange rate?

You can find expert analysis and commentary on financial news websites, research reports from investment banks, and economic blogs maintained by economists and financial analysts. These sources provide valuable insights into the factors driving currency movements.