What Is Sign Of Euro Currency? A Comprehensive Guide

What Is Sign Of Euro Currency? The euro symbol (€), used across the Eurozone, represents a unified currency and economic stability. At euro2.net, we provide real-time exchange rates, expert analysis, and user-friendly tools to help you navigate the world of Euro exchange, currency conversion, and international finance, ultimately assisting you in making informed financial decisions.

1. Understanding the Euro Symbol (€)

The euro symbol (€) is the graphic mark used to represent the euro, the official currency of the Eurozone, which comprises 19 of the 27 member states of the European Union. The design was finalized in 1996 and officially introduced with the currency in 1999.

1.1. Design and Symbolism

The euro symbol (€) was inspired by the Greek letter epsilon (Є), a reference to the cradle of European civilization, and includes two horizontal lines to signify the stability of the euro. The European Commission chose the final design from a shortlist of options, intending to create a symbol that was easily recognizable and conveyed a sense of credibility. According to the European Central Bank (ECB), the euro symbol represents “Europe’s identity.”

1.2. How to Type the Euro Symbol

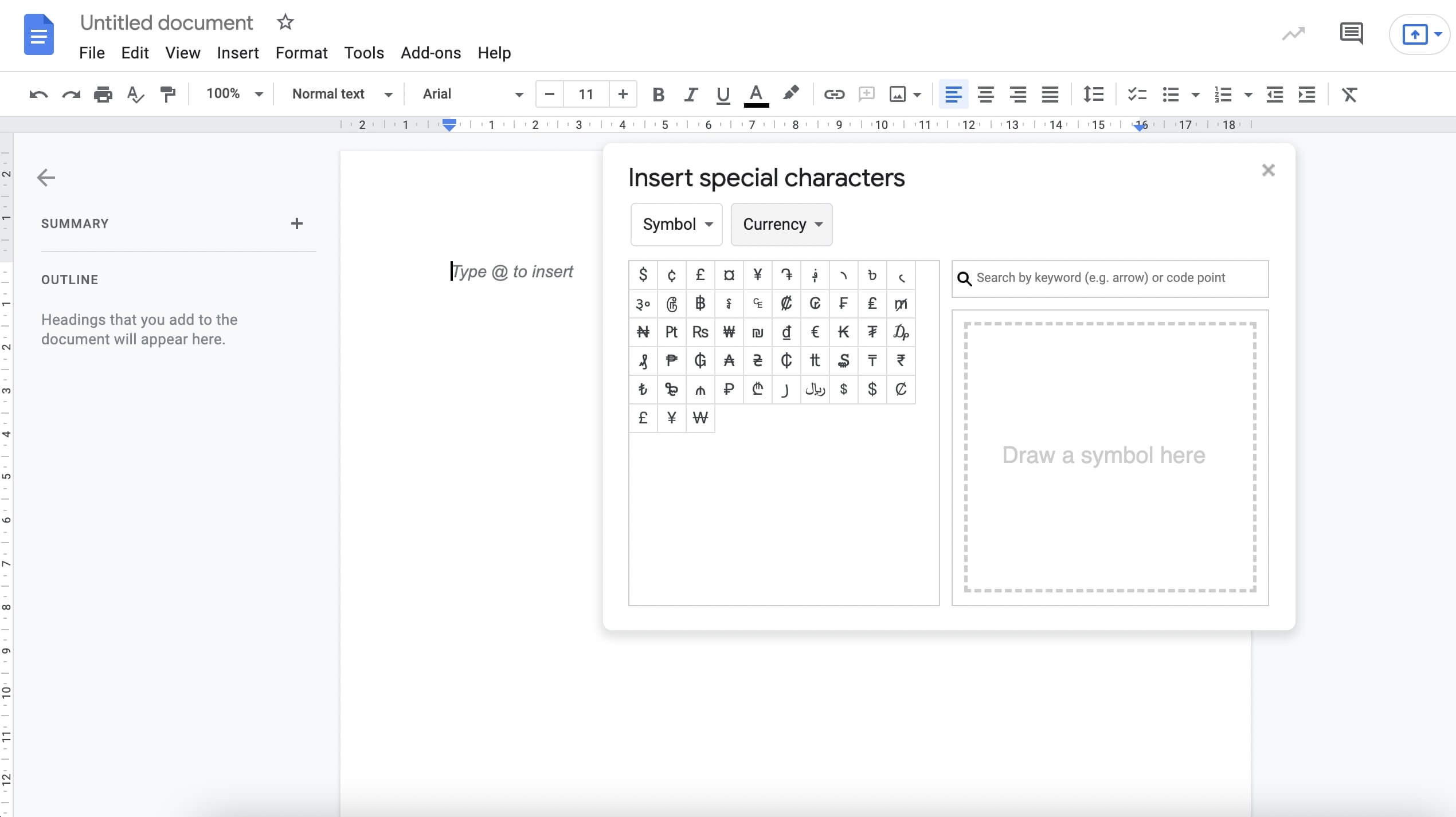

Typing the euro symbol can vary depending on your operating system and keyboard layout:

- Windows: You can type Alt + 0128 on the numeric keypad.

- Mac: Use the key combination Option + 2.

- HTML: The HTML entity code for the euro symbol is

€or the numeric character reference€.

1.3. Eurozone Countries

The Eurozone includes Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain. These countries have adopted the euro as their sole legal tender, facilitating trade and economic integration.

2. History of the Euro

The euro’s history is rooted in the Maastricht Treaty of 1992, which laid the groundwork for economic and monetary union in Europe. The currency was officially launched on January 1, 1999, as an accounting currency, with euro banknotes and coins introduced on January 1, 2002.

2.1. Key Milestones

- 1992: Maastricht Treaty: Established the framework for the introduction of a single European currency.

- 1999: Euro Introduction (Accounting Currency): The euro was launched as an accounting currency for non-cash transactions.

- 2002: Euro Banknotes and Coins: Euro banknotes and coins were introduced into circulation in the Eurozone countries.

- 2002-Present: Expansion of the Eurozone: More countries joined the Eurozone, adopting the euro as their currency.

2.2. Objectives of the Euro

The primary objectives of introducing the euro included:

- Facilitating Trade: Reducing transaction costs and exchange rate risks for businesses within the Eurozone.

- Price Stability: Maintaining price stability through a common monetary policy managed by the European Central Bank (ECB).

- Economic Integration: Promoting greater economic integration and cooperation among member states.

2.3. The Role of the European Central Bank (ECB)

The European Central Bank (ECB), headquartered in Frankfurt, Germany, is responsible for the monetary policy of the Eurozone. The ECB’s main task is to maintain price stability, defined as keeping inflation rates close to but below 2% over the medium term, according to the ECB’s official mandate.

3. Euro Exchange Rates and Factors Affecting Them

The euro exchange rate fluctuates based on various economic, political, and market factors. Understanding these factors is crucial for anyone dealing with the euro, whether for investment, trade, or travel.

3.1. Key Economic Indicators

- GDP Growth: Strong economic growth in the Eurozone can lead to a stronger euro, as it attracts investment.

- Inflation Rates: Higher inflation relative to other countries can weaken the euro, as it reduces the currency’s purchasing power.

- Unemployment Rates: Lower unemployment rates can strengthen the euro, indicating a healthy economy.

- Trade Balance: A trade surplus (more exports than imports) can increase demand for the euro, strengthening its value.

3.2. Interest Rates

Interest rates set by the European Central Bank (ECB) significantly impact the euro’s exchange rate. Higher interest rates can attract foreign investment, increasing demand for the euro and strengthening its value. Conversely, lower interest rates can make the euro less attractive to investors, potentially weakening its value.

3.3. Political Stability and Geopolitical Events

Political stability within the Eurozone and geopolitical events can also affect the euro’s exchange rate. Political uncertainty, such as elections or referendums, can create volatility in the currency markets. Geopolitical events, such as trade wars or international conflicts, can also impact investor sentiment and currency values.

3.4. Market Sentiment

Market sentiment, driven by news, rumors, and speculation, can lead to short-term fluctuations in the euro’s exchange rate. Positive news about the Eurozone economy can boost confidence and increase demand for the euro, while negative news can have the opposite effect.

4. Euro vs. Other Major Currencies

The euro is one of the world’s major currencies, along with the U.S. dollar (USD), Japanese yen (JPY), and British pound (GBP). Understanding the dynamics between the euro and these currencies is essential for international finance.

4.1. EUR/USD (Euro vs. U.S. Dollar)

The EUR/USD pair is the most heavily traded currency pair in the world. The exchange rate between the euro and the U.S. dollar is influenced by factors such as:

- Interest Rate Differentials: Differences in interest rates set by the ECB and the Federal Reserve (the Fed) can impact the relative attractiveness of the euro and the dollar.

- Economic Growth: Relative economic growth rates in the Eurozone and the United States can influence investor sentiment and currency values.

- Political Developments: Political events and policy changes in both regions can create volatility in the EUR/USD exchange rate.

4.2. EUR/JPY (Euro vs. Japanese Yen)

The EUR/JPY pair reflects the relative strength of the euro against the Japanese yen. Factors influencing this pair include:

- Monetary Policy: Differences in monetary policy between the ECB and the Bank of Japan (BOJ) can affect the EUR/JPY exchange rate.

- Risk Sentiment: The Japanese yen is often seen as a safe-haven currency, so risk aversion in global markets can lead to increased demand for the yen and a weaker EUR/JPY rate.

- Trade Flows: Trade relations between the Eurozone and Japan can also impact the demand for each currency.

4.3. EUR/GBP (Euro vs. British Pound)

The EUR/GBP pair is influenced by factors such as:

- Brexit: Developments related to Brexit and the UK’s relationship with the European Union continue to impact the EUR/GBP exchange rate.

- Economic Performance: Relative economic performance in the Eurozone and the United Kingdom can affect investor sentiment and currency values.

- Monetary Policy: Monetary policy decisions by the ECB and the Bank of England (BOE) play a crucial role in determining the EUR/GBP exchange rate.

5. Using the Euro in the United States

While the euro is not the official currency of the United States, it is widely accepted in many tourist areas and businesses catering to international visitors. However, it’s essential to understand the implications of using the euro in the U.S.

5.1. Acceptance of Euros in the U.S.

Many hotels, restaurants, and tourist attractions in major U.S. cities may accept euros as payment. However, it’s not mandatory, and the exchange rate offered may not be favorable.

5.2. Currency Exchange Options

Travelers can exchange euros for U.S. dollars at:

- Banks: Offering competitive exchange rates and lower fees for account holders.

- Currency Exchange Services: Located in airports, tourist areas, and major cities, but may charge higher fees.

- ATMs: Some ATMs offer the option to withdraw U.S. dollars from a euro-denominated account, but fees may apply.

5.3. Best Practices for Currency Exchange

- Compare Exchange Rates: Shop around for the best exchange rates before converting your currency.

- Check for Fees: Be aware of any fees or commissions charged by the exchange service.

- Use Credit or Debit Cards: Credit and debit cards often offer competitive exchange rates, but check for foreign transaction fees.

- Withdraw Cash from ATMs: ATMs can provide a convenient way to access local currency, but be mindful of fees.

6. The Euro and International Trade

The euro plays a significant role in international trade, particularly between the Eurozone and other countries. Its stability and widespread use make it a preferred currency for many international transactions.

6.1. Euro as a Reserve Currency

The euro is one of the world’s major reserve currencies, held by central banks and governments as part of their foreign exchange reserves. As of 2023, the euro accounted for approximately 20% of global foreign exchange reserves, according to the International Monetary Fund (IMF).

6.2. Impact on Trade

- Reduced Transaction Costs: The euro eliminates the need for currency conversions within the Eurozone, reducing transaction costs for businesses.

- Price Transparency: A single currency makes it easier to compare prices across different countries, promoting competition.

- Stable Exchange Rates: The euro provides more stable exchange rates within the Eurozone, reducing uncertainty for businesses involved in cross-border trade.

6.3. Trade Relations between the U.S. and the Eurozone

The United States and the Eurozone have a strong trade relationship, with significant volumes of goods and services exchanged between the two regions. The EUR/USD exchange rate plays a crucial role in determining the competitiveness of exports and imports.

7. Investing in the Euro

Investing in the euro can be done through various financial instruments, including:

7.1. Euro-Denominated Bonds

Euro-denominated bonds are debt securities issued by governments, corporations, or international organizations and denominated in euros. These bonds can offer a stable income stream and potential capital appreciation.

7.2. Euro ETFs (Exchange-Traded Funds)

Euro ETFs are investment funds that track the performance of a basket of euro-denominated assets, such as stocks or bonds. They provide a convenient way to diversify your exposure to the euro.

7.3. Forex Trading (EUR/USD, EUR/JPY, EUR/GBP)

Forex trading involves buying and selling currencies on the foreign exchange market. The EUR/USD, EUR/JPY, and EUR/GBP pairs are popular choices for forex traders looking to profit from fluctuations in the euro’s exchange rate.

7.4. Risks and Considerations

- Exchange Rate Risk: Fluctuations in the euro’s exchange rate can impact the value of your investments.

- Interest Rate Risk: Changes in interest rates can affect the value of euro-denominated bonds.

- Political and Economic Risk: Political instability and economic uncertainty in the Eurozone can create volatility in the euro’s value.

8. Euro Travel Tips for Americans

Traveling to the Eurozone as an American requires some financial planning to ensure a smooth and cost-effective trip.

8.1. Currency Exchange Before Departure

It’s advisable to exchange some U.S. dollars for euros before departing for the Eurozone. This can provide you with immediate access to cash upon arrival and avoid potentially unfavorable exchange rates at airports.

8.2. Using Credit and Debit Cards

Credit and debit cards are widely accepted in the Eurozone, but it’s essential to check for foreign transaction fees before using them. Some cards offer no foreign transaction fees and can provide competitive exchange rates.

8.3. Withdrawing Cash from ATMs

ATMs are readily available in the Eurozone and can provide a convenient way to access local currency. However, be mindful of ATM fees and foreign transaction fees charged by your bank.

8.4. Budgeting and Expenses

- Accommodation: Varies widely depending on the city and type of accommodation, from budget hostels to luxury hotels.

- Food and Drink: Restaurant prices can be higher in tourist areas, so consider exploring local markets and eateries for more affordable options.

- Transportation: Public transportation is generally efficient and cost-effective, with options such as buses, trains, and trams.

- Activities and Sightseeing: Many museums and attractions offer discounts for students, seniors, and groups.

8.5. Safety and Security

- Protect Your Valuables: Be aware of pickpockets and scams, particularly in crowded tourist areas.

- Use Secure ATMs: Opt for ATMs located inside banks or well-lit areas to avoid potential fraud.

- Inform Your Bank: Notify your bank of your travel plans to avoid having your credit or debit cards blocked.

9. Common Misconceptions About the Euro

There are several common misconceptions about the euro that are worth clarifying.

9.1. The Euro is Only Used in the European Union

While the euro is the official currency of the Eurozone, some countries outside the European Union also use the euro as their currency, either officially or unofficially. These include Vatican City, Monaco, San Marino, and Andorra.

9.2. The Euro is Always Strong Against the U.S. Dollar

The euro’s exchange rate against the U.S. dollar fluctuates based on various economic and political factors. There have been periods when the euro was stronger than the dollar and vice versa.

9.3. All European Countries Use the Euro

Not all countries in Europe are part of the Eurozone. Some countries, such as Switzerland, Denmark, and Sweden, have retained their own currencies.

10. The Future of the Euro

The future of the euro depends on various factors, including economic policies, political developments, and global economic trends.

10.1. Potential Challenges

- Economic Divergence: Differences in economic performance among Eurozone countries can create challenges for the single currency.

- Political Instability: Political uncertainty and populist movements can threaten the stability of the Eurozone.

- Global Economic Slowdown: A global economic slowdown or recession can impact the euro’s value and the Eurozone economy.

10.2. Potential Opportunities

- Further Economic Integration: Deeper economic integration and reforms can strengthen the Eurozone and the euro.

- Digital Euro: The introduction of a digital euro could enhance the efficiency and competitiveness of the Eurozone economy.

- Global Role: The euro has the potential to play an even greater role in international trade and finance, challenging the dominance of the U.S. dollar.

10.3. Expert Opinions and Forecasts

Economists and financial analysts have varying opinions about the future of the euro. Some believe that the euro will continue to be a stable and important currency, while others express concerns about the challenges facing the Eurozone.

11. FAQ about the Euro Currency

Here are some frequently asked questions about the euro:

11.1. What is the symbol for the euro currency?

The symbol for the euro currency is €.

11.2. Which countries use the euro?

The euro is used by 19 of the 27 member states of the European Union, including Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain.

11.3. How can I get the best exchange rate for euros?

To get the best exchange rate for euros, compare rates from different banks, currency exchange services, and ATMs. Consider using credit or debit cards that offer competitive exchange rates and low foreign transaction fees.

11.4. Is it better to exchange currency before traveling to Europe?

It’s advisable to exchange some currency before traveling to Europe to have immediate access to cash upon arrival. However, avoid exchanging large amounts of currency, as you may get a better rate using credit or debit cards or withdrawing cash from ATMs.

11.5. What factors affect the euro exchange rate?

The euro exchange rate is affected by various factors, including economic growth, inflation rates, interest rates, political stability, and market sentiment.

11.6. How does the European Central Bank (ECB) influence the euro?

The European Central Bank (ECB) influences the euro through its monetary policy decisions, such as setting interest rates and managing the money supply.

11.7. Can I use euros in the United States?

While some businesses in the United States may accept euros, it’s not mandatory. It’s generally better to use U.S. dollars or credit/debit cards.

11.8. What are the risks of investing in the euro?

The risks of investing in the euro include exchange rate risk, interest rate risk, and political and economic risk.

11.9. How can I protect myself from currency fluctuations when traveling?

To protect yourself from currency fluctuations when traveling, consider using credit or debit cards with no foreign transaction fees, withdrawing cash from ATMs, and budgeting for potential changes in exchange rates.

11.10. What is the future outlook for the euro?

The future outlook for the euro depends on various factors, including economic policies, political developments, and global economic trends. While there are potential challenges, there are also opportunities for further economic integration and a greater global role for the euro.

12. Conclusion: Navigating the World of the Euro with euro2.net

Understanding the euro, its symbol, and the factors that influence its value is crucial for anyone involved in international finance, trade, or travel. At euro2.net, we are committed to providing you with the latest information, expert analysis, and user-friendly tools to help you navigate the world of the euro, currency conversion, and international finance.

Whether you’re looking to track the latest exchange rates, understand the economic forces driving currency values, or find the best way to exchange currency for your next trip, euro2.net is your trusted source for all things euro. Visit euro2.net today to explore our resources and empower your financial decisions.

Address: 33 Liberty Street, New York, NY 10045, United States

Phone: +1 (212) 720-5000

Website: euro2.net