Turkish Lira to Euro Conversion: Your Ultimate Guide to TRY to EUR Exchange Rates

Looking for the latest Turkish Lira exchange rates for your trip to Turkey or considering opening a TRY foreign currency account? Here’s a quick guide to what you need to know. The New Turkish Lira has been Turkey’s official currency since 2005, with banknotes and coins including Kuruş and the 1 Lira coin. 1 Lira is equivalent to 100 Kuruş. The TRY to EUR conversion rate is based on the current daily exchange rate. You can find the latest TRY EUR rate below (döviz kurları bugün, euro kaç tl).

EUR to TRY Currency Converter (Turkish Lira to Euro) 2024

Use this Euro to Turkish Lira currency converter to quickly and easily calculate amounts between these two currencies. Whether you’re comparing prices for your holiday or need data for a TRY investment, this tool provides instant conversions. For more detailed information, see our special feature on 100 Euro to Lira.

Are you a business owner or freelancer dealing with transactions in Turkey and need to monitor Turkish Lira exchange rates? Or perhaps you’re a tourist wanting to compare prices? Our converter delivers up-to-date rates immediately. Simply enter the amount in the desired field and click “Calculate.” The rate is current and reflects the official EUR TRY reference rate published by the ECB.

Turkish Lira to Euro Conversion Table

This currency conversion table provides a quick overview of the value of common Turkish Lira and Euro banknotes. A foreign exchange conversion table is particularly useful when shopping locally or online, helping you quickly understand the value of 1 Euro in Turkish Lira or 1 Turkish Lira in Euro. Below are common conversions for amounts ranging from 1 Turkish Lira to 5000 Turkish Lira: euro kaç tl.

| 1 EUR | = | 38.10 TRY | 1 TRY | = | 0.03 EUR | |

|---|---|---|---|---|---|---|

| 5 EUR | = | 190.51 TRY | 5 TRY | = | 0.13 EUR | |

| 10 EUR | = | 381.02 TRY | 10 TRY | = | 0.26 EUR | |

| 25 EUR | = | 952.56 TRY | 25 TRY | = | 0.66 EUR | |

| 50 EUR | = | 1905.12 TRY | 50 TRY | = | 1.31 EUR | |

| 100 EUR | = | 3810.23 TRY | 100 TRY | = | 2.62 EUR | |

| 250 EUR | = | 9525.58 TRY | 250 TRY | = | 6.56 EUR | |

| 500 EUR | = | 19051.15 TRY | 500 TRY | = | 13.12 EUR | |

| 1000 EUR | = | 38102.30 TRY | 1000 TRY | = | 26.25 EUR | |

| 5000 EUR | = | 190511.50 TRY | 5000 TRY | = | 131.23 EUR |

Current Turkish Lira to Euro Exchange Rate (döviz kurları bugün)

Here you can find the most up-to-date TRY exchange rate (TL Euro). This rate reflects the reference rate published by the ECB. Foreign exchange rates are updated daily shortly after 4:00 PM CET.

1 EUR = 38.1023 TRY

1 TRY = 0.0262 EUR

TL EUR News & Updates

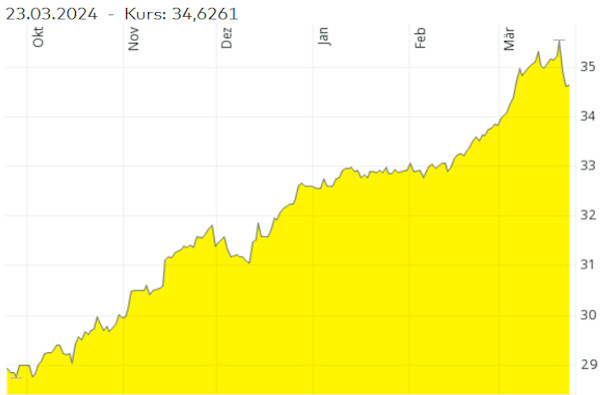

March 24, 2024: On March 21, 2024, the Turkish Central Bank increased its key interest rate from 45% to 50%, surprising the market. The Lira reacted immediately, appreciating by 1.8% against the Euro (Figure 1). This significant rate hike occurred ten days before nationwide local elections and was interpreted by the market as a signal of the central bank’s independence and determination to combat the high inflation rate of 70%, regardless of political pressures. In contrast, a previous key rate increase on December 21, 2023, did not result in any appreciation of the Lira.

Turkish Lira to Euro exchange rate chart following interest rate hike

Turkish Lira to Euro exchange rate chart following interest rate hike

Turkish Lira exchange rate development after the key interest rate hike to 50%.

Figure 1: EUR-TL Exchange Rate from October 22, 2023 – March 22, 2024. Source: comdirect.de

December 22, 2023: The Lira continues to fall. Even the Central Bank of the Republic of Turkey (TCMB)’s increase in the key interest rate by 250 basis points to 42.50% has not brought any recovery to the Turkish currency (Figure 1).

The depreciation of the Lira against the Euro is dramatic: The Turkish currency’s loss in value in 2023 is substantial, totaling around 63% within a year. On December 22, 2022, the EUR TL exchange rate was 19.7609, and by December 22, 2023, it had reached 32.1173.

Understanding the Turkish Lira (TRY)

The current Turkish Lira is a relatively young currency, officially recognized under the ISO code TRY 4217 since 2005. It is the legal tender in Turkey and Northern Cyprus. The currency abbreviation is TL, and one Turkish Lira is composed of 100 Kuruş. You might occasionally see the abbreviation YTL, which refers exclusively to the “New Turkish Lira” (Yeni Türk Lirası) used between 2005 and 2008. Although it consists of three characters, YTL is simply an abbreviation for the Turkish currency and not an ISO code.

The currency symbol ₺ was introduced on March 1, 2012, following a nationwide competition won by geologist Tülay Lale. The symbol is designed to resemble an anchor, symbolizing currency stability. The new currency symbol is placed before the amount in Turkish Lira.

TRY-EUR Exchange Rate Performance in 2024

The Lira has depreciated against the US dollar by approximately 14% from the beginning of the year to November 1, 2024. In 2021, the depreciation was even more severe at 46%. The sharp decline in 2021 was largely attributed to President Tayyip Erdogan’s unconventional monetary policy views, advocating for interest rate cuts to combat inflation. The Turkish Lira shows no signs of reversing its long-term depreciation in 2024 and 2025, having continued to lose value against most major global currencies throughout 2023.

From January 1, 2024, to November 10, 2024, the Turkish Lira (TRY) significantly lost value against both the Euro (EUR) and the US Dollar (USD).

Performance against the Euro: On January 1, 2024, the exchange rate was approximately 32.63 TRY per 1 EUR. By November 1, 2024, the rate had reached around 37.38 TRY per 1 EUR. This represents a depreciation of the Lira by about 14.5% against the Euro during this period.

Performance against the US Dollar: On January 1, 2024, the exchange rate was approximately 30.00 TRY per 1 USD. By November 1, 2024, the rate was around 34.17 TRY per 1 USD. This indicates a depreciation of the Lira by about 13.9% against the US Dollar over the same period.

These trends reflect the ongoing weakness of the Turkish Lira, influenced by factors such as high inflation, economic uncertainties, and monetary policy decisions.

Factors Influencing the Turkish Lira to Euro Exchange Rate

Several factors can influence the exchange rate between the Euro and the Turkish Lira (TRY). Here are some key factors that can affect the EUR/TRY exchange rate:

- Interest Rates: Higher interest rates in Europe compared to Turkey tend to attract foreign investors seeking better returns. Consequently, increased demand for the Euro can lead to an appreciation of its value against the TRY. The Turkish Central Bank’s extremely low interest rate policy was advocated by Erdogan for an extended period. The Lira exchange rate depreciated further with each interest rate cut, a trend observed over years, including 2021, 2022, and into early 2023. However, shortly after his re-election as President in June 2023, he shifted his stance and approved interest rate hikes, likely to revitalize the economy and regain international confidence.

- Inflation Rates: High inflation in Turkey can erode the value of the Turkish Lira, reducing its purchasing power. Conversely, lower inflation in the Eurozone could make the Euro relatively more attractive, potentially leading to appreciation against the TRY. (More information on Inflation in Turkey).

- Economic Indicators: Factors like GDP growth, employment rates, trade balances, and fiscal policies can influence market sentiment and investor confidence. Positive economic indicators in Europe compared to Turkey can sway the exchange rate in favor of the EUR.

- Political Stability and Geopolitical Events: Political stability or instability in either region can impact exchange rates. Uncertainty, conflicts, or significant political events can lead to currency fluctuations as investors adjust their positions based on perceived risks.

- Monetary Policy and Central Bank Actions: Decisions by the ECB and the Central Bank of the Republic of Turkey (CBRT) regarding interest rates, quantitative easing, or other policy measures can significantly affect the EUR/TRY exchange rate.

- Market Speculation and Investor Sentiment: Market sentiment and speculative trading can influence short-term exchange rate fluctuations. News, market expectations, and general risk appetite can lead to volatility in foreign exchange markets.

- Trade Relations and Balance: Changes in trade policies, tariffs, or trade imbalances between European countries and Turkey can affect the exchange rate. Trade deficits or surpluses can impact investor confidence and influence the value of the currencies involved.

It’s important to note that exchange rates are influenced by a complex interplay of various factors and are subject to unexpected changes. Therefore, predicting exchange rate movements with certainty is challenging.

Turkish Lira to Euro Exchange Rate History

How has the Turkish currency performed against the Euro historically? Figure 2 illustrates a dramatic trend: continuous devaluation, with increased momentum in recent years. A significant contributing factor is the persistently high inflation. In May 2023, the inflation rate was around 40%. When currencies depreciate, imported goods become more expensive. As Turkey imports many goods such as fuel, materials, and technology, a weaker currency leads to higher prices. This has resulted in record-high inflation in Turkey – among the highest in Europe. Turkish businesses suffer from the Lira’s devaluation, which has increased production costs, while people’s wages have effectively decreased as their money buys less.

The Turkish economy’s performance has also been less than desirable. While the Turkish economy made significant progress in the last two decades, averaging an annual GDP growth of 5.8% between 2002 and 2021, this strong GDP growth was not “sustainable.” Investors have significantly reduced their investments in recent years, leading to a sharp depreciation of the Turkish Lira against the Euro and the Dollar. The Euro-TRY exchange rate on June 12, 2023, compared to 2001, stands at 1.1.

Figure 2: TL € Development from 2005 -2023. Source: ecb.europa.eu

History of the Turkish Lira

The division of a Turkish Lira into 100 Kuruş dates back to around 1875 when Ottoman currency was in circulation in Turkey. The Republic of Turkey was officially established on October 29, 1923. Two years later, the Turkish Parliament passed Law No. 701 to print the first banknotes of the Turkish Republic. It replaced the previous currency, the Ottoman Lira, at a rate of 1 Turkish Lira to 1 Ottoman Lira. Ottoman banknotes in circulation were removed by December 4, 1927, and declared worthless from September 4, 1928. On September 5, 1928, the first series of new Turkish banknotes was issued.

Originally, the Turkish Lira was pegged to the British Pound at an exchange rate of 1 Turkish Lira to 4.5 British Pounds. This peg lasted until 1946 when it was replaced by a peg to the US Dollar. From 1946 to the early 2000s, the Turkish Lira maintained a fixed exchange rate system, primarily linked to the US Dollar. The exchange rate was managed by the Central Bank of the Republic of Turkey during this period. However, due to various economic challenges and inflationary pressures, the Lira underwent several devaluations against the Dollar.

Historical Development of the TRY-EUR Exchange Rate

The TRY-EUR exchange rate has been shaped by various historical factors.

In the early 2000s, Turkey faced a severe financial crisis, leading to a loss of confidence in the Turkish Lira. In response, the government and the Central Bank of Turkey implemented economic reforms, including transitioning to a floating exchange rate system for the TL. This allowed the TRY to fluctuate freely, determined by market forces.

Turkey has been pursuing membership in the European Union (EU) since the late 1980s. The prospect of EU membership has had implications for the TRY-EUR exchange rate. During periods of progress in the EU accession process, the Turkish Lira tended to appreciate against the Euro. Conversely, setbacks or political tensions have led to depreciation.

Currency Revisions and Nomenclature

Turkey’s economy has suffered from high inflation rates for decades. As prices rose, the subunit Kuruş became less practical and disappeared from daily use in the 1980s. The Kuruş only returned with the introduction of the new Turkish Lira on January 1, 2005. During this reform, one million old Turkish Lira were redenominated into one New Turkish Lira. Until the end of 2005, both old and new Turkish Lira banknotes were valid.

Until 2005, the Turkish Lira was known under the ISO code TRL, before being renamed to TRY due to the currency reform. To distinguish the former Turkish currency from the new one, the currency was officially referred to as “New Turkish Lira” between 2005 and 2008. However, from the beginning of 2009, Turkey reverted to the familiar name of Turkish Lira.

Current TRY Banknotes and Coins

The current Turkish banknotes are from the ninth series. Banknotes are available in the following denominations:

- 5 Lira

- 10 Lira

- 20 Lira

- 50 Lira

- 100 Lira

- 200 Lira

Following the currency reform in 2005, the eighth series of Turkish Lira banknotes was initially printed. This series included a 1 TRY banknote. However, this banknote was discontinued with the ninth series. In its place, the current series introduced a 200 TRY banknote. The banknotes, printed by the Turkish Central Bank (TCMB) based in Ankara, feature security standards comparable to Euro banknotes or the US Dollar. Strengthening security features significantly reduced the number of counterfeit Turkish currency banknotes. In contrast, banknotes printed in older series were considered less secure against counterfeiting.

Kuruş

Turkish coins were also updated and adapted to current standards. Since January 1, 2009, the following coins are in circulation in Turkey:

- 1 Kuruş

- 5 Kuruş

- 10 Kuruş

- 25 Kuruş

- 50 Kuruş

- 1 Lira

Travel Tips for Turkey: Euro vs. Lira

Travelers in Turkey will find that many places accept both Euro and Turkish Lira for payment. Many goods are priced in both currencies, making price comparison easier for European tourists and business travelers. However, having banknotes and coins in the local currency is still advisable, especially in restaurants, for taxi fares, or in bazaars where bargaining is common.

Paying in Euro or Lira in Turkey: Which is Cheaper?

Exchanging Euros for Lira in Turkey is generally more cost-effective. This is due to the overhead costs for German banks to maintain and procure foreign banknotes. Consequently, Turkish banks typically offer better exchange rates. Note that these are not the bid and ask rates of the stock exchange but rather currency exchange rates. In many tourist areas of Turkey, particularly in popular resorts, you can pay in Euros. However, the change given back is often converted at a less favorable Lira exchange rate. In some situations, especially in bazaars or markets, you might be able to negotiate prices if you pay in Lira. In such cases, paying in the local currency can be advantageous for potential discounts or better deals. Paying with a credit card can also be worthwhile, but it’s important to check the transaction fees beforehand. Ideally, use a card that does not charge foreign transaction fees for cash withdrawals or card payments.

Exchange Currency Locally for Better Rates

Currency exchange is usually more favorable locally in Turkey than in your home country. There is no limit to the amount of Euros or other foreign currency that can be brought into Turkey. For currency exchange, visiting a currency exchange office (Döviz Büro) or a jeweler is recommended, as they often offer better exchange rates than local banks. Tourists should keep the receipts they receive for currency exchange, as advised by the Foreign Office on its website. If travelers wish to exchange foreign currency back to Euros upon departure, they will need to present these receipts as proof of the original exchange in Turkey. Exporting Turkish Lira amounts is restricted to 5,000 USD or its equivalent in TRY.

Cash withdrawals from ATMs using a debit card (formerly EC card) or a credit card are widely available in tourist areas and larger cities. However, further inland, travelers should carry sufficient cash in local currency to pay in shops, restaurants, and hotels.

News & International Press

2023

December 13, 2023: The current account surplus reported for the second consecutive month in October 2023 by the Turkish Statistical Institute failed to strengthen the Lira. International investors remain skeptical about Turkey’s interest rate policy. According to figures released by the Turkish Central Bank on Monday, Turkey recorded a current account surplus of $186 million, compared to a surplus of $1.91 billion in the previous month. This is only the third month with a surplus in two years. The country’s services sector posted a net surplus of USD 6.04 billion, with the travel sector recording net inflows of USD 4.75 billion, reflecting the recovering tourism sector. However, the country still recorded a goods deficit of $4.87 billion. A weak Turkish Lira has steadily driven up import prices in recent years, fueling rampant inflation and straining the trade balance, although the central bank’s efforts in recent months through interest rate hikes have slowed the currency’s depreciation.

July 17, 2023: Turkish Lira extends losses as banks pull back ahead of the July 20, 2023, rate meeting. Lira falls most in the world before Thursday’s rate decision. The central bank’s rate hikes fell short of expectations at its June meeting. Source: Bloomberg.com

June 26, 2023: Turkish Lira hits a new low after bank rules rollback. The lira has slumped 28% against the USD this year. Most of the declines have come since elections last month (Source: Reuters).

June 2023: Erdogan’s election victory on May 29, 2023, did not halt the Turkish Lira’s depreciation. On the contrary, the TL USD and TL Euro rates continue to plummet.

June 10, 2023: The Turkish Central Bank gets a new governor: DR. Hafiz Gaye Erkan. The banker was nominated by President Erdogan to head the national bank, reflecting the challenging economic situation in Turkey.

January 3, 2023: The Turkish Central Bank announces its monetary policy plans for 2023. Key points include increasing the share of Lira deposits in the banking system:

“Main Framework of Monetary Policy and Liraization Strategy for 2023

- The primary objective of the Central Bank of the Republic of Türkiye (CBRT) is to achieve and maintain price stability. In pursuit of this objective, all available instruments will continue to be utilized. Financial stability will be supported as a supporting factor for permanent price stability. The Liraization Strategy, the CBRT’s integrated policy framework, will be maintained and further strengthened.

- Within the framework of inflation targeting regime, the medium-term inflation target of 5 percent jointly set with the government has been maintained. The forecasts announced via Inflation Reports will serve as intermediate targets, and monetary policy will be formulated to bring inflation gradually to the medium-term target.

- The CBRT’s main policy instrument is the one-week repo auction rate. In order to ensure that market rates are aligned with the policy rate, the CBRT will continue to implement policies that support the effectiveness of the monetary transmission mechanism.

- Measures to be implemented within the scope of the Liraization Strategy will continue to be utilized in a reinforced manner in order to permanently increase the weight of the Turkish Lira (TL) in both assets and liabilities of the banking system. Accordingly, the liraization target in deposits for the first half of 2023 is set at 60 percent. The conditions for banks’ utilization of funding, collateral and credit channels will be calibrated in line with the liraization targets.

- In TL liquidity management, the share of funding through Open Market Operations (OMO) will be gradually increased, and OMO will be the main component of the funding channel.

- Activities that boost investment, employment, production, exports and current account surplus will be supported through a targeted credit policy in a manner consistent with the inflation path projected for 2023.

- The free exchange rate regime will be maintained, and exchange rates will be determined under free market conditions, pursuant to supply and demand balance.

- Strengthening foreign exchange reserves is essential for effective monetary policy and financial stability. In this respect, the CBRT will continue to diversify its reserve sources and build up reserves.

- The first payment transactions in Digital Turkish Lira Network have been executed successfully. In 2023, the CBRT will expand the Digital Turkish Lira Collaboration Platform to include selected banks and financial technology companies, and introduce advanced phases of the pilot study with broader participation.

- Committed to the principles of transparency, predictability and accountability, the CBRT will continue to pursue its policy communication and data dissemination practices.”

2022

November 21, 2022: Foreign trade in Turkish Lira increased by 110 percent. Source: trade.gov.tr

Turkey’s foreign trade volume in Turkish Lira increased by 110 percent in the first 10 months of 2022 compared to the previous year, reaching 297 billion Lira, according to the latest data from the Ministry of Trade. Exports in local currency amounted to 98 billion Lira from January to October, an increase of 51.25 billion Lira in the same period of the previous year, while imports increased from 90 billion Lira to 199 billion Lira. The number of countries to which Turkey sold its products in Turkish Lira was 164, while the number of local companies exporting in local currency reached almost 6,900 in September. The country’s exports increased by 2.8 percent year-on-year to an all-time high in October of 21.3 billion US dollars.

March 30, 2019: The Turkish Lira Euro exchange rate dramatically surged by 5.2% to 6.5279 on March 22, 2019. In response, the Turkish Central Bank (Türkiye Cumhuriyet Merkez Bankasi) verbally intervened on Monday, March 25, 2019, to support the Lira. The press release in translation states:

“Macroeconomic indicators for the Turkish economy suggest that the rebalancing process continues thanks to coordinated policy measures. Leading indicators indicate that domestic demand has recovered moderately in the first quarter. Net exports, supported by the strong trend in goods exports and tourism demand, continue to contribute to growth. In this respect, the improvement in the current account balance is expected to continue with further acceleration. In the economic rebalancing process, monetary policy is focused on the objective of price stability, while strong coordination with fiscal policy supports disinflation. Meanwhile, the Central Bank is determined to strengthen its reserves. Accordingly, an upward trend has been observed in reserves after the financial market volatility observed last year. Recent fluctuations in gross reserves are due to normal transactions and periodic factors. There are no unforeseen incidents. The Central Bank will closely monitor fluctuations and unhealthy pricing in financial markets and will use all instruments of monetary policy and liquidity management to ensure price stability and support financial stability if deemed necessary.”

Due to this central bank statement, the EUR Lira rate fell to 5.9918 on March 27, 2019, but the Lira depreciated again in the following days.