Euro Where Is It Used: A Complete Guide for Americans?

Euro Where Is It Used? The Euro is the official currency for 20 of the 27 member states of the European Union (EU), commonly referred to as the Eurozone, and also adopted by several microstates. Understanding where the Euro is used is crucial for businesses, travelers, and anyone involved in international finance; euro2.net offers real-time exchange rates, in-depth analysis, and user-friendly tools. So, explore the Eurozone, discover the benefits of using the Euro, and make informed financial decisions with current Euro rates, insightful financial analysis, and convenient currency conversion tools!

1. What is the Euro and Where is it Officially Used?

The euro (€) is the official currency of the Eurozone, a monetary union comprising 20 of the 27 member states of the European Union. These countries have adopted the euro as their sole legal tender, replacing their former national currencies. As a result, the euro is used for all forms of transactions within these nations, from everyday purchases to international trade.

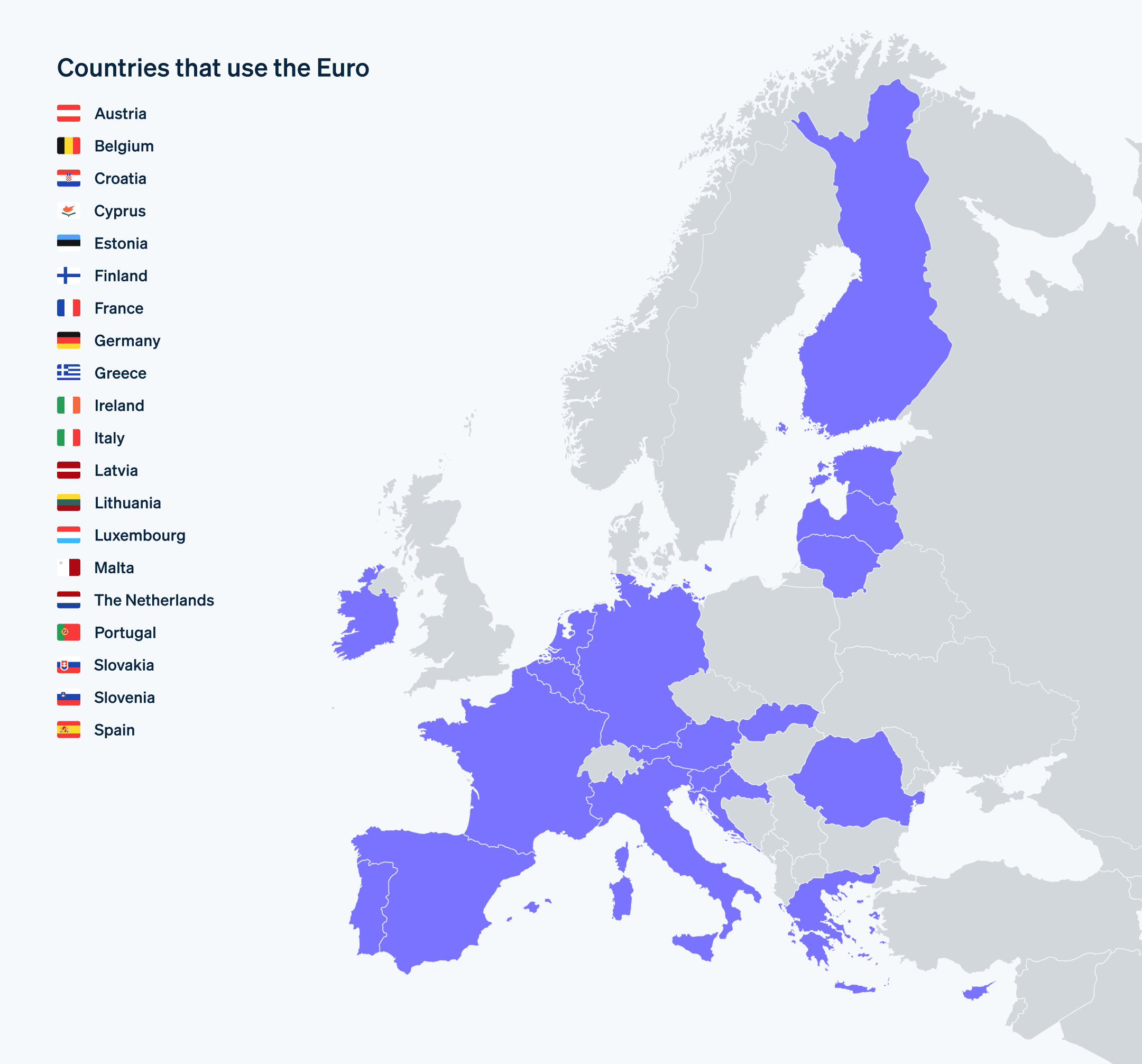

Here are the 20 countries that officially use the euro:

| Country | Capital | Population (approx.) |

|---|---|---|

| Austria | Vienna | 9 million |

| Belgium | Brussels | 11.5 million |

| Croatia | Zagreb | 4 million |

| Cyprus | Nicosia | 1.2 million |

| Estonia | Tallinn | 1.3 million |

| Finland | Helsinki | 5.5 million |

| France | Paris | 67 million |

| Germany | Berlin | 83 million |

| Greece | Athens | 10.5 million |

| Ireland | Dublin | 5 million |

| Italy | Rome | 59 million |

| Latvia | Riga | 1.9 million |

| Lithuania | Vilnius | 2.8 million |

| Luxembourg | Luxembourg City | 630,000 |

| Malta | Valletta | 520,000 |

| Netherlands | Amsterdam | 17.5 million |

| Portugal | Lisbon | 10.3 million |

| Slovakia | Bratislava | 5.5 million |

| Slovenia | Ljubljana | 2.1 million |

| Spain | Madrid | 47 million |

According to the European Central Bank (ECB), the euro aims to promote economic stability and integration within the Eurozone.

2. Which Non-EU Countries Use the Euro?

Several countries and territories outside the European Union also use the euro as their official currency. These include microstates and territories that have specific agreements or arrangements with EU member states. Their adoption of the euro facilitates economic stability and integration with the Eurozone.

Here are some notable non-EU countries and territories that use the euro:

- Andorra: This small principality located in the Pyrenees has adopted the euro as its official currency through an agreement with the EU.

- Kosovo: Although not officially part of the Eurozone, Kosovo uses the euro as its currency.

- Monaco: This city-state on the French Riviera has a monetary agreement with the EU, allowing it to use the euro as its official currency.

- Montenegro: Similar to Kosovo, Montenegro uses the euro despite not being an EU member.

- San Marino: Surrounded by Italy, San Marino has an agreement with the EU to use the euro as its official currency.

- Vatican City: As an independent city-state located within Rome, Vatican City uses the euro as its official currency.

These countries and territories benefit from the stability and credibility associated with the euro, enhancing their economic ties with the Eurozone.

3. What is the History of the Euro?

The history of the euro is rooted in the vision of European integration and economic cooperation. The journey towards a single European currency began in the late 20th century, driven by the desire to create a more unified and economically stable Europe.

The key milestones in the history of the euro include:

- 1957: Treaty of Rome: Laid the foundation for economic cooperation among European countries.

- 1970: Werner Report: Proposed the creation of a monetary union within the European Economic Community (EEC).

- 1979: European Monetary System (EMS): Established to stabilize exchange rates among participating countries.

- 1989: Delors Report: Outlined a roadmap for achieving economic and monetary union (EMU) in Europe.

- 1992: Maastricht Treaty: Formally established the criteria for countries to join the Eurozone.

- 1998: Establishment of the European Central Bank (ECB): The ECB was created to manage the monetary policy of the Eurozone.

- January 1, 1999: Introduction of the euro: The euro was introduced as an electronic currency for non-cash transactions.

- January 1, 2002: Circulation of euro banknotes and coins: Euro banknotes and coins began circulating in 12 member states, replacing their national currencies.

- 2002-Present: Gradual expansion of the Eurozone to include more EU member states.

The introduction of the euro marked a significant step in European integration, fostering economic stability and cooperation among member states. According to research from the European Central Bank (ECB), the euro has facilitated trade and investment within the Eurozone, promoting economic growth and stability.

4. Why is the Euro Important in the World Economy?

The euro plays a significant role in the global economy, influencing trade, finance, and monetary policy worldwide. Its importance stems from its status as one of the world’s major currencies and the economic strength of the Eurozone.

Here are some key reasons why the euro is important in the world economy:

- Global Reserve Currency: The euro is one of the most widely held reserve currencies by central banks and financial institutions worldwide. This status reflects confidence in the Eurozone economy and its monetary policy.

- Facilitates International Trade: The euro simplifies trade between Eurozone countries and the rest of the world by reducing exchange rate risks and transaction costs. This promotes cross-border trade and investment, benefiting businesses and consumers.

- Influences Global Financial Markets: The European Central Bank’s (ECB) monetary policy decisions, such as interest rate adjustments and quantitative easing, can have a significant impact on global financial markets. These decisions affect capital flows, investment decisions, and economic conditions worldwide.

- Promotes Economic Stability: The euro promotes economic stability within the Eurozone by fostering closer coordination of economic policies among member states. This reduces the likelihood of economic shocks and crises, benefiting the region and the global economy.

- Alternative to the US Dollar: The euro provides an alternative to the US dollar as a dominant currency in international trade and finance. This promotes diversification and reduces reliance on a single currency, enhancing global financial stability.

The euro’s importance in the world economy underscores its role as a key player in shaping global economic trends and policies.

5. How Does the Euro Impact International Trade?

The euro has a profound impact on international trade, particularly for countries within the Eurozone and those trading with them. Its introduction has streamlined trade processes, reduced transaction costs, and fostered greater economic integration.

Here are some key ways the euro impacts international trade:

- Elimination of Exchange Rate Risk: By using a single currency, businesses within the Eurozone no longer face exchange rate fluctuations when trading with each other. This eliminates the uncertainty and costs associated with currency conversions, making trade more predictable and profitable.

- Reduced Transaction Costs: The euro reduces transaction costs by eliminating the need for currency exchange fees and commissions. This simplifies trade processes and makes it easier for businesses to engage in cross-border transactions.

- Increased Price Transparency: With the euro, prices become more transparent across Eurozone countries, making it easier for businesses and consumers to compare prices and make informed decisions. This promotes competition and efficiency in the marketplace.

- Facilitation of Cross-Border Investment: The euro facilitates cross-border investment by reducing exchange rate risks and transaction costs. This encourages businesses to invest in other Eurozone countries, fostering economic growth and integration.

- Promotion of Trade with Non-Eurozone Countries: The euro also promotes trade with countries outside the Eurozone by providing a stable and reliable currency for international transactions. This benefits businesses in both Eurozone and non-Eurozone countries, fostering global trade and economic cooperation.

The euro’s impact on international trade underscores its role as a catalyst for economic integration and growth, both within the Eurozone and globally.

6. What Factors Influence the Euro Exchange Rate?

The euro exchange rate is influenced by a variety of factors, including economic indicators, political events, and market sentiment. Understanding these factors is crucial for businesses, investors, and policymakers who need to monitor and predict currency movements.

Here are some key factors that influence the euro exchange rate:

- Economic Indicators: Economic indicators such as GDP growth, inflation rates, unemployment figures, and trade balances can impact the euro exchange rate. Strong economic data tends to strengthen the euro, while weak data can weaken it.

- Interest Rates: Interest rates set by the European Central Bank (ECB) can affect the euro exchange rate. Higher interest rates tend to attract foreign investment, increasing demand for the euro and pushing its value up.

- Political Stability: Political stability within the Eurozone can influence the euro exchange rate. Political uncertainty or instability can weaken the euro, while stability can strengthen it.

- Government Debt Levels: High levels of government debt in Eurozone countries can weigh on the euro exchange rate. Concerns about debt sustainability can lead to a sell-off of the euro, pushing its value down.

- Market Sentiment: Market sentiment and investor confidence can also impact the euro exchange rate. Positive sentiment tends to strengthen the euro, while negative sentiment can weaken it.

According to the International Monetary Fund (IMF), understanding these factors is essential for managing currency risk and making informed investment decisions.

7. What is the European Central Bank’s Role in Managing the Euro?

The European Central Bank (ECB) plays a central role in managing the euro and ensuring price stability within the Eurozone. As the monetary authority for the Eurozone, the ECB is responsible for setting interest rates, controlling the money supply, and overseeing the banking system.

Here are some key aspects of the ECB’s role in managing the euro:

- Monetary Policy: The ECB’s primary objective is to maintain price stability, defined as inflation rates close to, but below, 2% over the medium term. To achieve this goal, the ECB uses monetary policy tools such as interest rate adjustments and quantitative easing.

- Interest Rate Setting: The ECB sets the key interest rates for the Eurozone, which influence borrowing costs for banks and businesses. Lower interest rates stimulate economic activity, while higher rates help control inflation.

- Money Supply Control: The ECB controls the money supply in the Eurozone through various measures, such as open market operations and reserve requirements. By managing the money supply, the ECB can influence inflation and economic growth.

- Banking Supervision: The ECB oversees the banking system in the Eurozone, ensuring that banks are financially sound and comply with regulatory requirements. This helps maintain financial stability and prevent banking crises.

- International Cooperation: The ECB cooperates with other central banks and international organizations to promote global financial stability and coordinate monetary policy. This helps address global economic challenges and prevent currency crises.

The ECB’s role in managing the euro is crucial for maintaining price stability, promoting economic growth, and ensuring financial stability within the Eurozone.

8. How Does the Euro Compare to the US Dollar?

The euro and the US dollar are the world’s two most important currencies, each playing a significant role in international trade, finance, and monetary policy. While both currencies share some similarities, they also have distinct characteristics that set them apart.

Here’s a comparison of the euro and the US dollar:

| Feature | Euro | US Dollar |

|---|---|---|

| Issuer | European Central Bank (ECB) | Federal Reserve (the Fed) |

| Area of Use | Eurozone (20 EU member states) and several non-EU countries | United States and its territories |

| Status | Second most widely held reserve currency | Most widely held reserve currency |

| Impact on Global Trade | Facilitates trade within the Eurozone and promotes trade with non-Eurozone countries | Facilitates trade within the US and promotes trade with countries around the world |

| Impact on Global Finance | Influences global financial markets through ECB monetary policy decisions | Influences global financial markets through Federal Reserve monetary policy decisions |

| Stability | Aims to maintain price stability within the Eurozone | Aims to promote price stability and full employment in the US |

According to the Federal Reserve, the US dollar remains the dominant currency in international trade and finance, but the euro has emerged as a significant competitor, challenging the dollar’s dominance in certain areas.

9. What are the Benefits of Using the Euro for Travelers?

For travelers visiting Eurozone countries, the euro offers several benefits that make travel easier, more convenient, and more cost-effective.

Here are some key benefits of using the euro for travelers:

- Convenience: Using a single currency eliminates the need to exchange money when traveling between Eurozone countries. This simplifies travel logistics and saves time and effort.

- Transparency: With the euro, prices are more transparent across Eurozone countries, making it easier for travelers to compare prices and make informed purchasing decisions.

- Cost Savings: The euro reduces transaction costs by eliminating exchange rate fees and commissions. This can result in significant cost savings for travelers, especially those visiting multiple Eurozone countries.

- Wider Acceptance: The euro is widely accepted in Eurozone countries, making it easy for travelers to pay for goods and services. This eliminates the need to carry multiple currencies or rely on credit cards.

- Budgeting: Using a single currency makes it easier for travelers to budget their expenses and track their spending. This helps travelers stay within their budget and avoid unexpected costs.

For Americans planning a trip to Europe, understanding the benefits of using the euro can enhance their travel experience and make their trip more enjoyable.

10. What are the Potential Risks and Challenges of the Euro?

While the euro offers numerous benefits, it also faces several potential risks and challenges that could impact its stability and long-term success.

Here are some key risks and challenges associated with the euro:

- Sovereign Debt Crisis: The Eurozone is vulnerable to sovereign debt crises, where member states struggle to repay their government debts. These crises can lead to financial instability and economic recessions.

- Lack of Fiscal Integration: The Eurozone lacks full fiscal integration, meaning that member states retain control over their national budgets. This can lead to imbalances and tensions within the Eurozone.

- Economic Divergence: Economic divergence among Eurozone member states can create challenges for monetary policy. The ECB’s monetary policy may not be appropriate for all member states, leading to economic disparities.

- Political Risks: Political risks, such as populism and nationalism, can threaten the stability of the Eurozone. Political uncertainty can lead to capital flight and economic instability.

- Global Economic Shocks: The Eurozone is vulnerable to global economic shocks, such as recessions and trade wars. These shocks can negatively impact the Eurozone economy and the value of the euro.

Addressing these risks and challenges is crucial for ensuring the long-term stability and success of the euro.

11. How Has the Euro Performed Since its Inception?

Since its inception in 1999, the euro has experienced both successes and challenges, shaping its performance in the global economy.

Here’s an overview of the euro’s performance since its inception:

- Early Years (1999-2007): The euro enjoyed a period of relative stability and strength in its early years, benefiting from increased trade and investment within the Eurozone.

- Global Financial Crisis (2008-2009): The global financial crisis of 2008-2009 exposed vulnerabilities in the Eurozone’s economic architecture, leading to increased volatility and uncertainty.

- Sovereign Debt Crisis (2010-2012): The sovereign debt crisis in several Eurozone countries, including Greece, Ireland, and Portugal, threatened the stability of the euro and led to calls for reforms.

- Recovery and Growth (2013-2019): The Eurozone experienced a period of recovery and growth in the years following the sovereign debt crisis, benefiting from reforms and supportive monetary policy.

- COVID-19 Pandemic (2020-Present): The COVID-19 pandemic has created new challenges for the Eurozone economy, leading to economic contractions and increased government debt levels.

Despite these challenges, the euro remains one of the world’s most important currencies, playing a key role in international trade, finance, and monetary policy.

12. What is the Future Outlook for the Euro?

The future outlook for the euro is subject to various factors, including economic trends, political developments, and policy decisions. While predicting the future is always challenging, there are several key trends and scenarios that could shape the euro’s trajectory.

Here are some potential future outlooks for the euro:

- Continued Stability: The euro could continue to serve as a stable and reliable currency, benefiting from increased economic integration and policy coordination within the Eurozone.

- Increased Volatility: The euro could experience increased volatility due to economic shocks, political uncertainty, and external risks.

- Reform and Integration: The Eurozone could undertake further reforms to strengthen its economic architecture and promote greater fiscal integration.

- Challenges and Crises: The euro could face new challenges and crises, such as sovereign debt crises, banking crises, or political instability.

- Global Role: The euro could continue to play a key role in the global economy, serving as a major reserve currency and facilitating international trade and finance.

The future of the euro will depend on the choices made by policymakers, businesses, and citizens in the years to come.

13. How Can Americans Invest in the Euro?

For Americans interested in investing in the euro, there are several options available, ranging from direct investments in Eurozone assets to indirect exposure through financial instruments.

Here are some ways Americans can invest in the euro:

- Purchase Euro-Denominated Assets: Americans can invest in Eurozone stocks, bonds, and real estate, which provide direct exposure to the euro and the Eurozone economy.

- Invest in Euro Currency ETFs: Exchange-Traded Funds (ETFs) that track the value of the euro against the US dollar can provide indirect exposure to the euro. These ETFs allow investors to profit from fluctuations in the euro exchange rate.

- Open a Euro-Denominated Bank Account: Americans can open a bank account in euros, which allows them to hold euros and earn interest on their deposits. This can be a convenient way to invest in the euro and hedge against currency risk.

- Trade Euro Futures and Options: Investors can trade euro futures and options contracts on commodity exchanges, which allow them to speculate on the future value of the euro.

- Invest in International Mutual Funds: Mutual funds that invest in Eurozone stocks and bonds can provide diversified exposure to the euro and the Eurozone economy.

Before investing in the euro, Americans should carefully consider their investment goals, risk tolerance, and the potential risks and rewards associated with each investment option.

14. How Does Brexit Affect the Euro?

Brexit, the United Kingdom’s withdrawal from the European Union, has had significant implications for the euro and the Eurozone economy.

Here are some key ways Brexit affects the euro:

- Economic Impact: Brexit has created uncertainty and disruption for the Eurozone economy, leading to slower economic growth and increased volatility.

- Trade Relations: Brexit has altered trade relations between the Eurozone and the UK, leading to new trade barriers and tariffs.

- Financial Markets: Brexit has impacted financial markets in the Eurozone, leading to increased volatility in currency and bond markets.

- Political Implications: Brexit has had political implications for the Eurozone, leading to increased calls for reforms and greater integration.

- Future Relationship: The future relationship between the Eurozone and the UK will continue to shape the euro and the Eurozone economy for years to come.

According to research from the European Commission, Brexit has had a negative impact on the Eurozone economy, reducing trade and investment and increasing uncertainty.

15. What is the Impact of the Russia-Ukraine War on the Euro?

The Russia-Ukraine war has had a significant impact on the euro and the Eurozone economy, creating new challenges and exacerbating existing vulnerabilities.

Here are some key ways the Russia-Ukraine war affects the euro:

- Economic Impact: The war has disrupted supply chains, increased energy prices, and reduced trade with Russia and Ukraine, leading to slower economic growth and higher inflation in the Eurozone.

- Energy Crisis: The war has triggered an energy crisis in Europe, with Russia reducing its gas supplies to Eurozone countries. This has led to higher energy prices and concerns about energy security.

- Inflationary Pressures: The war has contributed to inflationary pressures in the Eurozone, with higher energy and food prices pushing up consumer prices.

- Geopolitical Risks: The war has increased geopolitical risks in Europe, leading to increased uncertainty and volatility in financial markets.

- Policy Response: The ECB has responded to the war by tightening monetary policy and providing support to the Eurozone economy.

The Russia-Ukraine war poses significant challenges for the euro and the Eurozone economy, requiring a coordinated policy response to mitigate its impact.

16. How Does the Euro Affect the Cost of Living in the Eurozone?

The euro has had a mixed impact on the cost of living in the Eurozone, with both positive and negative effects.

Here are some key ways the euro affects the cost of living:

- Price Transparency: The euro has increased price transparency across Eurozone countries, making it easier for consumers to compare prices and make informed purchasing decisions.

- Inflation: The euro has contributed to inflation in some Eurozone countries, with prices rising after the introduction of the euro.

- Wage Convergence: The euro has led to greater wage convergence across Eurozone countries, with wages rising in lower-wage countries and falling in higher-wage countries.

- Housing Costs: The euro has contributed to higher housing costs in some Eurozone countries, with increased demand for housing pushing up prices.

- Consumer Spending: The euro has influenced consumer spending patterns in the Eurozone, with consumers becoming more price-sensitive and value-conscious.

The impact of the euro on the cost of living varies across Eurozone countries, depending on factors such as economic conditions, government policies, and consumer behavior.

17. How Does the Euro Promote Economic Integration in Europe?

The euro plays a crucial role in promoting economic integration in Europe by fostering closer cooperation and coordination among Eurozone member states.

Here are some key ways the euro promotes economic integration:

- Single Currency: The euro serves as a single currency for the Eurozone, eliminating exchange rate risks and transaction costs and promoting trade and investment.

- Monetary Policy: The ECB’s monetary policy is designed to maintain price stability across the Eurozone, promoting economic stability and reducing the likelihood of economic shocks.

- Fiscal Coordination: The euro encourages fiscal coordination among Eurozone member states, with countries required to adhere to fiscal rules and targets.

- Structural Reforms: The euro promotes structural reforms in Eurozone countries, with countries encouraged to implement reforms to improve their competitiveness and economic performance.

- Economic Governance: The euro has led to greater economic governance in the Eurozone, with the EU playing a greater role in overseeing national economic policies.

The euro’s role in promoting economic integration has helped create a more stable and prosperous Europe, benefiting businesses, consumers, and citizens across the Eurozone.

18. What are the Differences Between the Eurozone and the European Union?

It’s important to distinguish between the Eurozone and the European Union (EU), as they are not synonymous. The Eurozone is a subset of the EU, comprising those member states that have adopted the euro as their official currency.

Here are some key differences between the Eurozone and the EU:

- Membership: The EU consists of 27 member states, while the Eurozone consists of 20 member states.

- Currency: All Eurozone member states use the euro as their official currency, while some EU member states retain their national currencies.

- Monetary Policy: The ECB is responsible for monetary policy in the Eurozone, while EU member states that are not part of the Eurozone retain control over their national monetary policies.

- Fiscal Policy: Eurozone member states are subject to fiscal rules and targets set by the EU, while EU member states that are not part of the Eurozone have greater flexibility in their fiscal policies.

- Economic Integration: The Eurozone is more economically integrated than the EU as a whole, with closer cooperation and coordination among member states.

Understanding the differences between the Eurozone and the EU is crucial for comprehending the economic and political dynamics of Europe.

19. How Can Businesses in the USA Benefit from the Euro?

Businesses in the USA can benefit from the euro in several ways, particularly if they engage in international trade or investment with Eurozone countries.

Here are some key benefits of the euro for businesses in the USA:

- Reduced Exchange Rate Risk: The euro reduces exchange rate risk for US businesses trading with Eurozone countries, as they no longer have to worry about fluctuations in exchange rates.

- Lower Transaction Costs: The euro lowers transaction costs for US businesses trading with Eurozone countries, as they no longer have to pay exchange rate fees and commissions.

- Increased Price Transparency: The euro increases price transparency for US businesses trading with Eurozone countries, making it easier to compare prices and make informed decisions.

- Greater Access to Eurozone Markets: The euro facilitates greater access to Eurozone markets for US businesses, as it makes it easier for them to sell their products and services in the Eurozone.

- Diversification of Investments: The euro allows US businesses to diversify their investments by investing in Eurozone assets, reducing their exposure to the US economy.

US businesses can maximize their benefits from the euro by developing a clear understanding of the Eurozone economy and the factors that influence the euro exchange rate.

20. What Resources are Available to Track the Euro Exchange Rate?

Tracking the euro exchange rate is essential for businesses, investors, and individuals who need to monitor currency movements and make informed financial decisions. Fortunately, there are numerous resources available to track the euro exchange rate, ranging from online tools to financial news outlets.

Here are some popular resources for tracking the euro exchange rate:

- Financial News Websites: Websites such as Bloomberg, Reuters, and the Wall Street Journal provide real-time information on the euro exchange rate, as well as news and analysis on the Eurozone economy.

- Currency Converter Tools: Online currency converter tools, such as those offered by Google Finance and Yahoo Finance, allow users to convert euros to US dollars and other currencies.

- Central Bank Websites: The European Central Bank (ECB) and the Federal Reserve (the Fed) publish data on the euro exchange rate on their websites.

- Forex Trading Platforms: Forex trading platforms offer real-time charts and analysis of the euro exchange rate, as well as tools for trading currencies.

- Financial Data Providers: Financial data providers such as Bloomberg and Refinitiv provide comprehensive data on the euro exchange rate, as well as economic data and news on the Eurozone.

By utilizing these resources, businesses, investors, and individuals can stay informed about the euro exchange rate and make informed financial decisions. euro2.net provides real-time exchange rates, in-depth analysis, and user-friendly tools.

Euro currency exchange rate chart illustrating fluctuations in value

Euro currency exchange rate chart illustrating fluctuations in value

FAQ about the Euro

- What countries use the euro as their currency?

The euro is the official currency of 20 European Union member states, forming the Eurozone, including countries like Germany, France, Italy, and Spain.

- Are there any non-EU countries that use the euro?

Yes, several non-EU countries, such as Vatican City, Monaco, San Marino, and Andorra, use the euro as their official currency.

- What is the role of the European Central Bank (ECB) in managing the euro?

The ECB manages the monetary policy of the Eurozone, ensuring price stability by setting interest rates and controlling the money supply.

- How does the euro affect international trade?

The euro simplifies trade among Eurozone members by eliminating exchange rate risks and reducing transaction costs, thus promoting economic integration.

- What factors influence the euro exchange rate?

The euro exchange rate is influenced by various factors, including economic indicators, interest rates, political stability, and market sentiment.

- How has Brexit affected the euro?

Brexit has created economic uncertainty, altered trade relations, and impacted financial markets in the Eurozone, leading to increased volatility.

- What is the impact of the Russia-Ukraine war on the euro?

The war has disrupted supply chains, increased energy prices, and reduced trade, leading to slower economic growth and higher inflation in the Eurozone.

- How can Americans invest in the euro?

Americans can invest in the euro by purchasing euro-denominated assets, investing in Euro currency ETFs, opening a euro-denominated bank account, or trading euro futures and options.

- What are the benefits of using the euro for travelers?

Travelers benefit from the euro through convenience, price transparency, cost savings, and wider acceptance in Eurozone countries.

- Where can I find reliable information on the euro exchange rate?

You can find reliable information on financial news websites, currency converter tools, central bank websites, and forex trading platforms.

Stay informed, make wise decisions, and explore the world of the euro on euro2.net! Get the latest exchange rates, in-depth analysis, and user-friendly tools to navigate the Eurozone with confidence.

Address: 33 Liberty Street, New York, NY 10045, United States.

Phone: +1 (212) 720-5000.

Website: euro2.net.