What Is $99 EUR to USD and Why Does It Matter?

$99 Eur To Usd represents the equivalent value of 99 Euros in United States Dollars based on the current exchange rate, and euro2.net provides a seamless way to convert currency. Understanding this conversion is crucial for various financial activities. Explore the latest exchange rates and insightful tools at euro2.net for informed financial decisions, including Euro to Dollar exchange rates and currency conversion tools.

1. Understanding the Basics: What is EUR to USD Exchange?

The EUR to USD exchange rate reflects how many US Dollars (USD) you can obtain for one Euro (EUR). It’s a constantly fluctuating value influenced by a myriad of economic factors. A stronger Euro means you get more USD for each EUR, while a weaker Euro means you get less. This rate is vital for international trade, investments, and even tourism. According to research from the European Central Bank (ECB), exchange rates are influenced by factors such as interest rate differentials and economic growth.

1.1. How is the EUR to USD Exchange Rate Determined?

The EUR to USD exchange rate is primarily determined by supply and demand in the foreign exchange (forex) market. Several factors influence this supply and demand, including:

- Economic Indicators: Data releases such as GDP growth, inflation rates, and unemployment figures can significantly impact currency values. Strong economic data in the Eurozone typically strengthens the Euro, while strong US data strengthens the Dollar.

- Interest Rates: Interest rate decisions made by the European Central Bank (ECB) and the Federal Reserve (the Fed) play a crucial role. Higher interest rates tend to attract foreign investment, increasing demand for the currency.

- Geopolitical Events: Political instability, trade wars, and major global events can create uncertainty, leading to fluctuations in exchange rates.

- Market Sentiment: Speculation and investor confidence also play a role. If investors believe the Eurozone economy will perform well, they may buy Euros, driving up its value.

1.2. Why Does the EUR to USD Rate Fluctuate?

The EUR to USD rate fluctuates constantly due to the dynamic nature of the factors that influence it. Imagine it as a tug-of-war between the Eurozone and the United States, with each side pulling based on their respective economic strengths and weaknesses. News events, economic data releases, and even rumors can cause the rate to move up or down in real-time.

- Real-Time Trading: The Forex market operates 24/7, with trillions of dollars changing hands every day. This constant trading activity ensures that the EUR to USD rate is always adjusting to reflect the latest information.

- Global News: Major news events, such as central bank announcements or political developments, can trigger significant price swings.

- Economic Reports: Regular economic reports, like the monthly jobs report in the US or the Eurozone’s GDP figures, provide snapshots of economic health, influencing investor sentiment.

2. Converting 99 EUR to USD: A Practical Guide

So, how do you determine the exact USD equivalent of 99 EUR? Here’s a step-by-step guide:

2.1. Finding the Current EUR to USD Exchange Rate

The first step is to find the current EUR to USD exchange rate. You can find this information from various sources:

- Online Currency Converters: Websites like euro2.net offer real-time currency conversion tools.

- Financial News Websites: Major financial news outlets such as Bloomberg, Reuters, and the Wall Street Journal provide up-to-date exchange rates.

- Bank Websites: Many banks offer currency conversion tools on their websites.

euro2.net stands out by offering a user-friendly interface, constantly updated rates, and additional financial tools, making it an excellent choice for accurate conversions.

2.2. Using the Exchange Rate to Calculate the Conversion

Once you have the current exchange rate, the calculation is simple:

USD = EUR Amount x EUR to USD Exchange Rate

For example, if the current EUR to USD exchange rate is 1.10:

USD = 99 EUR x 1.10 = $108.90

Therefore, 99 EUR is equivalent to $108.90 USD.

2.3. Example Scenario: Real-World Conversion

Let’s consider a practical example. Suppose you are an American tourist returning from a trip to Europe with 99 EUR left over. You want to convert this back to USD. If the exchange rate is 1.08, the calculation would be:

USD = 99 EUR x 1.08 = $106.92

You would receive $106.92 USD for your 99 EUR.

3. Factors Affecting the EUR to USD Exchange Rate in the USA

Several factors specific to the US market influence the EUR to USD exchange rate. Understanding these can help you anticipate fluctuations and make informed financial decisions.

3.1. U.S. Economic Data and Its Impact

Key U.S. economic indicators that can affect the EUR to USD exchange rate include:

- GDP Growth: A strong U.S. GDP growth rate typically strengthens the USD, making EUR relatively cheaper.

- Inflation Rate: Higher inflation in the U.S. can weaken the USD as the purchasing power of the currency decreases.

- Unemployment Rate: A low unemployment rate generally indicates a healthy economy, strengthening the USD.

- Federal Reserve (The Fed) Policies: The Fed’s monetary policy decisions, such as interest rate changes and quantitative easing, have a significant impact on the USD.

The Federal Reserve’s monetary policy is critical, as noted in various studies. For instance, research indicates that unexpected interest rate hikes by the Fed can lead to a stronger USD.

3.2. Political and Geopolitical Events in the U.S.

Political events and geopolitical tensions can also influence the EUR to USD exchange rate:

- Political Stability: Political uncertainty in the U.S. can weaken the USD as investors seek safer assets.

- Trade Policies: Changes in U.S. trade policies, such as tariffs and trade agreements, can affect the USD’s value.

- International Relations: Strained relationships between the U.S. and other major economies can create uncertainty and impact the USD.

3.3. The Role of the Federal Reserve (The Fed)

The Federal Reserve plays a crucial role in managing the U.S. economy and influencing the value of the USD. The Fed’s main tools include:

- Interest Rate Adjustments: Raising interest rates can attract foreign investment, increasing demand for the USD and strengthening its value.

- Quantitative Easing (QE): QE involves the Fed buying government bonds or other assets to inject liquidity into the economy. This can weaken the USD.

- Forward Guidance: The Fed provides forward guidance to communicate its future policy intentions. This can help stabilize markets and reduce uncertainty.

4. Why is Knowing the EUR to USD Exchange Rate Important?

Knowing the EUR to USD exchange rate is essential for a variety of reasons, impacting individuals, businesses, and the broader economy.

4.1. For Travelers: Managing Travel Expenses

If you’re traveling from the U.S. to the Eurozone, or vice versa, understanding the exchange rate helps you manage your travel expenses effectively.

- Budgeting: Knowing the exchange rate allows you to accurately budget for your trip.

- Making Purchases: When making purchases in a foreign currency, you can quickly calculate the cost in your home currency.

- Avoiding Hidden Fees: Be aware of potential fees charged by banks or currency exchange services.

4.2. For Businesses: International Trade and Pricing

Businesses engaged in international trade need to closely monitor the EUR to USD exchange rate.

- Pricing Strategies: Exchange rates affect the cost of goods and services, influencing pricing decisions.

- Profit Margins: Fluctuations in exchange rates can impact profit margins.

- Hedging Strategies: Businesses can use financial instruments to hedge against exchange rate risk.

4.3. For Investors: Currency Trading and Portfolio Diversification

Investors can profit from currency trading by speculating on the EUR to USD exchange rate.

- Forex Trading: The forex market is the largest and most liquid financial market in the world.

- Portfolio Diversification: Investing in foreign assets can diversify your portfolio and reduce risk.

- Analyzing Trends: Understanding the factors that influence exchange rates can help investors make informed decisions.

5. Practical Tools for Converting EUR to USD

Several tools can help you convert EUR to USD quickly and accurately.

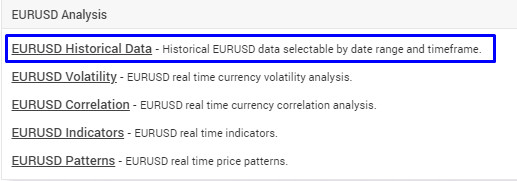

5.1. Online Currency Converters: euro2.net and Others

Online currency converters are the most convenient way to convert EUR to USD. Some popular options include:

- euro2.net: Offers real-time exchange rates, a user-friendly interface, and additional financial tools.

- Google Currency Converter: A simple and quick tool for basic conversions.

- XE.com: Provides historical exchange rates and currency charts.

- Bloomberg Currency Converter: Offers advanced features for professional traders.

euro2.net provides an edge with its comprehensive suite of tools and up-to-the-minute exchange rates, ideal for both casual users and financial professionals.

5.2. Mobile Apps for Currency Conversion

Mobile apps make it easy to convert currencies on the go. Some popular options include:

- XE Currency Converter: Offers real-time rates, historical charts, and the ability to set rate alerts.

- Currency Converter Plus: Supports a wide range of currencies and offers offline access.

- Easy Currency Converter: A simple and intuitive app for basic conversions.

5.3. Understanding Bank and Exchange Service Fees

When converting EUR to USD, be aware of potential fees charged by banks and exchange services. These fees can include:

- Commission Fees: A percentage of the total amount converted.

- Transaction Fees: A fixed fee for each transaction.

- Hidden Markups: Some services may add a markup to the exchange rate, effectively charging you more than the market rate.

Always compare fees from different providers to get the best deal.

6. Common Mistakes to Avoid When Converting EUR to USD

To ensure you get the most accurate and cost-effective conversion, avoid these common mistakes:

6.1. Ignoring Exchange Rate Fluctuations

Exchange rates can change rapidly, so it’s important to check the current rate before making a conversion. Waiting even a few hours can make a difference.

6.2. Not Factoring in Fees and Commissions

Always factor in fees and commissions when calculating the total cost of a conversion. These fees can significantly reduce the amount you receive.

6.3. Using Unreliable Conversion Tools

Use reputable and reliable conversion tools to ensure accuracy. Avoid using obscure or unverified sources. Euro2.net is a reliable resource known for its precision and up-to-date information.

6.4. Converting at the Airport or Tourist Traps

Avoid converting currency at airports or tourist traps, as these locations often offer the worst exchange rates and highest fees.

7. Advanced Strategies for Managing EUR to USD Exchange Rate Risk

For businesses and investors, managing EUR to USD exchange rate risk is crucial. Here are some advanced strategies:

7.1. Hedging with Currency Futures and Options

Currency futures and options are financial instruments that allow you to lock in an exchange rate for a future transaction. This can protect you from adverse exchange rate movements.

7.2. Using Forward Contracts

A forward contract is an agreement to exchange currency at a specified rate on a future date. This can provide certainty for future transactions.

7.3. Diversifying Currency Holdings

Diversifying your currency holdings can reduce your exposure to exchange rate risk. By holding a mix of currencies, you can mitigate the impact of fluctuations in any one currency.

8. Real-Life Scenarios: How Different People Use EUR to USD Conversions

To illustrate the practical applications of EUR to USD conversions, let’s look at some real-life scenarios.

8.1. The American Tourist in Europe

An American tourist traveling in Europe needs to convert USD to EUR to pay for expenses. By using euro2.net, they can quickly determine the current exchange rate and budget accordingly.

8.2. The European Exporter Selling to the U.S.

A European exporter selling goods to the U.S. needs to convert USD revenue back to EUR. By monitoring the exchange rate and using hedging strategies, they can protect their profit margins.

8.3. The U.S. Investor Buying European Stocks

A U.S. investor buying European stocks needs to convert USD to EUR to make the purchase. By understanding the exchange rate and its potential impact, they can make informed investment decisions.

9. Case Studies: Companies Affected by EUR to USD Exchange Rate Fluctuations

Several companies have been significantly affected by EUR to USD exchange rate fluctuations. Here are a few examples:

9.1. Airbus

Airbus, the European aircraft manufacturer, reports its earnings in EUR but sells many of its planes in USD. Fluctuations in the EUR to USD exchange rate can significantly impact Airbus’s profitability.

9.2. McDonald’s

McDonald’s, the global fast-food chain, operates in both the U.S. and the Eurozone. Changes in the EUR to USD exchange rate can affect McDonald’s reported earnings.

9.3. BMW

BMW, the German automaker, exports cars to the U.S. Changes in the EUR to USD exchange rate can affect the competitiveness of BMW’s products in the U.S. market.

10. Expert Opinions on the Future of the EUR to USD Exchange Rate

Experts have varying opinions on the future of the EUR to USD exchange rate.

10.1. Economic Analysts’ Forecasts

Some economic analysts predict that the EUR to USD exchange rate will remain relatively stable in the near term, while others anticipate significant fluctuations. These forecasts are based on various factors, including economic growth, interest rates, and geopolitical events.

10.2. Influential Economists’ Views

Influential economists often share their views on the EUR to USD exchange rate. These views can provide valuable insights into the potential direction of the exchange rate.

10.3. Bank Strategists’ Predictions

Bank strategists provide predictions on the EUR to USD exchange rate based on their analysis of economic and market trends. These predictions can be helpful for businesses and investors looking to manage exchange rate risk.

11. The Impact of Brexit on the EUR to USD Exchange Rate

Brexit, the United Kingdom’s withdrawal from the European Union, has had a notable impact on the EUR to USD exchange rate.

11.1. Short-Term Volatility

Brexit caused short-term volatility in the EUR to USD exchange rate as investors reacted to the uncertainty surrounding the UK’s future relationship with the EU.

11.2. Long-Term Effects

The long-term effects of Brexit on the EUR to USD exchange rate are still unfolding. Some analysts believe that Brexit could weaken the Euro, while others argue that it could strengthen the USD.

11.3. Trade Implications

Brexit has implications for trade between the U.S. and the Eurozone, which could affect the EUR to USD exchange rate.

12. How Government Policies Affect the EUR to USD Rate

Government policies in both the U.S. and the Eurozone can influence the EUR to USD exchange rate.

12.1. Fiscal Policy

Fiscal policy, which involves government spending and taxation, can affect economic growth and inflation, which in turn can impact the exchange rate.

12.2. Trade Policy

Trade policy, such as tariffs and trade agreements, can affect the balance of trade between the U.S. and the Eurozone, which can influence the exchange rate.

12.3. Regulatory Policy

Regulatory policy, such as financial regulations, can affect investor confidence and capital flows, which can impact the exchange rate.

13. Historical Analysis: EUR to USD Rate Over Time

Looking at the historical performance of the EUR to USD exchange rate can provide valuable insights into its potential future direction.

13.1. Key Trends and Patterns

The EUR to USD exchange rate has exhibited key trends and patterns over time, influenced by economic cycles, political events, and market sentiment.

13.2. Major Economic Events and Their Impact

Major economic events, such as the 2008 financial crisis and the European debt crisis, have had a significant impact on the EUR to USD exchange rate.

13.3. Long-Term Fluctuations

The EUR to USD exchange rate has experienced long-term fluctuations, reflecting the relative economic performance of the U.S. and the Eurozone.

14. Using EUR to USD for Online Shopping

Online shopping across borders requires understanding the EUR to USD exchange rate.

14.1. Calculating the Real Cost of Purchases

When shopping online from European retailers, it’s important to calculate the real cost of purchases in USD, including shipping and taxes.

14.2. Payment Methods and Exchange Rates

Different payment methods, such as credit cards and PayPal, may offer different exchange rates. Compare rates to get the best deal.

14.3. Avoiding Hidden Fees

Be aware of potential hidden fees charged by payment processors or banks.

15. Understanding the Forex Market and EUR/USD Trading

The Forex market is the largest and most liquid financial market in the world, where currencies are traded.

15.1. Basics of Forex Trading

Forex trading involves buying one currency and selling another, with the goal of profiting from exchange rate fluctuations.

15.2. EUR/USD as a Major Currency Pair

EUR/USD is one of the most heavily traded currency pairs in the world, offering high liquidity and tight spreads.

15.3. Risks and Rewards of Forex Trading

Forex trading can be highly rewarding, but it also involves significant risks. It’s important to understand these risks before engaging in forex trading.

16. Tax Implications of EUR to USD Conversions

EUR to USD conversions can have tax implications, depending on the purpose of the conversion and the amount involved.

16.1. Reporting Requirements

You may be required to report EUR to USD conversions to tax authorities, especially if the amounts are significant.

16.2. Capital Gains and Losses

Profits or losses from currency trading may be subject to capital gains taxes.

16.3. Seeking Professional Advice

Consult with a tax professional to understand the tax implications of EUR to USD conversions.

17. Economic Indicators to Watch for EUR/USD Trading

Several economic indicators can provide valuable insights for EUR/USD trading.

17.1. GDP Growth Rates

GDP growth rates in the U.S. and the Eurozone can indicate the relative strength of the two economies.

17.2. Inflation Rates

Inflation rates can influence interest rate decisions and currency values.

17.3. Employment Data

Employment data, such as unemployment rates and job growth, can provide insights into the health of the labor market.

18. Predictions for the Eurozone Economy and Its Impact on the EUR

Predictions for the Eurozone economy can provide insights into the future direction of the Euro.

18.1. Growth Forecasts

Growth forecasts for the Eurozone can indicate the potential for the Euro to strengthen or weaken.

18.2. Policy Changes

Policy changes by the European Central Bank (ECB) can affect the value of the Euro.

18.3. Political Stability

Political stability in the Eurozone can support the Euro’s value.

19. Resources for Staying Updated on EUR to USD Rates

Staying updated on EUR to USD rates is crucial for making informed financial decisions.

19.1. Financial News Websites

Financial news websites such as Bloomberg, Reuters, and the Wall Street Journal provide up-to-date exchange rates and analysis.

19.2. Central Bank Websites

Central bank websites such as the European Central Bank (ECB) and the Federal Reserve provide information on monetary policy and economic conditions.

19.3. Online Currency Converters

Online currency converters such as euro2.net offer real-time exchange rates and conversion tools.

20. The Future of Currency Exchange: Digital Currencies and EUR/USD

Digital currencies and blockchain technology are poised to disrupt the traditional currency exchange market.

20.1. The Rise of Digital Currencies

Digital currencies such as Bitcoin and Ethereum are gaining popularity as alternative forms of currency.

20.2. Blockchain Technology

Blockchain technology has the potential to streamline currency exchange and reduce transaction costs.

20.3. Potential Impact on EUR/USD

Digital currencies could potentially impact the EUR/USD exchange rate by providing alternative avenues for international transactions.

EURUSD Forex History Data

EURUSD Forex History Data

FAQ: Frequently Asked Questions About EUR to USD Conversion

Here are some frequently asked questions about EUR to USD conversion:

FAQ 1: What is the current EUR to USD exchange rate?

The current EUR to USD exchange rate fluctuates constantly; check euro2.net for real-time updates.

FAQ 2: How do I convert EUR to USD?

Multiply the EUR amount by the current EUR to USD exchange rate to find the USD equivalent.

FAQ 3: Where can I find the best EUR to USD exchange rate?

Compare rates from various sources, including online currency converters, banks, and exchange services to find the best deal.

FAQ 4: Are there any fees for converting EUR to USD?

Yes, banks and exchange services typically charge fees, which can include commission fees, transaction fees, and hidden markups.

FAQ 5: What factors affect the EUR to USD exchange rate?

Economic indicators, interest rates, geopolitical events, and market sentiment can all influence the EUR to USD exchange rate.

FAQ 6: How can I manage EUR to USD exchange rate risk?

Businesses and investors can use hedging strategies, forward contracts, and currency diversification to manage exchange rate risk.

FAQ 7: What are the tax implications of EUR to USD conversions?

EUR to USD conversions may have tax implications, depending on the purpose of the conversion and the amount involved. Consult with a tax professional for guidance.

FAQ 8: How does Brexit affect the EUR to USD exchange rate?

Brexit has caused short-term volatility in the EUR to USD exchange rate, and its long-term effects are still unfolding.

FAQ 9: Can digital currencies replace traditional currency exchange?

Digital currencies have the potential to disrupt the traditional currency exchange market, but their long-term impact is still uncertain.

FAQ 10: How often does the EUR to USD exchange rate change?

The EUR to USD exchange rate changes constantly, as the Forex market operates 24/7. Check euro2.net for live updates.

Conclusion: Navigating the EUR to USD Exchange Rate with Confidence

Understanding the EUR to USD exchange rate is crucial for travelers, businesses, and investors alike. By staying informed, using reliable conversion tools, and managing exchange rate risk, you can navigate the world of currency exchange with confidence. For the most up-to-date information, comprehensive analysis, and user-friendly tools, be sure to visit euro2.net and make informed decisions about your Euro to Dollar conversions. With real-time data and expert insights, euro2.net empowers you to make the most of every exchange.

Ready to stay on top of the EUR to USD exchange rate? Visit euro2.net today for real-time rates, expert analysis, and powerful conversion tools. Whether you’re planning a trip, managing international transactions, or investing in foreign markets, euro2.net has everything you need to make informed financial decisions. Don’t miss out on the latest updates and opportunities – explore euro2.net now! Address: 33 Liberty Street, New York, NY 10045, United States. Phone: +1 (212) 720-5000. Website: euro2.net.