How Much Is 49.99 Euros to Dollars? A Comprehensive Guide

Are you wondering what 49.99 Euros is worth in US Dollars today? At euro2.net, we provide you with the latest exchange rates and tools to easily convert EUR to USD, ensuring you get the most accurate information. This guide dives into the intricacies of currency conversion, factors influencing the Euro to Dollar exchange rate, and how to make informed financial decisions. Explore insightful analyses, practical advice, and user-friendly resources tailored for investors, travelers, and anyone interested in the EUR/USD exchange rate.

1. Understanding the EUR/USD Exchange Rate

The EUR/USD exchange rate represents how many US Dollars (USD) you can buy with one Euro (EUR). This rate fluctuates constantly due to various economic, political, and market factors. A higher EUR/USD rate means the Euro is stronger relative to the Dollar, while a lower rate indicates a weaker Euro. Keeping track of this rate is essential for anyone dealing with international transactions, investments, or travel.

1.1. Factors Influencing the EUR/USD Exchange Rate

Several factors can influence the EUR/USD exchange rate:

- Economic Indicators: Economic data releases, such as GDP growth, inflation rates, and unemployment figures, can significantly impact currency values. For instance, strong economic growth in the Eurozone might strengthen the Euro.

- Interest Rates: Interest rate decisions by central banks, like the European Central Bank (ECB) and the Federal Reserve (Fed), play a crucial role. Higher interest rates typically attract foreign investment, increasing demand for the currency.

- Political Events: Political instability, elections, or policy changes can create uncertainty and affect investor sentiment, leading to currency fluctuations.

- Market Sentiment: Overall market sentiment and risk appetite can drive currency movements. During times of economic uncertainty, investors may flock to safer currencies like the US Dollar.

- Geopolitical Risks: Events such as trade wars, political tensions, and global crises can impact currency values as investors react to changing circumstances.

1.2. Historical Performance of EUR/USD

The EUR/USD exchange rate has seen significant fluctuations over the years. Analyzing historical data provides valuable insights into its behavior and potential future trends. For example, during the 2008 financial crisis, the EUR/USD rate experienced considerable volatility as investors sought safe-haven assets. Similarly, policy changes by the ECB or the Federal Reserve have led to notable shifts in the exchange rate.

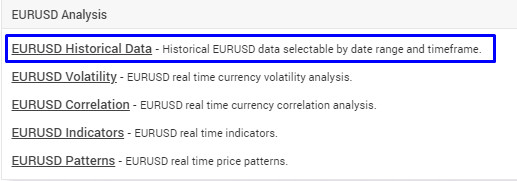

EURUSD Forex History Data

EURUSD Forex History Data

EUR/USD Forex History Data: A look at historical exchange rates provides insights into currency trends.

1.3. Current Market Conditions

As of today, understanding the EUR/USD exchange rate requires considering the current global economic landscape. Factors such as inflation, interest rate policies, and geopolitical events are continuously shaping the value of both currencies. For real-time updates and in-depth analysis, euro2.net offers the latest information to help you stay informed.

2. Converting 49.99 Euros to US Dollars

To accurately convert 49.99 Euros to US Dollars, you need the current EUR/USD exchange rate. This rate changes constantly, so it’s important to use a reliable currency converter that provides real-time data.

2.1. Using a Currency Converter

A currency converter is an essential tool for anyone needing to convert currencies quickly and accurately. Here’s how to use one:

- Find a Reliable Converter: euro2.net offers a user-friendly currency converter with real-time exchange rates.

- Enter the Amount: Input 49.99 in the EUR field.

- Select Currencies: Choose EUR as the source currency and USD as the target currency.

- View the Result: The converter will display the equivalent amount in US Dollars based on the current exchange rate.

2.2. Understanding the Conversion Result

The result provided by the currency converter is an estimate based on the current exchange rate. Keep in mind that the actual amount you receive when exchanging currency may vary slightly due to fees and commissions charged by banks or exchange services.

2.3. Factors Affecting the Final Amount

Several factors can affect the final amount you receive when converting Euros to Dollars:

- Exchange Rate Fluctuations: The exchange rate can change between the time you check the rate and the time you make the actual conversion.

- Fees and Commissions: Banks and exchange services typically charge fees or commissions for currency conversions.

- Transaction Costs: Additional transaction costs may apply, especially for international transfers.

- Hidden Charges: Be aware of any hidden charges that may not be immediately apparent.

3. Why Track the EUR/USD Exchange Rate?

Tracking the EUR/USD exchange rate is crucial for various individuals and organizations. Understanding its dynamics can help make informed financial decisions and mitigate risks.

3.1. For Investors and Traders

Investors and traders closely monitor the EUR/USD exchange rate for several reasons:

- Forex Trading: The EUR/USD is one of the most actively traded currency pairs in the foreign exchange (Forex) market. Traders aim to profit from fluctuations in the exchange rate.

- Portfolio Diversification: Investors may use currency movements to diversify their portfolios and hedge against currency risk.

- International Investments: Understanding the exchange rate is essential when investing in foreign markets, as it affects the returns on those investments.

3.2. For Businesses with International Operations

Businesses engaged in international trade and operations need to track the EUR/USD exchange rate to manage their financial exposure:

- Pricing Strategies: Exchange rate fluctuations can impact the cost of goods and services, influencing pricing strategies.

- Profit Margins: Changes in the exchange rate can affect profit margins on international sales.

- Hedging Strategies: Companies may use hedging strategies to mitigate currency risk and protect their profits.

3.3. For Travelers

Travelers planning trips to the Eurozone or the United States need to understand the EUR/USD exchange rate to budget their expenses effectively:

- Budgeting: Knowing the exchange rate helps travelers estimate the cost of accommodation, food, and activities.

- Currency Exchange: Travelers can make informed decisions about when and where to exchange their currency to get the best rates.

- Avoiding Overspending: Understanding the value of their money in the local currency helps travelers avoid overspending.

4. Common Mistakes to Avoid When Converting Currency

Converting currency can be tricky, and it’s easy to make mistakes that can cost you money. Here are some common pitfalls to avoid:

4.1. Not Checking the Current Exchange Rate

One of the biggest mistakes is not checking the current exchange rate before converting currency. Exchange rates can fluctuate rapidly, and using outdated information can lead to inaccurate conversions.

Solution: Always use a reliable currency converter like the one on euro2.net to get real-time exchange rates.

4.2. Ignoring Fees and Commissions

Fees and commissions can significantly reduce the amount of money you receive when converting currency. Ignoring these costs can lead to unpleasant surprises.

Solution: Always inquire about fees and commissions before making a currency conversion. Compare rates and fees from different providers to find the best deal.

4.3. Using Airport or Hotel Exchange Services

Airport and hotel exchange services often offer the worst exchange rates and charge high fees. Using these services can be very expensive.

Solution: Avoid using airport and hotel exchange services whenever possible. Instead, use a bank, credit union, or online currency exchange service.

4.4. Waiting Until the Last Minute

Waiting until the last minute to exchange currency can leave you vulnerable to unfavorable exchange rates.

Solution: Plan ahead and exchange your currency in advance. Monitor exchange rates and convert your currency when the rate is favorable.

4.5. Carrying Large Amounts of Cash

Carrying large amounts of cash can be risky, as it can be lost or stolen. It can also attract unwanted attention.

Solution: Avoid carrying large amounts of cash. Use credit or debit cards whenever possible. Consider using a travel card that allows you to load multiple currencies.

5. Tips for Getting the Best EUR/USD Exchange Rate

Getting the best EUR/USD exchange rate requires careful planning and research. Here are some tips to help you maximize your money:

5.1. Monitor Exchange Rates Regularly

Exchange rates can fluctuate constantly, so it’s important to monitor them regularly. This will help you identify favorable exchange rates and make informed decisions about when to convert your currency.

Tools: Use online currency converters, financial news websites, and mobile apps to track exchange rates. euro2.net provides real-time exchange rates and historical data to help you stay informed.

5.2. Compare Exchange Rates from Different Providers

Exchange rates can vary significantly from one provider to another. Comparing rates from different providers can help you find the best deal.

Providers: Check exchange rates at banks, credit unions, online currency exchange services, and currency exchange brokers.

5.3. Use Online Currency Exchange Services

Online currency exchange services often offer better exchange rates and lower fees than traditional banks and currency exchange services.

Popular Services: Research reputable online currency exchange services that offer competitive rates and secure transactions.

5.4. Consider Using a Travel Card

Travel cards allow you to load multiple currencies onto a single card. This can be a convenient and cost-effective way to manage your money while traveling.

Benefits: Travel cards often offer competitive exchange rates, low fees, and the ability to lock in exchange rates.

5.5. Avoid Exchanging Currency at Airports and Hotels

Airports and hotels typically offer the worst exchange rates and charge high fees. Avoid using these services whenever possible.

Alternatives: Use a bank, credit union, or online currency exchange service instead.

6. The Role of Central Banks in EUR/USD Exchange Rate

Central banks, such as the European Central Bank (ECB) and the Federal Reserve (Fed), play a crucial role in influencing the EUR/USD exchange rate. Their monetary policies and decisions can have a significant impact on currency values.

6.1. European Central Bank (ECB)

The ECB is the central bank of the Eurozone, responsible for maintaining price stability and managing monetary policy. The ECB influences the EUR/USD exchange rate through:

- Interest Rate Decisions: The ECB sets interest rates for the Eurozone. Higher interest rates can attract foreign investment, increasing demand for the Euro and potentially strengthening it against the Dollar.

- Quantitative Easing (QE): QE involves the ECB purchasing government bonds and other assets to inject liquidity into the Eurozone economy. This can weaken the Euro by increasing the money supply.

- Forward Guidance: The ECB provides forward guidance on its future monetary policy intentions, which can influence market expectations and currency values.

6.2. Federal Reserve (Fed)

The Federal Reserve (Fed) is the central bank of the United States, responsible for maintaining price stability and promoting full employment. The Fed influences the EUR/USD exchange rate through:

- Interest Rate Decisions: The Fed sets interest rates for the United States. Higher interest rates can attract foreign investment, increasing demand for the Dollar and potentially strengthening it against the Euro.

- Quantitative Easing (QE): QE involves the Fed purchasing government bonds and other assets to inject liquidity into the US economy. This can weaken the Dollar by increasing the money supply.

- Forward Guidance: The Fed provides forward guidance on its future monetary policy intentions, which can influence market expectations and currency values.

6.3. Impact of Monetary Policy on EUR/USD

The monetary policies of the ECB and the Fed can have a significant impact on the EUR/USD exchange rate. For example, if the Fed raises interest rates while the ECB keeps rates unchanged, the Dollar may strengthen against the Euro. Conversely, if the ECB adopts a more dovish monetary policy than the Fed, the Euro may weaken against the Dollar.

7. Economic Indicators and EUR/USD

Economic indicators provide insights into the health and performance of an economy. These indicators can influence the EUR/USD exchange rate by affecting investor sentiment and expectations.

7.1. Key Economic Indicators in the Eurozone

Key economic indicators in the Eurozone include:

- GDP Growth: Gross Domestic Product (GDP) measures the total value of goods and services produced in the Eurozone. Strong GDP growth can indicate a healthy economy and potentially strengthen the Euro.

- Inflation Rate: The inflation rate measures the rate at which prices for goods and services are rising in the Eurozone. High inflation can erode the value of the Euro and potentially weaken it against the Dollar.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is unemployed. A low unemployment rate can indicate a healthy economy and potentially strengthen the Euro.

- Purchasing Managers’ Index (PMI): The PMI is a survey-based indicator that measures the activity of purchasing managers in the manufacturing and services sectors. A high PMI can indicate strong economic growth and potentially strengthen the Euro.

7.2. Key Economic Indicators in the United States

Key economic indicators in the United States include:

- GDP Growth: Gross Domestic Product (GDP) measures the total value of goods and services produced in the United States. Strong GDP growth can indicate a healthy economy and potentially strengthen the Dollar.

- Inflation Rate: The inflation rate measures the rate at which prices for goods and services are rising in the United States. High inflation can erode the value of the Dollar and potentially weaken it against the Euro.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is unemployed. A low unemployment rate can indicate a healthy economy and potentially strengthen the Dollar.

- Non-Farm Payrolls: Non-farm payrolls measure the number of jobs added or lost in the United States excluding agricultural jobs. Strong job growth can indicate a healthy economy and potentially strengthen the Dollar.

7.3. How Economic Indicators Affect EUR/USD

Economic indicators can affect the EUR/USD exchange rate by influencing investor sentiment and expectations. For example, if the Eurozone releases stronger-than-expected GDP growth data while the United States releases weaker-than-expected data, the Euro may strengthen against the Dollar. Conversely, if the United States releases stronger-than-expected data while the Eurozone releases weaker-than-expected data, the Dollar may strengthen against the Euro.

8. Geopolitical Factors and EUR/USD

Geopolitical factors, such as political instability, elections, and policy changes, can create uncertainty and affect investor sentiment, leading to currency fluctuations.

8.1. Political Instability

Political instability in the Eurozone or the United States can create uncertainty and weaken their respective currencies. For example, political crises, government shutdowns, or social unrest can lead to investor concerns and capital flight.

8.2. Elections

Elections can have a significant impact on currency values, especially if the outcome is uncertain or if the winning party is expected to implement policies that could affect the economy. For example, a surprise election result or a shift in political power can lead to currency volatility.

8.3. Policy Changes

Policy changes, such as changes in fiscal policy, trade policy, or regulatory policy, can affect investor sentiment and currency values. For example, a new trade agreement or a change in tax laws can have a significant impact on the EUR/USD exchange rate.

8.4. Global Events

Global events, such as trade wars, political tensions, and global crises, can impact currency values as investors react to changing circumstances. For example, a trade war between the United States and China can lead to increased uncertainty and volatility in the Forex market.

9. Hedging Currency Risk

Hedging currency risk involves taking steps to protect yourself from adverse movements in exchange rates. This is particularly important for businesses with international operations and investors with foreign investments.

9.1. Forward Contracts

A forward contract is an agreement to buy or sell a currency at a specified exchange rate on a future date. This allows you to lock in an exchange rate and protect yourself from currency fluctuations.

9.2. Currency Options

A currency option gives you the right, but not the obligation, to buy or sell a currency at a specified exchange rate on or before a future date. This provides flexibility and allows you to benefit from favorable movements in exchange rates while protecting yourself from adverse movements.

9.3. Currency Swaps

A currency swap involves exchanging principal and interest payments on debt denominated in different currencies. This can be used to hedge currency risk and manage exposure to foreign currencies.

9.4. Natural Hedging

Natural hedging involves matching your assets and liabilities in the same currency. For example, if you have revenues in Euros and expenses in Euros, you are naturally hedged against currency risk.

10. Practical Tools and Resources on euro2.net

euro2.net offers a range of practical tools and resources to help you track the EUR/USD exchange rate, convert currencies, and make informed financial decisions.

10.1. Real-Time Currency Converter

Our real-time currency converter provides up-to-the-minute exchange rates for the EUR/USD currency pair. You can use it to quickly and accurately convert Euros to Dollars or Dollars to Euros.

10.2. Historical Exchange Rate Data

Our historical exchange rate data allows you to analyze past movements in the EUR/USD exchange rate. This can help you identify trends and patterns and make informed predictions about future movements.

10.3. Currency Charts and Graphs

Our currency charts and graphs provide a visual representation of the EUR/USD exchange rate over time. This can help you see how the exchange rate has fluctuated and identify key support and resistance levels.

10.4. News and Analysis

Our news and analysis section provides the latest updates on economic events, central bank decisions, and geopolitical factors that can affect the EUR/USD exchange rate. This can help you stay informed and make timely financial decisions.

10.5. Educational Resources

Our educational resources provide information on currency trading, risk management, and other topics related to the Forex market. This can help you improve your knowledge and skills and make more informed trading decisions.

11. Understanding the Forex Market

The Forex market, short for foreign exchange market, is a decentralized global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with trillions of dollars changing hands every day.

11.1. Key Participants in the Forex Market

Key participants in the Forex market include:

- Central Banks: Central banks, such as the ECB and the Fed, intervene in the Forex market to influence exchange rates and manage their currency reserves.

- Commercial Banks: Commercial banks facilitate currency transactions for their clients and also trade currencies for their own accounts.

- Hedge Funds: Hedge funds are investment firms that use a variety of strategies to generate returns, including trading currencies.

- Corporations: Corporations with international operations use the Forex market to exchange currencies for trade and investment purposes.

- Retail Traders: Retail traders are individual investors who trade currencies for their own accounts.

11.2. Factors Driving Forex Trading

Several factors drive Forex trading:

- Speculation: Traders speculate on future movements in exchange rates and attempt to profit from those movements.

- Hedging: Businesses and investors use the Forex market to hedge currency risk and protect themselves from adverse movements in exchange rates.

- Arbitrage: Traders exploit price differences in different markets to profit from arbitrage opportunities.

- Interest Rate Differentials: Traders seek to profit from interest rate differentials between different currencies.

11.3. Risks of Forex Trading

Forex trading involves significant risks:

- Leverage: Forex trading is often conducted with high leverage, which can amplify both profits and losses.

- Volatility: Exchange rates can be highly volatile, leading to unexpected losses.

- Market Risk: Changes in economic conditions, political events, and market sentiment can affect exchange rates.

- Counterparty Risk: There is a risk that the counterparty to a Forex transaction may default on their obligations.

12. Case Studies: Real-World EUR/USD Conversions

Examining real-world case studies can provide valuable insights into the practical implications of EUR/USD conversions.

12.1. A US Tourist Visiting Europe

A US tourist planning a trip to Europe needs to convert Dollars to Euros to pay for accommodation, food, and activities. By monitoring the EUR/USD exchange rate and using a currency converter, the tourist can budget their expenses effectively and avoid overspending.

12.2. A European Exporter Selling Goods to the US

A European exporter selling goods to the US needs to convert Dollars to Euros to repatriate their profits. By hedging their currency risk, the exporter can protect their profit margins from adverse movements in the EUR/USD exchange rate.

12.3. A US Investor Buying European Stocks

A US investor buying European stocks needs to convert Dollars to Euros to purchase the stocks. By understanding the EUR/USD exchange rate, the investor can assess the potential returns on their investment and manage their currency risk.

13. Future Trends in EUR/USD Exchange Rate

Predicting future trends in the EUR/USD exchange rate is challenging due to the numerous factors that can influence currency values. However, analyzing current economic conditions, central bank policies, and geopolitical events can provide some insights.

13.1. Economic Forecasts

Economic forecasts from reputable organizations, such as the International Monetary Fund (IMF) and the World Bank, can provide insights into the future performance of the Eurozone and US economies. These forecasts can help you assess the potential direction of the EUR/USD exchange rate.

13.2. Central Bank Policies

Monitoring the policies of the ECB and the Fed is crucial for understanding potential future movements in the EUR/USD exchange rate. Changes in interest rates, quantitative easing, and forward guidance can all have a significant impact on currency values.

13.3. Geopolitical Developments

Keeping an eye on geopolitical developments, such as trade wars, political tensions, and global crises, is also important. These events can create uncertainty and volatility in the Forex market, leading to unexpected movements in the EUR/USD exchange rate.

14. Expert Opinions on EUR/USD

Seeking expert opinions from economists, currency strategists, and financial analysts can provide valuable insights into the EUR/USD exchange rate. These experts often have a deep understanding of the factors that influence currency values and can offer informed perspectives on potential future movements.

14.1. Economists

Economists can provide insights into the macroeconomic factors that drive the EUR/USD exchange rate, such as GDP growth, inflation, and unemployment.

14.2. Currency Strategists

Currency strategists specialize in analyzing the Forex market and predicting future movements in exchange rates.

14.3. Financial Analysts

Financial analysts can provide insights into the financial and investment implications of movements in the EUR/USD exchange rate.

15. Understanding Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory that suggests exchange rates should adjust to equalize the price of a basket of goods and services in different countries.

15.1. How PPP Works

PPP works by comparing the cost of a standardized basket of goods and services in two countries. If the cost of the basket is higher in one country than the other, the exchange rate should adjust to reflect the difference in prices.

15.2. Limitations of PPP

PPP has several limitations:

- Trade Barriers: Trade barriers, such as tariffs and quotas, can prevent prices from equalizing across countries.

- Non-Traded Goods and Services: Many goods and services, such as haircuts and real estate, are not traded internationally, so their prices may not be subject to PPP.

- Transportation Costs: Transportation costs can increase the cost of goods and services, preventing prices from equalizing across countries.

15.3. PPP and EUR/USD

While PPP is not a perfect predictor of exchange rates, it can provide some insights into the long-term equilibrium value of the EUR/USD exchange rate.

16. The Impact of Inflation on EUR/USD

Inflation is the rate at which prices for goods and services are rising in an economy. High inflation can erode the value of a currency and potentially weaken it against other currencies.

16.1. Inflation in the Eurozone

Monitoring inflation in the Eurozone is crucial for understanding potential movements in the EUR/USD exchange rate. High inflation in the Eurozone can weaken the Euro against the Dollar.

16.2. Inflation in the United States

Monitoring inflation in the United States is also important. High inflation in the United States can weaken the Dollar against the Euro.

16.3. Inflation Differentials

The difference in inflation rates between the Eurozone and the United States can affect the EUR/USD exchange rate. If inflation is higher in the Eurozone than in the United States, the Euro may weaken against the Dollar. Conversely, if inflation is higher in the United States than in the Eurozone, the Dollar may weaken against the Euro.

17. Trade Balance and EUR/USD

The trade balance is the difference between a country’s exports and imports. A trade surplus occurs when a country exports more than it imports, while a trade deficit occurs when a country imports more than it exports.

17.1. Trade Balance in the Eurozone

Monitoring the trade balance in the Eurozone is crucial for understanding potential movements in the EUR/USD exchange rate. A trade surplus in the Eurozone can strengthen the Euro against the Dollar.

17.2. Trade Balance in the United States

Monitoring the trade balance in the United States is also important. A trade deficit in the United States can weaken the Dollar against the Euro.

17.3. Trade Balance Differentials

The difference in trade balances between the Eurozone and the United States can affect the EUR/USD exchange rate. If the Eurozone has a larger trade surplus than the United States, the Euro may strengthen against the Dollar. Conversely, if the United States has a smaller trade deficit than the Eurozone, the Dollar may weaken against the Euro.

18. Public Debt and EUR/USD

Public debt is the total amount of money that a government owes to its creditors. High levels of public debt can raise concerns about a country’s fiscal sustainability and potentially weaken its currency.

18.1. Public Debt in the Eurozone

Monitoring public debt levels in the Eurozone is crucial for understanding potential movements in the EUR/USD exchange rate. High levels of public debt in the Eurozone can weaken the Euro against the Dollar.

18.2. Public Debt in the United States

Monitoring public debt levels in the United States is also important. High levels of public debt in the United States can weaken the Dollar against the Euro.

18.3. Public Debt Differentials

The difference in public debt levels between the Eurozone and the United States can affect the EUR/USD exchange rate. If the Eurozone has lower levels of public debt than the United States, the Euro may strengthen against the Dollar. Conversely, if the United States has higher levels of public debt than the Eurozone, the Dollar may weaken against the Euro.

19. Interest Rate Differentials and EUR/USD

Interest rate differentials are the difference in interest rates between two countries. Higher interest rates can attract foreign investment, increasing demand for the currency and potentially strengthening it against other currencies.

19.1. Interest Rates in the Eurozone

Monitoring interest rates in the Eurozone, set by the ECB, is crucial for understanding potential movements in the EUR/USD exchange rate. Higher interest rates in the Eurozone can strengthen the Euro against the Dollar.

19.2. Interest Rates in the United States

Monitoring interest rates in the United States, set by the Fed, is also important. Higher interest rates in the United States can strengthen the Dollar against the Euro.

19.3. Impact of Interest Rate Decisions on EUR/USD

The interest rate decisions of the ECB and the Fed can have a significant impact on the EUR/USD exchange rate. For example, if the Fed raises interest rates while the ECB keeps rates unchanged, the Dollar may strengthen against the Euro. Conversely, if the ECB adopts a more dovish monetary policy than the Fed, the Euro may weaken against the Dollar.

20. Political Stability and EUR/USD

Political stability is a crucial factor influencing currency values. Countries with stable political systems and policies tend to have stronger currencies, as they attract more foreign investment and confidence.

20.1. Political Stability in the Eurozone

Monitoring the political stability in the Eurozone is essential for understanding potential movements in the EUR/USD exchange rate. Political instability, such as government crises or social unrest, can weaken the Euro against the Dollar.

20.2. Political Stability in the United States

Monitoring the political stability in the United States is also important. Political instability can weaken the Dollar against the Euro.

20.3. Impact of Political Events on EUR/USD

Political events, such as elections, policy changes, and geopolitical tensions, can affect investor sentiment and currency values. For example, a surprise election result or a shift in political power can lead to currency volatility.

21. Market Sentiment and EUR/USD

Market sentiment refers to the overall attitude or feeling of investors towards a particular market or currency. Positive market sentiment can lead to increased demand for a currency, while negative sentiment can lead to decreased demand.

21.1. Factors Influencing Market Sentiment

Several factors can influence market sentiment:

- Economic Data: Strong economic data releases can boost market sentiment and lead to increased demand for a currency.

- Central Bank Policies: Central bank decisions, such as interest rate changes, can affect market sentiment and currency values.

- Political Events: Political events, such as elections and policy changes, can influence market sentiment and currency values.

- Global Events: Global events, such as trade wars and geopolitical tensions, can impact market sentiment and currency values.

21.2. How Market Sentiment Affects EUR/USD

Market sentiment can affect the EUR/USD exchange rate by influencing investor demand for the Euro and the Dollar. Positive market sentiment towards the Eurozone can lead to increased demand for the Euro and potentially strengthen it against the Dollar. Conversely, positive market sentiment towards the United States can lead to increased demand for the Dollar and potentially strengthen it against the Euro.

22. Economic Growth and EUR/USD

Economic growth is the increase in the total value of goods and services produced in an economy over time. Strong economic growth can indicate a healthy economy and potentially strengthen its currency.

22.1. Economic Growth in the Eurozone

Monitoring economic growth in the Eurozone is crucial for understanding potential movements in the EUR/USD exchange rate. Strong economic growth in the Eurozone can strengthen the Euro against the Dollar.

22.2. Economic Growth in the United States

Monitoring economic growth in the United States is also important. Strong economic growth in the United States can strengthen the Dollar against the Euro.

22.3. Impact of Economic Growth on EUR/USD

The relative economic growth rates between the Eurozone and the United States can affect the EUR/USD exchange rate. If the Eurozone is growing faster than the United States, the Euro may strengthen against the Dollar. Conversely, if the United States is growing faster than the Eurozone, the Dollar may strengthen against the Euro.

23. Technical Analysis of EUR/USD

Technical analysis involves analyzing historical price and volume data to identify patterns and trends that can be used to predict future movements in exchange rates.

23.1. Key Technical Indicators

Key technical indicators include:

- Moving Averages: Moving averages smooth out price data to identify trends.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): The MACD identifies changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

- Fibonacci Retracement Levels: Fibonacci retracement levels are used to identify potential support and resistance levels.

23.2. Using Technical Analysis for EUR/USD

Traders use technical analysis to identify potential entry and exit points for EUR/USD trades. By analyzing charts and indicators, traders can make informed decisions about when to buy or sell the currency pair.

23.3. Limitations of Technical Analysis

Technical analysis has limitations:

- Subjectivity: Technical analysis can be subjective, as different traders may interpret charts and indicators differently.

- False Signals: Technical indicators can generate false signals, leading to incorrect trading decisions.

- Ignoring Fundamentals: Technical analysis often ignores fundamental factors, such as economic data and central bank policies, which can affect exchange rates.

24. Fundamental Analysis of EUR/USD

Fundamental analysis involves analyzing economic, financial, and political factors to assess the intrinsic value of a currency.

24.1. Key Fundamental Factors

Key fundamental factors include:

- Economic Growth: Strong economic growth can strengthen a currency.

- Inflation: Low inflation can strengthen a currency.

- Interest Rates: Higher interest rates can attract foreign investment and strengthen a currency.

- Trade Balance: A trade surplus can strengthen a currency.

- Political Stability: Political stability can attract foreign investment and strengthen a currency.

24.2. Using Fundamental Analysis for EUR/USD

Traders use fundamental analysis to assess the long-term value of the EUR/USD exchange rate. By analyzing economic data, central bank policies, and political events, traders can make informed decisions about whether to buy or sell the currency pair.

24.3. Limitations of Fundamental Analysis

Fundamental analysis has limitations:

- Time Lag: Economic data and other fundamental factors are often released with a time lag, making it difficult to make timely trading decisions.

- Complexity: Fundamental analysis can be complex, requiring a deep understanding of economics, finance, and politics.

- Market Sentiment: Market sentiment can override fundamental factors, leading to unexpected movements in exchange rates.

25. How to Stay Updated on EUR/USD Exchange Rate

Staying updated on the EUR/USD exchange rate is crucial for anyone involved in international transactions, investments, or travel. Here are some ways to stay informed:

25.1. Online Currency Converters

Use online currency converters like the one on euro2.net to get real-time exchange rates. These converters provide up-to-the-minute information on the EUR/USD exchange rate.

25.2. Financial News Websites

Visit financial news websites like Bloomberg, Reuters, and The Wall Street Journal to get the latest updates on economic events, central bank decisions, and geopolitical factors that can affect the EUR/USD exchange rate.

25.3. Mobile Apps

Download mobile apps that provide real-time exchange rates and financial news. These apps allow you to stay informed on the go.

25.4. Social Media

Follow financial news outlets and economists on social media platforms like Twitter to get the latest updates on the EUR/USD exchange rate.

25.5. Email Alerts

Sign up for email alerts from financial news websites and currency exchange services to receive notifications when the EUR/USD exchange rate reaches a certain level.

26. Tax Implications of Currency Exchange

Currency exchange can have tax implications, depending on the amount of money involved and the purpose of the exchange.

26.1. Capital Gains Tax

If you profit from currency exchange, you may be subject to capital gains tax. The rules for capital gains tax vary depending on your country of residence and the amount of profit you make.

26.2. Income Tax

If you receive income in a foreign currency, you may be subject to income tax. The rules for income tax vary depending on your country of residence and the type of income you receive.

26.3. Reporting Requirements

In some countries, you may be required to report currency exchanges to the tax authorities. The reporting requirements vary depending on your country of residence and the amount of money involved.

26.4. Seeking Professional Advice

It is always a good idea to seek professional advice from a tax advisor to understand the tax implications of currency exchange.

27. The Future of the Euro

The future of the Euro is a topic of much debate among economists and policymakers. Several factors could influence the Euro’s future, including economic growth, political stability, and central bank policies.

27.1. Challenges Facing the Eurozone

The Eurozone faces several challenges, including:

- Sovereign Debt: High levels of sovereign debt in some Eurozone countries pose a risk to the stability of the Euro.

- Economic Divergence: Economic divergence between Eurozone countries can lead to imbalances and tensions.

- Political Fragmentation: Political fragmentation can make it difficult to implement necessary reforms.

27.2. Opportunities for the Eurozone

The Eurozone also has opportunities: