What Is 1 TL Euro And How Does It Impact The US Market?

Navigating the complexities of foreign exchange can be daunting, but understanding key currency relationships, like the value of “1 Tl Euro” (likely a typo intending “EUR” or Euro), is crucial for informed financial decisions, especially for those in the US market; euro2.net simplifies this process by providing real-time exchange rates, in-depth analysis, and user-friendly tools. By offering up-to-date exchange rates, comprehensive analysis, and easy-to-use conversion tools, euro2.net empowers users to stay informed and make smart financial choices, which include monetary policy, currency pairs, and financial analysis.

1. Understanding The Euro (EUR) and Its Significance

The Euro (EUR) is the official currency of the Eurozone, a monetary union of 20 European Union (EU) member states; its stability and value have far-reaching effects on international trade, investment, and the global economy, including the United States.

1.1. What is the Eurozone?

The Eurozone is a group of European Union member states that have adopted the euro (€) as their common currency. As of 2024, the Eurozone consists of 20 countries: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. These countries share a common monetary policy overseen by the European Central Bank (ECB).

1.2. How the Euro Impacts Global Trade

The euro is the second most widely held currency in the world, playing a vital role in international trade and finance, especially between the Eurozone and the United States. A stable euro can facilitate smoother trade relations, reduce transaction costs, and promote cross-border investments.

1.3. The Euro as a Reserve Currency

As a major reserve currency, the euro is held by central banks worldwide as part of their foreign exchange reserves; the demand for euros by central banks can influence its value and impact the balance of payments for Eurozone countries.

2. Exchange Rates: EUR/USD and Their Dynamics

The EUR/USD exchange rate is one of the most actively traded currency pairs globally; understanding the factors that influence this rate is essential for businesses, investors, and individuals dealing with cross-border transactions.

2.1. Factors Influencing the EUR/USD Exchange Rate

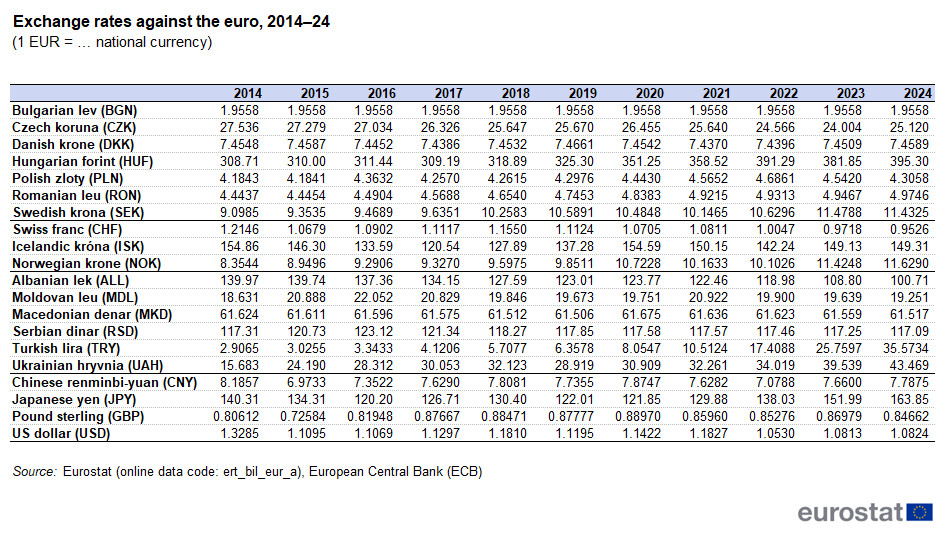

Euro exchange rates against other currencies

Euro exchange rates against other currencies

Several factors influence the EUR/USD exchange rate, including:

- Economic Indicators: GDP growth, inflation rates, employment data, and manufacturing indices in both the Eurozone and the United States.

- Interest Rate Differentials: The difference in interest rates set by the European Central Bank (ECB) and the Federal Reserve (the Fed).

- Geopolitical Events: Political instability, trade wars, and global crises.

- Market Sentiment: Investor confidence and risk appetite.

2.2. How to Interpret EUR/USD Quotes

The EUR/USD quote represents the amount of US dollars (USD) required to purchase one euro (EUR). For example, if the EUR/USD is quoted at 1.10, it means that 1 euro can be exchanged for 1.10 US dollars.

2.3. Historical Trends of EUR/USD

Examining the historical trends of the EUR/USD exchange rate can provide insights into its potential future movements. According to Eurostat data, the euro depreciated by 18.5% against the US dollar between 2014 and 2024, largely due to a sharp depreciation in 2015 (down 16.5%).

3. The European Central Bank (ECB) and Monetary Policy

The ECB plays a crucial role in maintaining price stability within the Eurozone; its monetary policy decisions can significantly impact the value of the euro and, consequently, the EUR/USD exchange rate.

3.1. ECB’s Role in Maintaining Price Stability

The ECB’s primary objective is to maintain price stability, defined as a year-on-year increase in the Harmonized Index of Consumer Prices (HICP) for the Eurozone below, but close to, 2% over the medium term.

3.2. Key Interest Rates Set by the ECB

The ECB sets three key interest rates:

- The Main Refinancing Operations (MRO) Rate: The rate at which commercial banks can borrow money from the ECB on a weekly basis.

- The Marginal Lending Facility Rate: The rate at which commercial banks can borrow money from the ECB overnight.

- The Deposit Facility Rate: The rate commercial banks receive for depositing money with the ECB overnight.

3.3. Impact of ECB Decisions on the Euro

Changes in the ECB’s key interest rates can influence the euro’s value; for instance, an increase in interest rates tends to strengthen the euro, while a decrease can weaken it. These decisions also affect borrowing costs, investment flows, and overall economic activity in the Eurozone.

4. US Economic Indicators and Their Influence

US economic indicators are closely watched by global investors as they provide insights into the health and performance of the US economy, which in turn affects the value of the US dollar and the EUR/USD exchange rate.

4.1. Key US Economic Indicators

Key US economic indicators include:

- Gross Domestic Product (GDP): The total value of goods and services produced in the US.

- Employment Data: Including the unemployment rate, non-farm payrolls, and average hourly earnings.

- Inflation Rate: Measured by the Consumer Price Index (CPI) and the Producer Price Index (PPI).

- Manufacturing Indices: Such as the ISM Manufacturing Index.

- Retail Sales: A measure of consumer spending.

4.2. The Federal Reserve (The Fed) and Its Policies

The Federal Reserve (the Fed) is the central bank of the United States; it is responsible for setting monetary policy to promote maximum employment and price stability; the Fed’s decisions on interest rates, quantitative easing, and other policy tools can significantly influence the value of the US dollar.

4.3. How US Data Impacts EUR/USD

Strong US economic data generally leads to a stronger US dollar, which can cause the EUR/USD exchange rate to decline; conversely, weak US data can weaken the dollar and cause the EUR/USD rate to rise.

5. Geopolitical Factors and Market Sentiment

Geopolitical events and market sentiment can create volatility in the EUR/USD exchange rate.

5.1. Impact of Political Events

Political events, such as elections, policy changes, and international relations, can create uncertainty and impact investor sentiment. For instance, the UK’s decision to leave the European Union (Brexit) in 2016 led to significant volatility in both the euro and the pound sterling.

5.2. Trade Wars and Their Consequences

Trade wars, such as the US-China trade dispute, can disrupt global trade flows and impact currency valuations; tariffs, quotas, and other trade barriers can affect the competitiveness of businesses and the overall economic outlook, leading to fluctuations in exchange rates.

5.3. Market Sentiment and Risk Appetite

Market sentiment refers to the overall attitude of investors towards financial markets. When investors are optimistic and risk-tolerant, they tend to invest in riskier assets, which can weaken safe-haven currencies like the US dollar; conversely, when investors are risk-averse, they seek safety in currencies like the dollar, which can strengthen it.

6. Using euro2.net for EUR/USD Analysis

euro2.net provides a suite of tools and resources to help users analyze the EUR/USD exchange rate and make informed decisions.

6.1. Real-Time Exchange Rates and Charts

euro2.net offers real-time exchange rates for the EUR/USD pair, along with historical charts and data; this allows users to track the currency’s movements and identify trends over time.

6.2. Economic Calendar and News

euro2.net provides an economic calendar that lists upcoming economic events and releases from both the Eurozone and the United States; this can help users anticipate potential market movements and adjust their strategies accordingly. Additionally, the website offers news and analysis on economic and political developments that could impact the EUR/USD exchange rate.

6.3. Expert Analysis and Forecasts

euro2.net features expert analysis and forecasts on the EUR/USD exchange rate from experienced financial professionals; these insights can provide valuable perspectives on potential future movements and help users make more informed decisions.

7. Practical Applications for US Businesses and Investors

Understanding the dynamics of the EUR/USD exchange rate is crucial for US businesses and investors involved in international trade and finance.

7.1. Hedging Currency Risk

Hedging currency risk involves using financial instruments to protect against adverse movements in exchange rates; US businesses that import or export goods to the Eurozone can use hedging strategies to minimize the impact of currency fluctuations on their profits.

7.2. Investment Strategies

Investors can take advantage of fluctuations in the EUR/USD exchange rate to generate profits. For example, if an investor believes that the euro will appreciate against the dollar, they can buy euros and sell them later at a higher price.

7.3. Transferring Funds

Individuals and businesses that need to transfer funds between the US and the Eurozone can use euro2.net to find the best exchange rates and minimize transaction costs; euro2.net provides a comparison of different money transfer services to help users find the most cost-effective option.

8. Case Studies: EUR/USD Impact on US Companies

Examining real-world case studies can provide valuable insights into how fluctuations in the EUR/USD exchange rate can impact US companies.

8.1. Impact on Exporters

A stronger dollar can make US exports more expensive for Eurozone buyers, which can reduce demand and negatively impact US exporters’ revenues; companies like Boeing and Caterpillar, which sell products in euros, can see their profits decline when the dollar strengthens.

8.2. Impact on Importers

A weaker dollar can make Eurozone imports more expensive for US buyers, which can increase costs for US importers; companies like Walmart and Target, which import goods from Europe, may face higher costs when the dollar weakens.

8.3. Strategies for Mitigation

US companies can mitigate the impact of currency fluctuations by using hedging strategies, diversifying their markets, and adjusting their pricing strategies; for example, a company could use forward contracts to lock in a specific exchange rate for future transactions, or it could diversify its sales to other countries to reduce its reliance on the Eurozone market.

9. Future Outlook for the Euro and EUR/USD

Predicting the future of the euro and the EUR/USD exchange rate is challenging due to the numerous factors that can influence their movements; however, examining current trends and expert forecasts can provide some insights into potential future developments.

9.1. Expert Predictions

Financial analysts and economists often provide forecasts on the future direction of the euro and the EUR/USD exchange rate. These predictions are based on a variety of factors, including economic indicators, monetary policy decisions, and geopolitical events.

9.2. Potential Scenarios

Several potential scenarios could impact the euro and the EUR/USD exchange rate in the future:

- Continued Economic Recovery: If both the US and the Eurozone continue to recover from the COVID-19 pandemic, the EUR/USD exchange rate could stabilize or appreciate.

- Monetary Policy Divergence: If the Federal Reserve and the European Central Bank pursue different monetary policies, the EUR/USD exchange rate could become more volatile.

- Geopolitical Risks: Geopolitical risks, such as trade wars or political instability, could lead to sharp fluctuations in the EUR/USD exchange rate.

9.3. Long-Term Trends

Long-term trends, such as demographic changes, technological advancements, and shifts in global trade patterns, could also impact the euro and the EUR/USD exchange rate; for example, the aging population in Europe could put downward pressure on the euro, while the rise of emerging markets could lead to a shift in global currency reserves.

10. Frequently Asked Questions (FAQs) about the Euro and EUR/USD

10.1. What is the current EUR/USD exchange rate?

The current EUR/USD exchange rate can be found on euro2.net, which provides real-time exchange rates and historical data.

10.2. How is the EUR/USD exchange rate determined?

The EUR/USD exchange rate is determined by supply and demand in the foreign exchange market.

10.3. What factors influence the EUR/USD exchange rate?

Factors influencing the EUR/USD exchange rate include economic indicators, interest rate differentials, geopolitical events, and market sentiment.

10.4. How can US businesses hedge currency risk?

US businesses can hedge currency risk by using financial instruments such as forward contracts, options, and currency swaps.

10.5. What is the European Central Bank (ECB)?

The European Central Bank (ECB) is the central bank of the Eurozone; it is responsible for setting monetary policy to maintain price stability.

10.6. How does the ECB influence the euro’s value?

The ECB influences the euro’s value by setting key interest rates and implementing other monetary policy tools.

10.7. What are the key US economic indicators to watch?

Key US economic indicators to watch include GDP growth, employment data, inflation rates, and manufacturing indices.

10.8. How does the Federal Reserve (the Fed) impact the EUR/USD exchange rate?

The Federal Reserve (the Fed) impacts the EUR/USD exchange rate by setting monetary policy to promote maximum employment and price stability.

10.9. Where can I find expert analysis and forecasts on the EUR/USD exchange rate?

Expert analysis and forecasts on the EUR/USD exchange rate can be found on euro2.net.

10.10. How can euro2.net help me make informed decisions about the euro and EUR/USD?

euro2.net provides real-time exchange rates, economic calendar, news, expert analysis, and other resources to help users make informed decisions about the euro and EUR/USD.

11. Conclusion: Staying Informed with euro2.net

Understanding the dynamics of the euro and the EUR/USD exchange rate is crucial for businesses, investors, and individuals involved in international trade and finance. euro2.net provides a comprehensive suite of tools and resources to help users stay informed and make smart financial decisions.

For the latest EUR/USD exchange rates, in-depth analysis, and user-friendly tools, visit euro2.net today.

Address: 33 Liberty Street, New York, NY 10045, United States

Phone: +1 (212) 720-5000

Website: euro2.net