What Is 1 Euro TL And How Does It Affect You?

Are you curious about the “1 Euro Tl” exchange rate and its implications? At euro2.net, we provide you with the latest insights and tools to navigate the complexities of the Euro exchange rate. We offer comprehensive analysis, real-time data, and user-friendly tools to help you stay informed.

1. Understanding the Basics: What is 1 Euro TL?

The phrase “1 Euro TL” refers to the exchange rate between the Euro (EUR) and the Turkish Lira (TRY). In simpler terms, it tells you how many Turkish Lira you can get for one Euro. This rate is constantly fluctuating based on various economic factors, making it crucial to stay updated.

What Factors Influence the EUR/TRY Exchange Rate?

Several factors can influence the EUR/TRY exchange rate, including:

- Economic Indicators: Inflation rates, GDP growth, and unemployment figures in both the Eurozone and Turkey.

- Political Stability: Political events and government policies in both regions.

- Central Bank Policies: Decisions made by the European Central Bank (ECB) and the Central Bank of the Republic of Turkey (CBRT) regarding interest rates and monetary policy.

- Market Sentiment: Investor confidence and overall market sentiment towards the Euro and the Turkish Lira.

- Global Events: International trade agreements, geopolitical tensions, and global economic trends.

Why is the EUR/TRY Exchange Rate Important?

The EUR/TRY exchange rate is important for various reasons:

- International Trade: Businesses involved in trade between the Eurozone and Turkey need to monitor this rate to accurately price goods and services.

- Tourism: Travelers going between the Eurozone and Turkey need to know the exchange rate to manage their expenses.

- Investments: Investors considering opportunities in either the Eurozone or Turkey need to understand the exchange rate to assess potential returns and risks.

- Remittances: Individuals sending money between the Eurozone and Turkey need to be aware of the exchange rate to ensure fair transfers.

2. Historical Trends: How Has the 1 Euro TL Rate Changed Over Time?

To truly understand the current EUR/TRY exchange rate, it’s helpful to look at its historical trends. Over the past decade, the Turkish Lira has experienced significant volatility against the Euro.

Key Historical Trends:

- 2014-2018: The Lira gradually weakened against the Euro due to rising inflation and political instability in Turkey.

- 2018-2020: A currency crisis in 2018 led to a sharp depreciation of the Lira, followed by periods of recovery and further declines.

- 2020-2024: Continued economic challenges and unconventional monetary policies resulted in a persistent weakening of the Lira against the Euro.

Analyzing the Data:

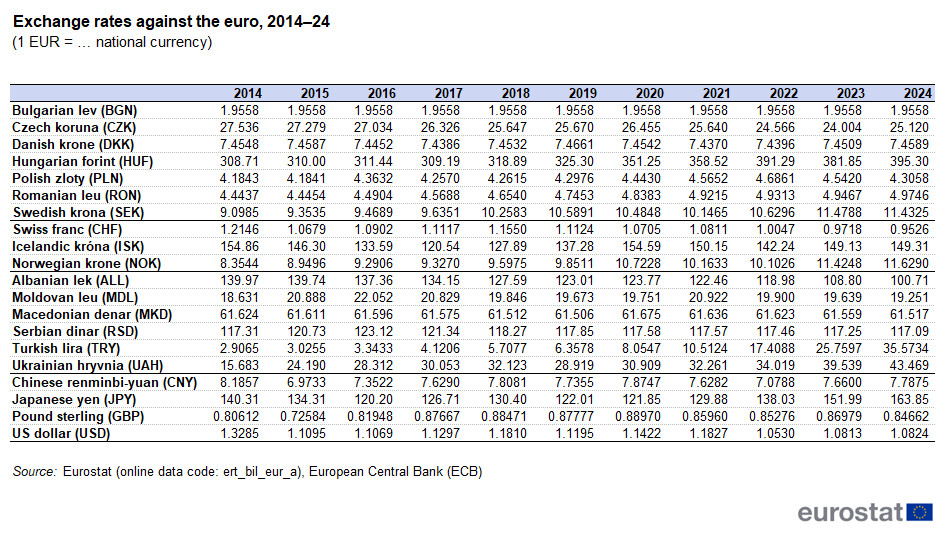

According to Eurostat data, the euro has appreciated significantly against the Turkish Lira over the past decade. From 2014 to 2024, the euro appreciated by a staggering 1123.9% against the Turkish lira. This shows a regular appreciation of the euro, with the euro gaining value every year between 2014 and 2024. In recent years, the euro appreciated by 65.6% in 2022, 48.0% in 2023, and 38.1% in 2024.

These trends highlight the importance of staying informed and adapting to the ever-changing exchange rate landscape.

3. Current Exchange Rate: What is the 1 Euro TL Rate Today?

The current EUR/TRY exchange rate is constantly changing, influenced by real-time market dynamics. It’s essential to have access to up-to-date information to make informed decisions.

Where to Find Real-Time Exchange Rates:

You can find real-time EUR/TRY exchange rates on various financial websites, including euro2.net. These platforms provide live data, charts, and analysis to help you track the latest movements.

Factors Affecting Today’s Rate:

Several factors could be influencing the EUR/TRY exchange rate today:

- Economic News: Recent economic data releases from the Eurozone and Turkey.

- Political Developments: Any significant political events or policy announcements.

- Market Sentiment: Overall investor confidence and risk appetite.

- Global Events: Major international news that could impact the Euro or the Turkish Lira.

4. Impact on Businesses: How Does the 1 Euro TL Rate Affect Trade?

The EUR/TRY exchange rate has a significant impact on businesses involved in trade between the Eurozone and Turkey. Fluctuations in the exchange rate can affect the competitiveness of exports and imports, as well as the profitability of international transactions.

Impact on Exporters:

A weaker Turkish Lira can make Turkish exports more competitive in the Eurozone, as goods and services become cheaper for Eurozone buyers. However, it can also reduce the Euro value of export earnings for Turkish companies.

Impact on Importers:

A weaker Turkish Lira can make Eurozone imports more expensive for Turkish buyers, potentially increasing the cost of goods and services in Turkey. This can lead to higher inflation and reduced consumer spending.

Strategies for Businesses:

Businesses can employ various strategies to mitigate the risks associated with exchange rate fluctuations:

- Hedging: Using financial instruments to lock in exchange rates for future transactions.

- Pricing Strategies: Adjusting prices to reflect changes in the exchange rate.

- Diversification: Expanding into new markets to reduce reliance on a single currency pair.

- Currency Accounts: Holding funds in both Euro and Turkish Lira to manage currency risk.

5. Impact on Consumers: How Does the 1 Euro TL Rate Affect Travel and Spending?

The EUR/TRY exchange rate also affects consumers, particularly those who travel between the Eurozone and Turkey or make purchases in either currency.

Impact on Travelers:

A weaker Turkish Lira can make Turkey a more affordable destination for Eurozone tourists, as their Euros can buy more goods and services. However, it can also make travel to the Eurozone more expensive for Turkish tourists.

Impact on Online Shopping:

Consumers who shop online from Eurozone or Turkish retailers need to be aware of the exchange rate, as it can affect the final cost of their purchases.

Tips for Consumers:

Here are some tips for consumers to manage the impact of exchange rate fluctuations:

- Monitor Exchange Rates: Keep an eye on the EUR/TRY exchange rate before making travel plans or online purchases.

- Compare Exchange Rates: Shop around for the best exchange rates from banks, currency exchange services, and online platforms.

- Use Credit Cards Wisely: Be aware of the exchange rates and fees charged by your credit card company for international transactions.

- Consider Local Currency: When traveling, consider using local currency to avoid unfavorable exchange rates and fees.

6. Investment Opportunities: How Does the 1 Euro TL Rate Affect Investments?

The EUR/TRY exchange rate can create both opportunities and risks for investors considering investments in the Eurozone or Turkey.

Opportunities for Eurozone Investors:

A weaker Turkish Lira can make Turkish assets, such as stocks, bonds, and real estate, more attractive to Eurozone investors. However, investors need to consider the risks associated with investing in a volatile currency.

Opportunities for Turkish Investors:

A stronger Euro can make Eurozone assets more expensive for Turkish investors. However, it can also provide diversification benefits and access to more stable markets.

Investment Strategies:

Here are some investment strategies to consider:

- Diversification: Investing in a mix of Eurozone and Turkish assets to reduce risk.

- Currency Hedging: Using financial instruments to protect against currency fluctuations.

- Long-Term Perspective: Taking a long-term view and focusing on the underlying fundamentals of the investments.

- Professional Advice: Seeking advice from financial advisors who specialize in international investments.

7. Economic Outlook: What is the Future of the 1 Euro TL Rate?

Predicting the future of the EUR/TRY exchange rate is challenging, as it depends on a complex interplay of economic, political, and global factors. However, analyzing current trends and expert forecasts can provide some insights.

Expert Forecasts:

Various economic analysts and financial institutions provide forecasts for the EUR/TRY exchange rate. These forecasts are based on economic models, historical data, and expert judgment. However, it’s important to remember that forecasts are not guarantees and should be used as one input in your decision-making process.

Key Factors to Watch:

Here are some key factors to watch that could influence the future of the EUR/TRY exchange rate:

- Inflation Rates: Continued high inflation in Turkey could put further downward pressure on the Lira.

- Central Bank Policies: The monetary policies of the ECB and the CBRT will play a crucial role in shaping the exchange rate.

- Political Stability: Political developments in Turkey and the Eurozone could impact investor confidence and currency valuations.

- Global Economic Trends: Global economic growth, trade tensions, and geopolitical events could all influence the EUR/TRY exchange rate.

8. Central Bank Influence: How Do ECB and CBRT Policies Affect the 1 Euro TL Rate?

The European Central Bank (ECB) and the Central Bank of the Republic of Turkey (CBRT) play a significant role in influencing the EUR/TRY exchange rate through their monetary policies.

ECB Policies:

The ECB’s primary mandate is to maintain price stability in the Eurozone. To achieve this, the ECB uses various tools, including:

- Interest Rates: Adjusting key interest rates to influence borrowing costs and inflation.

- Quantitative Easing (QE): Purchasing government bonds and other assets to inject liquidity into the financial system.

- Forward Guidance: Communicating its intentions to the market to influence expectations.

CBRT Policies:

The CBRT is responsible for maintaining price stability and financial stability in Turkey. Its main tools include:

- Interest Rates: Setting interest rates to control inflation and support economic growth.

- Reserve Requirements: Setting the minimum amount of reserves that banks must hold.

- Foreign Exchange Interventions: Buying or selling foreign currency to influence the exchange rate.

Impact on the EUR/TRY Rate:

The monetary policies of the ECB and the CBRT can have a significant impact on the EUR/TRY exchange rate. For example, if the ECB raises interest rates while the CBRT keeps rates unchanged, the Euro could strengthen against the Lira.

9. Global Economic Factors: How Do International Events Affect the 1 Euro TL Rate?

Global economic events and trends can also influence the EUR/TRY exchange rate. These events can impact investor sentiment, trade flows, and overall economic conditions in the Eurozone and Turkey.

Key Global Factors:

- Trade Wars: Trade disputes between major economies can disrupt global trade and investment flows, impacting currency valuations.

- Geopolitical Tensions: Political instability and conflicts in various regions can increase risk aversion and lead to currency volatility.

- Commodity Prices: Changes in commodity prices, such as oil and gold, can affect the economies of commodity-exporting and importing countries, influencing their currencies.

- Global Economic Growth: Overall global economic growth can impact trade, investment, and currency valuations.

Examples:

- A trade war between the United States and China could negatively impact global trade, leading to a weaker Turkish Lira due to Turkey’s reliance on exports.

- Rising oil prices could benefit commodity-exporting countries, such as Norway, while negatively impacting commodity-importing countries, such as Turkey.

10. Navigating Volatility: How to Manage Risks Associated with the 1 Euro TL Rate?

The EUR/TRY exchange rate can be highly volatile, making it essential to manage the risks associated with currency fluctuations.

Risk Management Strategies:

- Hedging: Using financial instruments, such as forward contracts, options, and currency swaps, to lock in exchange rates for future transactions.

- Diversification: Spreading investments across different asset classes and currencies to reduce risk.

- Currency Accounts: Holding funds in both Euro and Turkish Lira to manage currency risk.

- Stop-Loss Orders: Setting automatic orders to sell a currency if it falls below a certain level.

Professional Advice:

It’s always a good idea to seek advice from financial professionals who specialize in currency risk management. These experts can help you develop a tailored strategy to protect your assets and minimize potential losses.

FAQ: Your Questions About 1 Euro TL Answered

1. What does 1 Euro TL mean?

1 Euro TL represents the current exchange rate between the Euro (EUR) and the Turkish Lira (TRY), indicating how many Turkish Lira you can obtain for one Euro. This rate fluctuates constantly due to various economic factors.

2. How is the 1 Euro TL exchange rate determined?

The EUR/TRY exchange rate is determined by supply and demand in the foreign exchange market, influenced by factors such as economic indicators, political stability, central bank policies, market sentiment, and global events.

3. Where can I find the current 1 Euro TL exchange rate?

You can find the current EUR/TRY exchange rate on various financial websites, including euro2.net, which provide real-time data, charts, and analysis.

4. How does the 1 Euro TL rate affect businesses?

The EUR/TRY exchange rate impacts businesses involved in trade between the Eurozone and Turkey by affecting the competitiveness of exports and imports, as well as the profitability of international transactions.

5. How does the 1 Euro TL rate affect consumers?

The EUR/TRY exchange rate affects consumers who travel between the Eurozone and Turkey or make purchases in either currency, influencing the cost of travel and online shopping.

6. What factors influence the 1 Euro TL exchange rate?

Factors influencing the EUR/TRY exchange rate include economic indicators (inflation, GDP), political stability, central bank policies (ECB, CBRT), market sentiment, and global events.

7. Can the ECB and CBRT influence the 1 Euro TL rate?

Yes, the European Central Bank (ECB) and the Central Bank of the Republic of Turkey (CBRT) can influence the EUR/TRY exchange rate through their monetary policies, such as adjusting interest rates and implementing quantitative easing.

8. How can I manage risks associated with the 1 Euro TL rate?

You can manage risks associated with the EUR/TRY exchange rate by using hedging strategies, diversifying investments, holding currency accounts, and seeking professional advice from financial experts.

9. What is the future outlook for the 1 Euro TL rate?

The future outlook for the EUR/TRY exchange rate is uncertain and depends on a complex interplay of economic, political, and global factors. Expert forecasts and monitoring key factors can provide some insights.

10. Is it a good time to invest in Turkish Lira?

Whether it’s a good time to invest in Turkish Lira depends on your individual risk tolerance, investment goals, and understanding of the economic and political factors influencing the currency. It’s essential to conduct thorough research and seek professional advice before making any investment decisions.

Conclusion: Stay Informed with Euro2.net

Understanding the “1 euro tl” exchange rate is crucial for businesses, consumers, and investors alike. By staying informed about the latest trends, factors influencing the rate, and risk management strategies, you can make informed decisions and navigate the complexities of the currency market.

Remember to visit euro2.net for the latest EUR/TRY exchange rates, comprehensive analysis, and user-friendly tools. Our platform is designed to provide you with the information you need to succeed in the global economy.

Ready to take control of your financial future? Visit euro2.net today and discover the power of informed decision-making!

Address: 33 Liberty Street, New York, NY 10045, United States

Phone: +1 (212) 720-5000

Website: euro2.net