Euro v Dollar

The debate regarding the euro versus the dollar as the dominant global currency has captivated economists and political scientists for decades. Early proponents of the euro predicted a swift rise to prominence, driven by the European Union’s economic strength and the European Central Bank’s commitment to stability. These “euro-optimists” envisioned a bipolar currency system, with the euro rivaling or even surpassing the dollar.

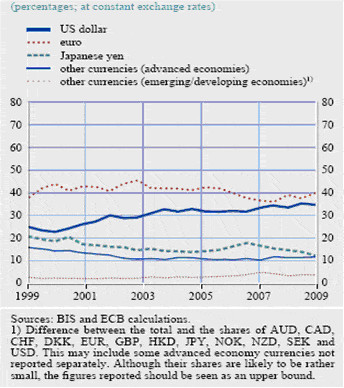

However, the reality has proven more complex. While the euro has undoubtedly become a significant international currency, it has fallen short of the initial optimistic projections. Data reveals that the dollar still commands a substantial lead in global transactions and reserve holdings.

Economists attribute this disparity to several factors. The eurozone’s fragmented financial markets, characterized by higher transaction costs and a lack of a unified debt market, hinder the euro’s ability to compete with the deep and liquid US Treasury market. Furthermore, the eurozone’s emphasis on price stability, enshrined in the Maastricht Treaty and the European Central Bank’s mandate, can limit its flexibility in responding to economic shocks.

The political landscape also plays a crucial role. The eurozone’s decentralized governance structure, with fiscal policy remaining largely a national prerogative, creates challenges in coordinating macroeconomic responses and projecting a unified voice in international monetary affairs. This lack of a centralized authority comparable to the US Treasury can undermine confidence in the euro’s long-term prospects.

Alt: A graph illustrating the dollar’s dominance in foreign exchange market turnover compared to the euro.

Despite these challenges, the euro has achieved notable successes. It has provided a shield against exchange rate volatility within the eurozone and enhanced its members’ autonomy in monetary policy. The euro’s growing international role is evident in its increased share in debt issuance, international trade invoicing, and foreign exchange reserves.

The emergence of the euro has undeniably transformed the international monetary system. While a complete transition to a euro-dominated system appears unlikely, the current landscape suggests a move toward a more multipolar system. The dollar’s enduring strengths, combined with the euro’s growing presence, point to a future characterized by competition and potential diversification in global currency holdings.

This evolving dynamic is further influenced by the rise of other potential contenders, such as the Chinese renminbi. The euro’s experience serves as a valuable case study in understanding the complex interplay of economic, political, and social factors that shape the international monetary order and the ongoing competition between the euro and the dollar. The future likely holds a more diversified currency landscape, with the euro playing a prominent, albeit not singular, role.