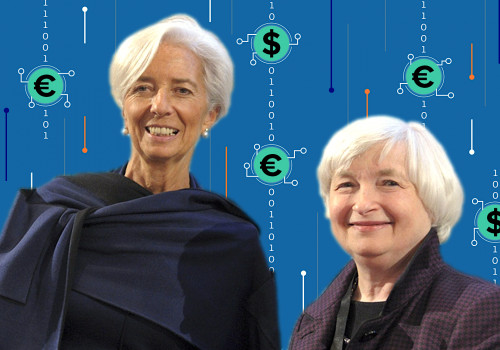

Euro a Yuan: A Comparison of Central Bank Digital Currencies

The global momentum for developing central bank digital currencies (CBDCs) brings into focus the actions of two major players: the People’s Bank of China (PBOC) with its digital yuan and the European Central Bank (ECB) with its digital euro. While both currencies share similarities, they also diverge in key aspects. The PBOC envisions the digital yuan potentially replacing physical cash entirely, while the ECB positions the digital euro as a complement to existing physical currency. Both institutions are leaning towards a two-tiered system, not reliant on distributed ledger technology but designed for interoperability with established digital payment platforms like Alipay and WePay in China. Both currencies would reside in digital wallets accessible via user-downloaded apps. This framework allows central banks to implement remunerative policies on CBDC holdings, a feature not possible with traditional cash. Furthermore, digital currencies could broaden access to payments, particularly for unbanked populations.

The implementation of CBDCs raises significant legal, political, and regulatory questions. These include the potential impact on bank intermediation and financial stability, anonymity concerns surrounding transactions, the future role of physical currency and its connection to negative interest rates, and the potential need for capital controls to mitigate capital flight. These issues are crucial for understanding the long-term implications of both the digital euro and the digital yuan.

Beyond CBDCs, privately developed digital currencies like Diem utilize distributed ledger technology and rely on base currencies to ensure stability against other cryptocurrencies like Bitcoin. However, the emergence of CBDCs raises questions about the long-term viability and widespread adoption of private digital currencies. The competitive landscape between state-backed and private digital currencies will be a defining factor in the future of finance.

European Central Bank headquarters at sunset

European Central Bank headquarters at sunset

The contrasting approaches of the PBOC and the ECB highlight the diverse strategies for CBDC development. The digital yuan’s potential for complete cash replacement signifies a more radical shift, whereas the digital euro’s complementary role suggests a more gradual integration into the existing financial infrastructure. The success of either approach will depend on navigating the complex interplay of technological innovation, regulatory frameworks, and user adoption. The Euro A Yuan dynamic will be crucial to observe as the global CBDC landscape evolves.