What Is The Symbol For Euro Currency And How To Use It?

Navigating the world of currency symbols, especially the Symbol For Euro Currency, can be confusing. At euro2.net, we’re here to simplify it for you, providing insights into euro exchange rates and their significance in global finance. Discover how to confidently use the euro symbol (€) and stay updated on the latest currency trends. Dive in for expert analysis, practical tools, and a user-friendly experience, ensuring you’re always informed and ready to make smart financial decisions regarding Eurozone economics.

1. What is the Symbol for Euro Currency?

The symbol for euro currency is €, representing the official currency of the Eurozone, a monetary union of 20 member states of the European Union. The euro symbol is derived from the Greek letter epsilon (Є), referencing Europe’s historical significance and the stability of the euro.

Expanding on this, the euro symbol (€) is more than just a character; it’s a representation of a major economic power. According to the European Central Bank (ECB), the euro is the second most traded currency in the world, after the U.S. dollar. Its symbol is widely recognized and used in financial transactions, price displays, and economic reports across the Eurozone and beyond. The design of the euro symbol includes two horizontal lines, signifying the stability of the euro.

The euro’s introduction on January 1, 1999, marked a significant milestone in European monetary integration. Initially, it was used as an accounting currency and for electronic payments. Euro banknotes and coins were introduced on January 1, 2002, replacing the national currencies of the participating countries.

The euro symbol is essential for anyone dealing with finances in the Eurozone, whether you’re a traveler, investor, or business owner. Understanding how to use it correctly and staying informed about the euro’s value is crucial for making informed financial decisions. Euro2.net provides updated exchange rates and insights to keep you ahead.

2. How Did The Euro Symbol (€) Come About?

The euro symbol (€) was designed to represent the euro currency and was created through an internal competition within the European Commission. The final design was inspired by the Greek letter epsilon (Є), with two parallel lines signifying stability.

The euro symbol’s creation was a deliberate process to ensure it reflected the currency’s significance and European identity. According to the European Commission, the final design was chosen from a shortlist of proposals, with the aim of creating a symbol that was easily recognizable and conveyed a sense of stability. The Greek letter epsilon was chosen to honor the cradle of European civilization, and the two parallel lines represent the euro’s strength and stability.

The euro symbol’s design process involved extensive consultations with experts in graphic design, marketing, and monetary policy. The goal was to create a symbol that would be easily recognizable to the public and could be used in a wide range of applications, from financial documents to everyday price displays.

The introduction of the euro symbol was accompanied by a comprehensive public awareness campaign to educate people about the new currency and its symbol. This campaign included the distribution of informational materials, the organization of public events, and the use of various media channels to promote the euro and its symbol.

The euro symbol has since become a ubiquitous part of the European landscape, appearing on banknotes, coins, and in countless financial and commercial contexts. Its design continues to represent the euro’s role as a stable and reliable currency.

3. What Is The Significance Of The Euro Symbol (€) In International Finance?

The euro symbol (€) signifies the second most traded currency globally, playing a crucial role in international finance by facilitating trade, investments, and economic stability within the Eurozone and beyond. Its presence indicates the Eurozone’s economic influence and its importance in global financial markets.

Expanding on this, the euro symbol’s significance in international finance is multifaceted. According to the International Monetary Fund (IMF), the euro is a major reserve currency held by central banks worldwide. Its stability and widespread use make it a preferred currency for international transactions, reducing exchange rate risks and transaction costs for businesses operating within the Eurozone.

The euro symbol also represents the Eurozone’s economic integration, which includes 20 member states with a combined population of over 340 million people. This integration has fostered greater economic cooperation and stability within the region, making the euro a key player in global finance.

The euro’s role in international finance extends beyond trade and investment. It is also used as a benchmark currency for pricing goods and services in many parts of the world. Its value against other currencies, such as the U.S. dollar, is closely monitored by financial institutions and investors worldwide. Euro2.net provides real-time exchange rates and expert analysis to help you stay informed about these critical market movements.

The euro symbol also represents the monetary policy of the European Central Bank (ECB), which is responsible for maintaining price stability within the Eurozone. The ECB’s decisions on interest rates and other monetary policy tools have a significant impact on the value of the euro and its role in international finance.

4. Where Is The Euro Currency Symbol (€) Primarily Used?

The euro currency symbol (€) is primarily used in the Eurozone countries, which include Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain and Croatia, as well as in several non-EU countries and territories. It is used for pricing, financial transactions, and official documents.

Expanding on this, the euro symbol (€) is ubiquitous within the Eurozone, appearing on price tags, receipts, bank statements, and financial reports. Its widespread use helps to create a sense of economic unity and facilitates cross-border transactions within the region. According to Eurostat, the statistical office of the European Union, the euro is used daily by over 340 million people.

The euro symbol is also used in several non-EU countries and territories, such as Vatican City, Monaco, San Marino, and Andorra. These countries have adopted the euro as their official currency due to their close economic ties with the Eurozone.

Outside of Europe, the euro symbol is recognized and used in international financial markets and trade. Many businesses and financial institutions around the world use the euro for transactions with Eurozone countries.

The euro’s global presence is further supported by its status as a major reserve currency held by central banks worldwide. This contributes to its stability and importance in international finance. Euro2.net offers updated information and analysis to help you understand the euro’s global impact.

5. How Does The Euro Symbol (€) Impact Trade Between The US And Eurozone?

The euro symbol (€) significantly impacts trade between the U.S. and the Eurozone by simplifying transactions, reducing exchange rate risks, and promoting economic stability. It facilitates clearer pricing and financial dealings, fostering stronger trade relationships.

Expanding on this, the euro symbol’s impact on trade between the U.S. and the Eurozone is substantial. According to the U.S. Trade Representative, the Eurozone is one of the largest trading partners of the United States, with billions of dollars in goods and services exchanged annually. The euro simplifies these transactions by providing a common currency, reducing the need for currency conversions and associated fees.

The euro also helps to mitigate exchange rate risks for businesses engaged in trade between the U.S. and the Eurozone. By pricing goods and services in euros, Eurozone companies can avoid fluctuations in the value of the U.S. dollar. Similarly, U.S. companies can benefit from the euro’s stability when trading with Eurozone partners.

The euro’s presence also promotes economic stability within the Eurozone, which in turn benefits trade with the U.S. A stable Eurozone economy is more likely to engage in trade and investment with the U.S., fostering stronger economic ties between the two regions. Euro2.net offers insights into these economic dynamics, helping you stay informed about the factors influencing trade between the U.S. and the Eurozone.

The euro’s impact extends beyond direct trade. It also influences investment flows, financial market integration, and macroeconomic policies in both the U.S. and the Eurozone.

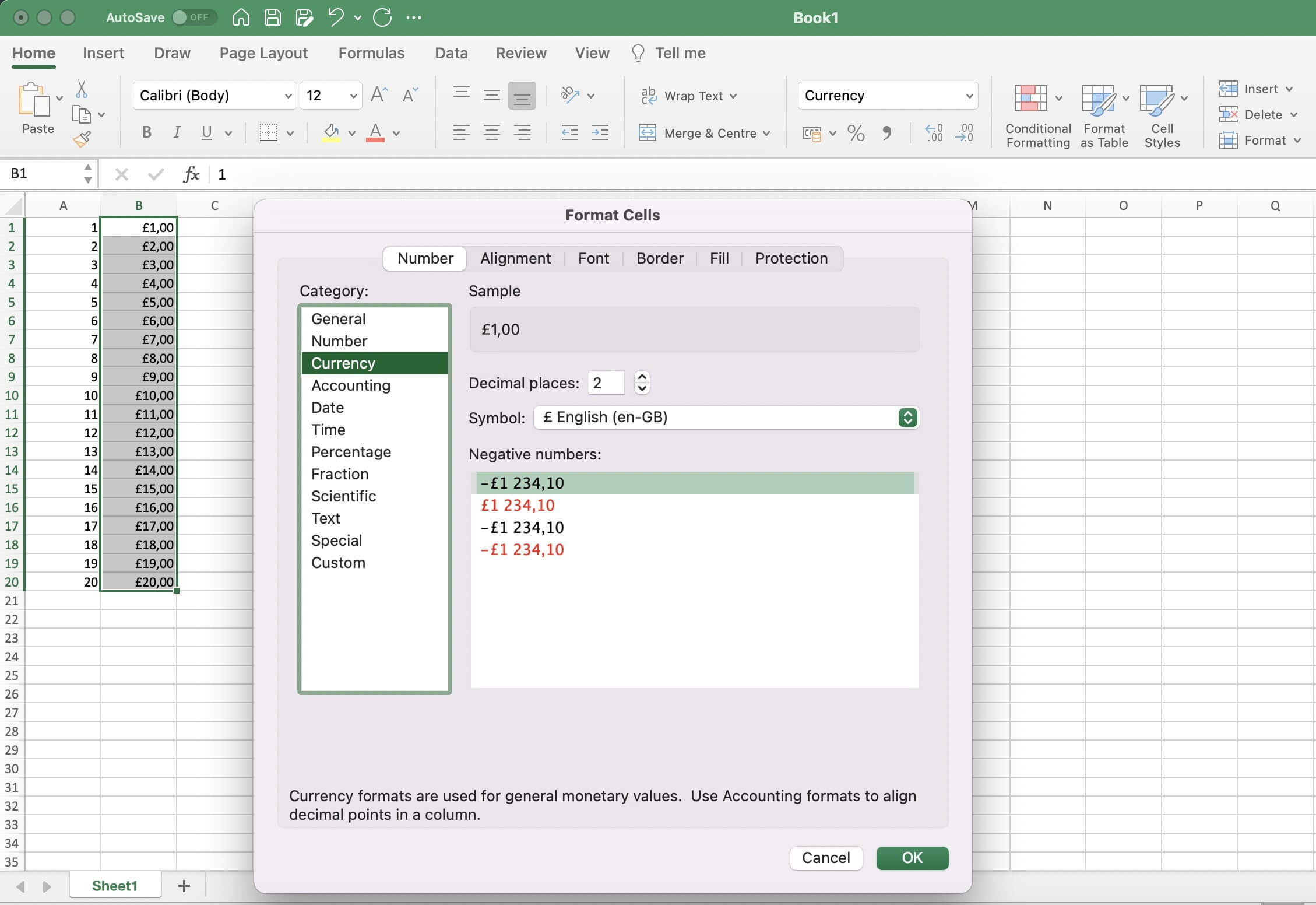

6. What Are The Keyboard Shortcuts To Type The Euro Symbol (€)?

The keyboard shortcuts to type the euro symbol (€) vary depending on the operating system: On Windows, use Alt + 0128; on Mac, use Option + 2 or Shift + Option + 2. These shortcuts provide a quick and easy way to insert the euro symbol in documents and applications.

Expanding on this, the euro symbol (€) is a common character in financial and commercial documents, making it essential to know how to type it quickly. Here’s a more detailed breakdown of the keyboard shortcuts:

- Windows: Hold down the Alt key and type 0128 on the numeric keypad. Ensure that Num Lock is enabled for this to work.

- Mac: Press Option + 2 or Shift + Option + 2. Both shortcuts will produce the euro symbol.

These shortcuts work in most applications, including word processors, spreadsheets, and email clients. However, some programs may have their own specific methods for inserting currency symbols.

In addition to keyboard shortcuts, you can also insert the euro symbol using the character map in Windows or the character viewer in Mac. These tools allow you to browse and select from a wide range of symbols and characters, including the euro symbol. Euro2.net provides helpful tips and tricks for using the euro symbol in various contexts.

Knowing these keyboard shortcuts and alternative methods can save you time and effort when working with the euro currency.

7. How Does The Value Of The Euro (€) Affect The US Economy?

The value of the euro (€) significantly affects the U.S. economy through trade balances, investment flows, and monetary policy. A weaker euro can make U.S. exports more expensive, while a stronger euro can boost U.S. exports and investment attractiveness.

Expanding on this, the value of the euro (€) has a direct and indirect impact on the U.S. economy. According to the Federal Reserve, fluctuations in the euro’s value can influence U.S. trade, inflation, and economic growth. Here’s how:

- Trade Balance: A weaker euro relative to the U.S. dollar makes U.S. goods and services more expensive for Eurozone consumers, potentially reducing U.S. exports. Conversely, a stronger euro makes U.S. exports more competitive, boosting demand and increasing U.S. exports.

- Investment Flows: The euro’s value also affects investment flows between the U.S. and the Eurozone. A stronger euro can make U.S. assets more attractive to Eurozone investors, leading to increased investment in the U.S. Conversely, a weaker euro can reduce the attractiveness of U.S. assets to Eurozone investors.

- Monetary Policy: The value of the euro can influence the Federal Reserve’s monetary policy decisions. A weaker euro can lead to increased import prices in the U.S., potentially contributing to inflation. In response, the Federal Reserve may raise interest rates to curb inflation, which can impact economic growth.

The euro’s value is influenced by a variety of factors, including economic growth, interest rates, inflation, and political stability in the Eurozone. Monitoring these factors and their potential impact on the euro is crucial for understanding the U.S. economy. Euro2.net offers expert analysis and real-time exchange rates to help you stay informed about these critical market dynamics.

The relationship between the euro and the U.S. economy is complex and multifaceted, requiring careful analysis and monitoring.

8. What Are Common Misconceptions About The Euro Symbol (€)?

Common misconceptions about the euro symbol (€) include believing it’s solely a currency symbol, confusing it with other symbols, and misunderstanding its proper usage in different countries. Correct understanding ensures accurate communication in financial contexts.

Expanding on this, the euro symbol (€) is often misunderstood in several ways. Here are some common misconceptions:

- It’s Just a Currency Symbol: Some people think the euro symbol is simply a way to represent the euro currency. However, it’s also a symbol of European economic integration and the Eurozone’s economic power.

- Confusion with Other Symbols: The euro symbol is sometimes confused with similar-looking symbols, such as the Greek letter epsilon (Є). While the euro symbol was inspired by epsilon, it is a distinct character with its own unique Unicode value.

- Incorrect Usage: In some countries, the euro symbol is placed before the amount (e.g., €50), while in others, it is placed after the amount (e.g., 50€). Using the wrong format can lead to confusion and miscommunication.

- Limited to the Eurozone: While the euro is primarily used in the Eurozone, it is also used in several non-EU countries and territories. Additionally, it is recognized and used in international financial markets worldwide.

Understanding these common misconceptions can help you use the euro symbol correctly and avoid confusion. Euro2.net provides clear and accurate information about the euro and its symbol, ensuring you stay informed and up-to-date.

Correcting these misconceptions is essential for clear and accurate communication in financial and economic contexts.

9. How Can I Stay Updated On The Euro Exchange Rate And Symbol (€)?

You can stay updated on the euro exchange rate and symbol (€) by using financial websites like euro2.net, subscribing to financial news outlets, and following economic reports from institutions such as the ECB and IMF. These resources provide real-time data, expert analysis, and comprehensive coverage of the euro’s performance.

Expanding on this, staying informed about the euro exchange rate and symbol is crucial for anyone involved in international trade, investment, or travel. Here are some effective ways to stay updated:

- Financial Websites: Websites like euro2.net provide real-time exchange rates, historical data, and interactive charts to track the euro’s performance against other currencies.

- Financial News Outlets: Subscribe to reputable financial news outlets such as Bloomberg, Reuters, and The Wall Street Journal for in-depth coverage of the euro and the Eurozone economy.

- Economic Reports: Follow economic reports from institutions such as the European Central Bank (ECB) and the International Monetary Fund (IMF) for insights into the euro’s economic outlook and monetary policy decisions.

- Mobile Apps: Use mobile apps from financial institutions and currency converters to track the euro exchange rate on the go.

By using these resources, you can stay informed about the euro’s performance and make informed financial decisions. Euro2.net offers a user-friendly platform with updated exchange rates, analysis, and tools to help you navigate the world of euro currency.

Staying proactive and informed is key to understanding the euro’s role in the global economy.

10. What Tools Does Euro2.Net Offer For Tracking The Euro Symbol (€) And Exchange Rates?

Euro2.net offers real-time euro exchange rates, historical data, currency converters, and expert analysis to help you track the euro symbol (€) and its performance against other currencies. Our user-friendly platform provides comprehensive tools for informed financial decision-making.

Expanding on this, Euro2.net is designed to be your go-to resource for all things related to the euro. Our platform offers a range of tools and features to help you track the euro symbol (€) and exchange rates effectively:

- Real-Time Exchange Rates: Get up-to-the-minute exchange rates for the euro against major currencies, including the U.S. dollar, British pound, and Japanese yen.

- Historical Data: Access historical exchange rate data to analyze trends and patterns in the euro’s performance over time.

- Currency Converter: Use our easy-to-use currency converter to quickly calculate the value of the euro in other currencies.

- Expert Analysis: Read expert analysis and commentary on the factors influencing the euro exchange rate, including economic indicators, monetary policy decisions, and geopolitical events.

- Customizable Alerts: Set up customizable alerts to receive notifications when the euro exchange rate reaches your desired levels.

Our platform is designed to be user-friendly and accessible, providing you with the information and tools you need to make informed financial decisions. Whether you’re a traveler, investor, or business owner, Euro2.net is here to help you navigate the world of euro currency with confidence.

At euro2.net, we understand the importance of staying informed and equipped with the right tools to make sound financial decisions. That’s why we provide real-time data, expert analysis, and a user-friendly experience. Visit euro2.net today to take control of your financial future.

Euro currency sign on a sign

Euro currency sign on a sign

11. How To Correctly Use The Euro Symbol (€) In Writing?

To correctly use the euro symbol (€) in writing, place it before the amount in most English-speaking countries (e.g., €50) and after the amount in many European countries (e.g., 50€). Ensure consistency and clarity in your writing.

Expanding on this, the correct usage of the euro symbol (€) in writing depends on the country and language. Here are some guidelines:

- English-Speaking Countries: In most English-speaking countries, including the United States, the euro symbol is placed before the amount (e.g., €50).

- European Countries: In many European countries, the euro symbol is placed after the amount (e.g., 50€). This is common in France, Germany, and Spain.

- Spacing: There is typically no space between the euro symbol and the amount. However, some style guides may recommend a small space.

- Consistency: Regardless of the format you choose, it is important to be consistent throughout your document.

Using the euro symbol correctly can help avoid confusion and miscommunication, especially in financial and commercial contexts. Euro2.net provides helpful tips and resources to ensure you use the euro symbol with accuracy and confidence.

Consistency and accuracy are key when using the euro symbol in writing.

12. What Economic Factors Influence The Strength Of The Euro (€)?

Economic factors influencing the strength of the euro (€) include Eurozone GDP growth, inflation rates, interest rates set by the ECB, unemployment levels, and political stability. Strong economic performance typically strengthens the euro, while economic challenges can weaken it.

Expanding on this, the strength of the euro (€) is influenced by a complex interplay of economic factors. Here are some of the key drivers:

- GDP Growth: Strong economic growth in the Eurozone typically leads to a stronger euro. Higher GDP growth indicates a healthy economy, which attracts investment and increases demand for the euro.

- Inflation Rates: Low and stable inflation rates are generally positive for the euro. High inflation can erode the euro’s value and reduce its attractiveness to investors.

- Interest Rates: The European Central Bank (ECB) sets interest rates for the Eurozone. Higher interest rates can attract foreign investment and strengthen the euro, while lower interest rates can weaken it.

- Unemployment Levels: Low unemployment levels indicate a strong labor market, which can boost economic growth and support the euro.

- Political Stability: Political stability within the Eurozone is crucial for maintaining investor confidence and supporting the euro. Political uncertainty can lead to capital flight and weaken the euro.

Monitoring these economic factors and their potential impact on the euro is essential for understanding its performance in the global currency market. Euro2.net provides expert analysis and real-time data to help you stay informed about these critical market dynamics.

Understanding these factors is crucial for predicting the euro’s performance.

13. Can The Euro Symbol (€) Be Used Interchangeably With Other Currency Symbols?

No, the euro symbol (€) cannot be used interchangeably with other currency symbols. Each currency has its unique symbol representing its value and origin. Using the correct symbol ensures clarity and accuracy in financial transactions and communications.

Expanding on this, using the correct currency symbol is essential for clear communication and accurate financial transactions. Here’s why the euro symbol (€) cannot be used interchangeably with other currency symbols:

- Uniqueness: Each currency symbol is unique to its respective currency. For example, the U.S. dollar is represented by the symbol ($), the British pound by (£), and the Japanese yen by (¥).

- Recognition: Currency symbols are widely recognized and understood in international finance. Using the wrong symbol can lead to confusion and misinterpretation.

- Legal and Financial Implications: In financial transactions and legal documents, using the correct currency symbol is crucial for ensuring accuracy and compliance.

- Cultural Significance: Currency symbols often have cultural and historical significance. Using the correct symbol shows respect for the currency’s origin and identity.

Always use the correct currency symbol to avoid confusion and ensure accuracy in financial and commercial contexts. Euro2.net provides helpful resources and information to help you navigate the world of currency symbols with confidence.

Accuracy is paramount when dealing with currency symbols.

14. How Do Political Events In The Eurozone Affect The Euro Symbol (€) Value?

Political events in the Eurozone significantly affect the euro symbol (€) value. Events such as elections, policy changes, and political instability can create uncertainty, leading to fluctuations in the euro’s value as investors react to potential economic shifts.

Expanding on this, political events in the Eurozone can have a profound impact on the value of the euro. Here’s how:

- Elections: Elections can bring uncertainty about future economic policies. If investors anticipate policies that could harm the economy, they may sell euros, driving down its value.

- Policy Changes: Major policy changes, such as fiscal reforms or changes in labor laws, can also affect the euro. Positive changes that are expected to boost economic growth can strengthen the euro, while negative changes can weaken it.

- Political Instability: Political instability, such as government crises or social unrest, can create uncertainty and lead to capital flight, which can weaken the euro.

- Geopolitical Events: Geopolitical events, such as trade disputes or international conflicts, can also impact the euro. These events can affect investor sentiment and lead to fluctuations in the euro’s value.

Monitoring political events in the Eurozone is crucial for understanding the potential impact on the euro. Euro2.net provides expert analysis and real-time data to help you stay informed about these critical market dynamics.

Political stability is a key factor in maintaining the euro’s strength.

15. What Is The Unicode Value For The Euro Symbol (€)?

The Unicode value for the euro symbol (€) is U+20AC. This value is used in digital environments to ensure the euro symbol is displayed correctly across different platforms, software, and devices.

Expanding on this, the Unicode value for the euro symbol (€) is an essential piece of information for anyone working with digital text and character encoding. Here’s why:

- Standardization: Unicode is a universal character encoding standard that assigns a unique number to every character, regardless of language or platform.

- Cross-Platform Compatibility: Using the Unicode value ensures that the euro symbol is displayed correctly on different operating systems, web browsers, and software applications.

- Web Development: In web development, the Unicode value can be used in HTML and CSS to display the euro symbol. For example, you can use the HTML entity

€or the CSS code20AC. - Database Management: In database management, the Unicode value can be used to store and retrieve the euro symbol correctly.

Knowing the Unicode value for the euro symbol is essential for ensuring consistent and accurate display in digital environments. Euro2.net provides helpful resources and information to help you navigate the world of character encoding with confidence.

Unicode ensures consistent display of the euro symbol across all digital platforms.

16. How To Insert The Euro Symbol (€) In HTML And CSS?

To insert the euro symbol (€) in HTML, use the HTML entity € or the numeric character reference €. In CSS, use the 20AC Unicode escape sequence. These methods ensure the euro symbol displays correctly on web pages.

Expanding on this, when creating web pages, it’s crucial to display the euro symbol (€) correctly to ensure a professional and accurate presentation. Here are the methods for inserting the euro symbol in HTML and CSS:

HTML:

- HTML Entity: Use the code

€to insert the euro symbol. This is the most common and widely supported method. - Numeric Character Reference: Use the code

€to insert the euro symbol. This method is also well-supported and can be used as an alternative to the HTML entity.

CSS:

- Unicode Escape Sequence: Use the code

20ACin your CSS styles to display the euro symbol. This method allows you to style the euro symbol using CSS properties such as font size, color, and positioning.

Here’s an example of how to use these methods in HTML and CSS:

<!DOCTYPE html>

<html>

<head>

<title>Euro Symbol Example</title>

<style>

.euro {

font-size: 20px;

color: green;

}

</style>

</head>

<body>

<p>Price: <span class="euro">20AC</span>100</p>

<p>Price: € 100</p>

<p>Price: € 100</p>

</body>

</html>Using these methods ensures that the euro symbol is displayed correctly on your web pages, regardless of the user’s operating system or browser. Euro2.net provides helpful resources and information to help you create professional and accurate web content.

Correctly implementing the euro symbol on web pages ensures a professional and accurate presentation.

17. What Is The History Of The Euro (€) Currency?

The history of the euro (€) currency dates back to the Maastricht Treaty in 1992, with its official launch in 1999 and the introduction of euro banknotes and coins in 2002. The euro aimed to foster economic integration and stability within the European Union.

Expanding on this, the euro’s journey from concept to reality is a story of European cooperation and integration. Here’s a brief overview of its history:

- Maastricht Treaty (1992): The Maastricht Treaty laid the foundation for the euro by setting out the criteria for countries to join the single currency.

- Official Launch (1999): The euro was officially launched on January 1, 1999, as an accounting currency and for electronic payments.

- Introduction of Banknotes and Coins (2002): Euro banknotes and coins were introduced on January 1, 2002, replacing the national currencies of the participating countries.

- Expansion of the Eurozone: Over the years, more countries have joined the Eurozone, expanding its reach and influence.

- Challenges and Crises: The euro has faced challenges and crises, such as the sovereign debt crisis in the early 2010s, which tested the resilience of the Eurozone.

Today, the euro is the second most traded currency in the world and a symbol of European economic integration. Euro2.net provides updated information and analysis to help you understand the euro’s history and its role in the global economy.

The euro’s history reflects the ongoing efforts to foster economic unity in Europe.

18. How Does The European Central Bank (ECB) Influence The Euro Symbol (€) Value?

The European Central Bank (ECB) influences the euro symbol (€) value through its monetary policy decisions, including setting interest rates, managing inflation, and implementing quantitative easing. These actions impact the euro’s attractiveness to investors and its overall strength in the global market.

Expanding on this, the European Central Bank (ECB) plays a crucial role in influencing the value of the euro. Here’s how:

- Interest Rates: The ECB sets interest rates for the Eurozone. Higher interest rates can attract foreign investment and strengthen the euro, while lower interest rates can weaken it.

- Inflation Management: The ECB’s primary goal is to maintain price stability in the Eurozone. By managing inflation, the ECB helps to maintain the euro’s value and purchasing power.

- Quantitative Easing (QE): The ECB can implement quantitative easing programs, which involve buying government bonds and other assets to inject liquidity into the Eurozone economy. QE can lower interest rates and weaken the euro.

- Forward Guidance: The ECB provides forward guidance on its future monetary policy intentions. This can influence investor expectations and impact the euro’s value.

The ECB’s decisions are closely watched by financial markets and can have a significant impact on the euro. Euro2.net provides expert analysis and real-time data to help you stay informed about the ECB’s actions and their potential impact on the euro.

The ECB’s monetary policy decisions are key drivers of the euro’s value.

19. How Does Global Economic Growth Impact The Euro Symbol (€) Value?

Global economic growth significantly impacts the euro symbol (€) value. Strong global growth typically supports the euro as increased trade and investment flows boost demand for the currency, while slower growth or economic downturns can weaken it.

Expanding on this, the euro’s value is closely tied to the health of the global economy. Here’s how global economic growth affects the euro:

- Increased Trade: Strong global economic growth leads to increased international trade. As the Eurozone is a major trading partner, increased trade flows boost demand for the euro.

- Investment Flows: Global economic growth can attract investment to the Eurozone, increasing demand for the euro and strengthening its value.

- Investor Sentiment: Positive global economic growth typically improves investor sentiment, leading to increased confidence in the euro.

- Commodity Prices: Global economic growth can impact commodity prices, which can in turn affect the euro. For example, higher oil prices can negatively impact the Eurozone economy and weaken the euro.

Monitoring global economic growth trends is crucial for understanding the potential impact on the euro. Euro2.net provides expert analysis and real-time data to help you stay informed about these critical market dynamics.

Global economic growth acts as a significant driver for the euro’s performance.

20. What Are The Benefits Of Using The Euro (€) For Businesses?

The benefits of using the euro (€) for businesses include reduced transaction costs, eliminated exchange rate risks within the Eurozone, simplified cross-border trade, and increased price transparency, fostering greater economic efficiency and competitiveness.

Expanding on this, the euro offers numerous advantages for businesses operating within the Eurozone:

- Reduced Transaction Costs: By using a single currency, businesses can avoid the costs associated with currency conversions.

- Eliminated Exchange Rate Risks: The euro eliminates exchange rate risks within the Eurozone, providing businesses with greater certainty and stability.

- Simplified Cross-Border Trade: The euro simplifies cross-border trade by removing the need for currency conversions and reducing administrative burdens.

- Increased Price Transparency: The euro promotes price transparency, making it easier for businesses to compare prices and compete effectively.

- Access to a Large Market: The Eurozone is a large and integrated market, providing businesses with access to millions of customers.

The euro has helped to foster greater economic integration and competitiveness within the Eurozone, benefiting businesses of all sizes. Euro2.net provides helpful resources and information to help businesses navigate the world of euro currency with confidence.

The euro provides significant advantages for businesses operating within the Eurozone.

21. What Challenges Does The Euro (€) Face As A Global Currency?

The challenges the euro (€) faces as a global currency include the lack of fiscal integration among Eurozone members, sovereign debt crises, political instability, and the influence of other major currencies like the US dollar. Addressing these issues is crucial for the euro to maintain its strength and stability.

Expanding on this, despite its success, the euro faces several challenges as a global currency:

- Lack of Fiscal Integration: The Eurozone lacks full fiscal integration, meaning that member states have independent fiscal policies. This can lead to imbalances and instability within the Eurozone.

- Sovereign Debt Crises: Sovereign debt crises, such as the Greek debt crisis in the early 2010s, can threaten the stability of the euro and the Eurozone economy.

- Political Instability: Political instability in member states can undermine investor confidence and weaken the euro.

- Competition from Other Currencies: The euro faces competition from other major currencies, such as the U.S. dollar, which remains the world’s dominant reserve currency.

Addressing these challenges is crucial for the euro to maintain its strength and stability as a global currency. Euro2.net provides expert analysis and real-time data to help you stay informed about these critical market dynamics.

Overcoming these challenges is essential for the euro’s long-term success.

22. How Do Currency Converters Use The Euro Symbol (€)?

Currency converters use the euro symbol (€) to clearly indicate the currency being converted, ensuring accuracy in financial calculations. The symbol is displayed alongside the converted amount, providing users with a visual reference for the currency they are working with.

Expanding on this, currency converters are essential tools for anyone dealing with multiple currencies. Here’s how they use the euro symbol (€):

- Clear Indication: The euro symbol is used to clearly indicate that the currency being converted is the euro.

- Accuracy: Currency converters use the latest exchange rates to ensure accurate conversions.

- User-Friendly Interface: Currency converters typically have a user-friendly interface that makes it easy to enter the amount to be converted and select the desired currencies.

- Visual Reference: The euro symbol is displayed alongside the converted amount, providing users with a visual reference for the currency they are working with.

Euro2.net offers a user-friendly currency converter that uses the latest exchange rates to provide accurate conversions. Our converter also displays the euro symbol (€) clearly, ensuring that you know exactly what currency you are working with.

Currency converters ensure accuracy and clarity in financial calculations involving the euro.

23. How Has Brexit Impacted The Value Of The Euro Symbol (€)?

Brexit has impacted the value of the euro symbol (€) by creating economic uncertainty in both the Eurozone and the United Kingdom. The euro’s value has fluctuated in response to Brexit-related news and events, reflecting investor sentiment and concerns about future trade relationships.

Expanding on this, Brexit has had a complex and multifaceted impact on the value of the euro. Here’s how:

- Economic Uncertainty: Brexit created economic uncertainty in both the Eurozone and the United Kingdom. This uncertainty led to fluctuations in the euro’s value as investors reacted to Brexit-related news and events.

- Trade Relationships: Brexit has altered trade relationships between the Eurozone and the United Kingdom. Changes in trade flows can impact the demand for the euro and its value.

- Investor Sentiment: Brexit has influenced investor sentiment towards the euro. Concerns about the potential economic impact of Brexit have led some investors to reduce their exposure to the euro.

- Monetary Policy: Brexit has influenced the monetary policy decisions of the European Central Bank (ECB). The ECB has taken steps to mitigate the economic impact of Brexit, which has affected the euro’s value.

The long-term impact of Brexit on the euro remains to be seen. However, it is clear that Brexit has added to the challenges facing the euro as a global currency. Euro2.net provides expert analysis and real-time data to help you stay informed about these critical market dynamics.

Brexit has introduced additional complexities to the euro’s global standing.

24. How Can Businesses In The US Benefit From Using The Euro (€)?

Businesses in the US can benefit from using the euro (€) by reducing transaction costs when trading with Eurozone countries, hedging against currency fluctuations, and accessing a large and stable market, ultimately enhancing their international competitiveness.

Expanding on this, using the euro can offer several advantages for U.S. businesses engaged in international trade:

- Reduced Transaction Costs: By invoicing and accepting payments in euros, U.S. businesses can avoid the costs associated with currency conversions.

- Hedging Against Currency Fluctuations: U.S. businesses can use the euro to hedge against fluctuations in the value of the U.S. dollar, providing greater certainty and stability.

- Access to a Large Market: The Eurozone is a large and stable market, providing U.S. businesses with access to millions of customers.

- Simplified Pricing: Pricing goods and services in euros can simplify the process for Eurozone customers and make U.S. businesses more competitive.

Using the euro can help U.S. businesses to reduce costs, manage risks, and expand their reach in the global market. euro2.net provides helpful resources and information to help U.S. businesses navigate the world of euro currency with confidence.

Adopting the euro can strategically benefit US businesses involved in Eurozone trade.

25. What Are The Disadvantages Of Using The Euro (€) For US Consumers?

The disadvantages of using the euro (€) for US consumers include potential currency conversion fees when traveling to the Eurozone, exchange rate fluctuations affecting the cost of goods and services, and the complexity of understanding different pricing structures.

Expanding on this, while the euro offers numerous advantages for businesses, it can also present some challenges for U.S. consumers:

- Currency Conversion Fees: U.S. consumers may incur currency conversion fees when traveling to the Eurozone or purchasing goods and services from Eurozone businesses.

- **Exchange Rate Flu