What Is PHP Euro And How Does It Impact Exchange Rates?

Php Euro represents the Philippine Peso to Euro exchange rate, a crucial metric for investors, businesses, and travelers. Stay updated on the latest PHP Euro exchange rates, in-depth analysis, and practical tools at euro2.net to empower your financial decisions. Our platform provides real-time currency conversion, historical data, and expert insights. Whether you’re tracking foreign exchange, currency fluctuations, or monetary policies, we’ve got you covered.

1. Understanding the Basics: What is PHP Euro?

PHP Euro refers to the exchange rate between the Philippine Peso (PHP) and the Euro (EUR). In simpler terms, it indicates how many Philippine Pesos you need to purchase one Euro. This exchange rate is influenced by various economic factors and is closely watched by individuals and businesses involved in international trade, investments, and travel.

1.1. Why is the PHP Euro Exchange Rate Important?

The PHP Euro exchange rate matters for several reasons:

- International Trade: Businesses importing goods from Eurozone countries (like Germany, France, or Italy) into the Philippines need to convert PHP to EUR to pay their suppliers. A weaker PHP means they need to spend more pesos to buy the same amount of Euros, increasing their import costs.

- Investments: Investors looking to invest in Euro-denominated assets, such as European stocks or bonds, need to consider the PHP Euro exchange rate when converting their pesos.

- Tourism: Filipinos traveling to Europe and Europeans visiting the Philippines need to exchange currencies. The PHP Euro rate affects the cost of their travel. A favorable exchange rate means more spending power in the destination country.

- Remittances: Overseas Filipino Workers (OFWs) in Europe sending money back home need to consider the exchange rate as it directly impacts the amount of pesos their families receive.

1.2. How is the PHP Euro Exchange Rate Determined?

The PHP Euro exchange rate, like most currency exchange rates, is primarily determined by the forces of supply and demand in the foreign exchange (forex) market. Several factors influence these forces:

- Economic Performance: The economic health of the Philippines and the Eurozone plays a significant role. Strong economic growth in either region can lead to a stronger currency. For instance, higher GDP growth, lower unemployment, and rising exports in the Philippines may strengthen the PHP.

- Interest Rates: Interest rate differentials between the Philippines and the Eurozone affect the attractiveness of investments. Higher interest rates in the Philippines can attract foreign investment, increasing demand for the PHP and potentially strengthening it against the Euro. The European Central Bank (ECB) and the Bangko Sentral ng Pilipinas (BSP) set these rates.

- Inflation: Inflation rates in both regions impact the purchasing power of their currencies. Higher inflation in the Philippines compared to the Eurozone can weaken the PHP as its purchasing power decreases relative to the Euro.

- Political Stability: Political stability and investor confidence are crucial. Political uncertainty or instability in either the Philippines or the Eurozone can lead to capital flight and currency depreciation.

- Market Sentiment: Speculative trading and market sentiment can also influence the exchange rate. News, rumors, and expectations about future economic conditions can drive short-term fluctuations in the PHP Euro rate.

2. Key Economic Indicators Influencing the PHP Euro Rate

Several key economic indicators can significantly influence the PHP Euro exchange rate. Monitoring these indicators can provide insights into potential currency movements.

2.1. Gross Domestic Product (GDP)

GDP measures the total value of goods and services produced in a country. A higher GDP growth rate typically indicates a stronger economy, which can lead to a stronger currency. For the Philippines, keep an eye on the quarterly and annual GDP growth figures released by the Philippine Statistics Authority (PSA). For the Eurozone, monitor the GDP growth data released by Eurostat.

2.2. Inflation Rate

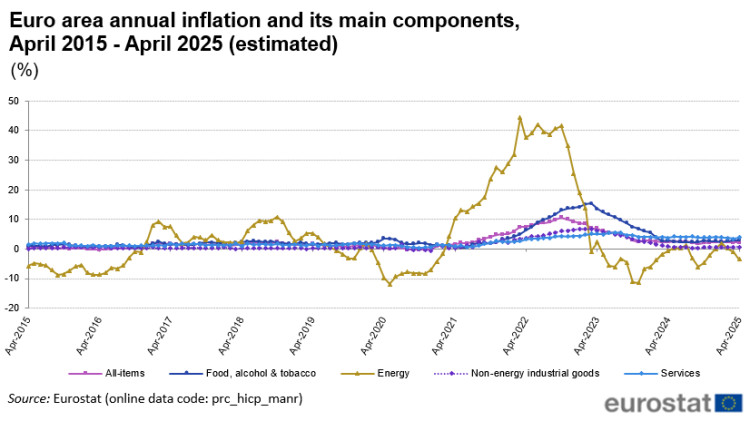

The inflation rate measures the rate at which the general level of prices for goods and services is rising. Central banks closely monitor inflation to maintain price stability. Higher inflation can erode a currency’s value. In the Philippines, the Philippine Statistics Authority releases the Consumer Price Index (CPI), which is used to calculate the inflation rate. In the Eurozone, Eurostat publishes the Harmonised Index of Consumer Prices (HICP), the key measure of inflation. According to research from the European Central Bank (ECB), the target inflation rate is close to but below 2%.

2.3. Interest Rates

Central banks use interest rates to manage inflation and stimulate economic growth. Higher interest rates can attract foreign capital, increasing demand for a currency. The Bangko Sentral ng Pilipinas (BSP) sets the Philippines’ benchmark interest rate, while the European Central Bank (ECB) sets the Eurozone’s interest rates.

2.4. Employment Data

Employment figures provide insights into the health of the labor market. Lower unemployment rates typically indicate a stronger economy. In the Philippines, the Philippine Statistics Authority releases employment data. In the Eurozone, Eurostat publishes unemployment statistics.

2.5. Trade Balance

The trade balance measures the difference between a country’s exports and imports. A trade surplus (exports exceeding imports) can lead to increased demand for a country’s currency, while a trade deficit (imports exceeding exports) can weaken it. Monitor the Philippines’ trade balance data released by the Philippine Statistics Authority and the Eurozone’s trade balance figures published by Eurostat.

2.6. Government Debt

High levels of government debt can raise concerns about a country’s ability to repay its obligations, potentially leading to currency depreciation. Monitor the Philippines’ government debt levels reported by the Bureau of the Treasury and the Eurozone’s debt levels reported by Eurostat.

3. How Central Banks Impact the PHP Euro Exchange Rate

Central banks play a crucial role in influencing exchange rates through monetary policy.

3.1. Bangko Sentral ng Pilipinas (BSP)

The BSP is the central bank of the Philippines and is responsible for maintaining price stability and managing the country’s currency. The BSP can intervene in the foreign exchange market to influence the PHP Euro exchange rate. For example, if the BSP believes the PHP is overvalued, it may sell pesos and buy Euros, increasing the supply of pesos and potentially weakening the currency. The BSP also uses interest rate adjustments to manage inflation and influence the attractiveness of the PHP to foreign investors.

3.2. European Central Bank (ECB)

The ECB is the central bank of the Eurozone and is responsible for maintaining price stability in the region. The ECB sets interest rates and implements monetary policy to achieve its inflation target. Changes in ECB policy can significantly impact the Euro and, consequently, the PHP Euro exchange rate. For instance, if the ECB raises interest rates, it can make the Euro more attractive to investors, potentially strengthening it against the PHP.

4. Historical Analysis of PHP Euro Exchange Rate

Analyzing the historical trends of the PHP Euro exchange rate can provide valuable insights for forecasting future movements.

4.1. Long-Term Trends

Over the past decade, the PHP Euro exchange rate has experienced fluctuations influenced by global economic events, monetary policy changes, and shifts in market sentiment. Examining long-term charts can reveal overall trends and patterns. You can find historical data on financial websites like Bloomberg, Reuters, and euro2.net.

4.2. Recent Fluctuations

In recent years, the PHP Euro exchange rate has been affected by factors such as the COVID-19 pandemic, changes in global trade policies, and monetary policy decisions by the BSP and ECB. Monitoring these recent fluctuations can help you understand the current dynamics of the exchange rate.

4.3. Impact of Global Events

Global events such as economic crises, political instability, and major policy changes can have a significant impact on the PHP Euro exchange rate. For example, the Eurozone debt crisis in the early 2010s led to volatility in the Euro, affecting its exchange rate against the PHP. Stay informed about global events by following reputable news sources like the Wall Street Journal.

5. Factors Affecting PHP Euro Exchange Rate in the US Market

While the PHP and Euro are not the primary currencies in the US, the exchange rate still matters for several reasons.

5.1. US-Eurozone Trade Relations

The trade relationship between the US and the Eurozone can indirectly influence the PHP Euro exchange rate. If the US economy is strong and imports a significant amount of goods from the Eurozone, it can strengthen the Euro. The US also has a significant Filipino population, and remittances from the US to the Philippines can affect the PHP.

5.2. US Monetary Policy

The US Federal Reserve’s monetary policy decisions can also impact the PHP Euro exchange rate. If the Federal Reserve raises interest rates, it can strengthen the US dollar, which may indirectly affect the Euro and its exchange rate against the PHP.

5.3. Investor Sentiment in the US

Investor sentiment in the US can also play a role. If US investors are optimistic about the Eurozone economy, they may invest in Euro-denominated assets, increasing demand for the Euro and potentially strengthening it against the PHP.

6. Tools and Resources for Tracking PHP Euro

Several tools and resources are available to help you track the PHP Euro exchange rate and stay informed about factors that may affect it.

6.1. Online Currency Converters

Online currency converters, such as the one available on euro2.net, allow you to quickly convert PHP to EUR and vice versa. These converters typically use real-time exchange rate data.

6.2. Financial News Websites

Financial news websites like Bloomberg, Reuters, and the Wall Street Journal provide up-to-date information on exchange rates, economic news, and market analysis.

6.3. Central Bank Websites

The websites of the Bangko Sentral ng Pilipinas (BSP) and the European Central Bank (ECB) offer information on monetary policy decisions, economic data, and press releases that can affect the PHP Euro exchange rate.

6.4. Forex Trading Platforms

Forex trading platforms provide real-time exchange rate data, charting tools, and analysis features. However, be aware of the risks involved in forex trading.

7. Strategies for Managing PHP Euro Exchange Rate Risk

Businesses and individuals can use various strategies to manage the risk associated with fluctuations in the PHP Euro exchange rate.

7.1. Hedging

Hedging involves using financial instruments to reduce or eliminate exchange rate risk. Common hedging strategies include forward contracts, options, and currency swaps.

7.2. Natural Hedging

Natural hedging involves matching revenues and expenses in the same currency. For example, a company that exports goods to the Eurozone and imports goods from the Eurozone can use its Euro revenues to pay for its Euro expenses, reducing its exposure to exchange rate risk.

7.3. Diversification

Diversifying investments across different currencies and asset classes can help reduce overall risk.

7.4. Currency Accounts

Holding currency accounts in both PHP and EUR can allow you to take advantage of favorable exchange rates when converting currencies.

8. Expert Opinions and Forecasts on PHP Euro

Following expert opinions and forecasts can provide insights into potential future movements of the PHP Euro exchange rate.

8.1. Economists’ Views

Economists from banks, research institutions, and consulting firms regularly publish forecasts on exchange rates. These forecasts are based on economic analysis and modeling.

8.2. Analyst Reports

Financial analysts provide reports on currencies and economies, offering insights into factors that may affect exchange rates.

8.3. Central Bank Communications

Central bank communications, such as press conferences and policy statements, can provide clues about future monetary policy decisions and their potential impact on exchange rates.

9. Real-World Applications: PHP Euro in Business and Travel

Understanding the PHP Euro exchange rate is crucial for various real-world applications.

9.1. Importing and Exporting

Businesses involved in importing and exporting goods between the Philippines and the Eurozone need to manage their exchange rate risk to protect their profit margins. A weaker PHP can increase the cost of imports, while a stronger PHP can make exports more expensive for Eurozone buyers.

9.2. Investing in Eurozone Assets

Investors looking to invest in Eurozone assets, such as stocks, bonds, or real estate, need to consider the PHP Euro exchange rate when converting their pesos.

9.3. Traveling to Europe

Filipinos traveling to Europe need to exchange PHP for EUR. A favorable exchange rate means they can get more Euros for their pesos, increasing their spending power. For example, if you’re planning a trip to see the Eiffel Tower, understanding the exchange rates can help manage your travel budget effectively.

9.4. Remittances from Europe to the Philippines

Overseas Filipino Workers (OFWs) in Europe sending money back home need to consider the exchange rate as it directly impacts the amount of pesos their families receive.

10. Frequently Asked Questions (FAQs) About PHP Euro

10.1. What is the current PHP Euro exchange rate?

The current PHP Euro exchange rate can be found on euro2.net, financial news websites, and online currency converters.

10.2. What factors influence the PHP Euro exchange rate?

Factors that influence the PHP Euro exchange rate include economic performance, interest rates, inflation, political stability, and market sentiment.

10.3. How do central banks impact the PHP Euro exchange rate?

Central banks can influence the PHP Euro exchange rate through monetary policy decisions, such as interest rate adjustments and interventions in the foreign exchange market.

10.4. How can I manage PHP Euro exchange rate risk?

You can manage PHP Euro exchange rate risk through hedging, natural hedging, diversification, and currency accounts.

10.5. Where can I find reliable information on the PHP Euro exchange rate?

Reliable information on the PHP Euro exchange rate can be found on euro2.net, financial news websites, and central bank websites.

10.6. How does the PHP Euro exchange rate affect international trade?

The PHP Euro exchange rate affects the cost of imports and exports between the Philippines and the Eurozone.

10.7. How does the PHP Euro exchange rate affect tourism?

The PHP Euro exchange rate affects the cost of travel for Filipinos visiting Europe and Europeans visiting the Philippines.

10.8. What is the role of the ECB in the PHP Euro exchange rate?

The European Central Bank (ECB) sets monetary policy for the Eurozone, which can impact the value of the Euro and its exchange rate against the PHP.

10.9. How does US monetary policy affect the PHP Euro exchange rate?

US monetary policy can indirectly affect the PHP Euro exchange rate by influencing the value of the US dollar, which can impact the Euro.

10.10. What are the best tools for tracking the PHP Euro exchange rate?

The best tools for tracking the PHP Euro exchange rate include online currency converters, financial news websites, and forex trading platforms.

By understanding the factors that influence the PHP Euro exchange rate and using the available tools and resources, you can make informed decisions and manage your currency risk effectively. For the latest updates and expert analysis, visit euro2.net and stay ahead of the curve in the world of currency exchange.

11. Advanced Strategies for PHP Euro Exchange Rate Analysis

For sophisticated users who require a deeper understanding of the PHP Euro exchange rate, advanced analytical techniques can provide a more nuanced perspective.

11.1. Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends that can be used to forecast future price movements. Technical analysts use various tools, such as charting patterns, moving averages, and oscillators, to identify potential buying and selling opportunities.

- Moving Averages: Moving averages smooth out price data to identify the underlying trend. Common moving averages include the 50-day and 200-day moving averages.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It can be used to identify overbought and oversold conditions.

- Fibonacci Retracement: Fibonacci retracement levels are used to identify potential support and resistance levels based on Fibonacci ratios.

11.2. Fundamental Analysis

Fundamental analysis involves evaluating the economic, financial, and political factors that can influence a currency’s value. This includes analyzing economic indicators, central bank policies, and geopolitical events.

- Economic Indicators: Key economic indicators to monitor include GDP growth, inflation, interest rates, employment data, and the trade balance.

- Central Bank Policies: Monitoring the policy decisions of the Bangko Sentral ng Pilipinas (BSP) and the European Central Bank (ECB) is crucial for understanding the potential direction of the PHP Euro exchange rate.

- Geopolitical Events: Geopolitical events, such as political instability or trade wars, can have a significant impact on currency values.

11.3. Econometric Modeling

Econometric modeling involves using statistical techniques to estimate the relationship between economic variables and exchange rates. This can provide a more quantitative and rigorous approach to forecasting currency movements.

- Regression Analysis: Regression analysis can be used to estimate the relationship between the PHP Euro exchange rate and various economic indicators.

- Time Series Analysis: Time series analysis can be used to model the historical behavior of the PHP Euro exchange rate and forecast future movements.

11.4. Sentiment Analysis

Sentiment analysis involves analyzing news articles, social media posts, and other sources of information to gauge market sentiment towards a currency. This can provide insights into potential short-term movements in the exchange rate.

- News Sentiment: Analyzing the tone and content of news articles can provide insights into market sentiment towards the PHP and Euro.

- Social Media Sentiment: Monitoring social media posts and comments can provide a real-time gauge of market sentiment.

12. Case Studies: PHP Euro Exchange Rate Impact on Businesses

Examining real-world case studies can illustrate the practical implications of the PHP Euro exchange rate for businesses.

12.1. Import Business Case Study

A Philippine company imports wine from France, paying in Euros. When the PHP weakens against the Euro, the cost of importing wine increases, reducing the company’s profit margin. To mitigate this risk, the company can use hedging strategies, such as forward contracts, to lock in a fixed exchange rate.

12.2. Export Business Case Study

A Philippine company exports handicrafts to Germany, receiving payment in Euros. When the PHP strengthens against the Euro, the company’s products become more expensive for German buyers, potentially reducing sales. To remain competitive, the company can explore strategies such as reducing production costs or diversifying its export markets.

12.3. Tourism Business Case Study

A Philippine travel agency offers tour packages to Europe. When the PHP weakens against the Euro, the cost of the tour packages increases, potentially reducing demand. To maintain sales, the travel agency can offer promotions or negotiate better rates with European hotels and airlines.

13. The Future of PHP Euro: Trends and Predictions

Predicting the future of the PHP Euro exchange rate is challenging, but analyzing current trends and expert forecasts can provide some insights.

13.1. Economic Outlook for the Philippines

The economic outlook for the Philippines will play a significant role in the future of the PHP Euro exchange rate. Factors to watch include GDP growth, inflation, and the government’s fiscal policies. According to projections by the International Monetary Fund (IMF), the Philippine economy is expected to continue growing in the coming years.

13.2. Economic Outlook for the Eurozone

The economic outlook for the Eurozone will also be a key factor. Factors to watch include GDP growth, inflation, and the European Central Bank’s (ECB) monetary policies. The Eurozone economy is facing challenges such as high energy prices and geopolitical uncertainty, which could impact the Euro’s value.

13.3. Geopolitical Risks

Geopolitical risks, such as trade tensions and political instability, can also impact the PHP Euro exchange rate. Monitoring these risks is crucial for understanding potential future movements in the exchange rate.

13.4. Impact of Technological Innovations

Technological innovations, such as the rise of digital currencies and blockchain technology, could also have an impact on the PHP Euro exchange rate in the long term. These technologies could potentially disrupt the traditional foreign exchange market and lead to increased efficiency and transparency.

14. Practical Tips for Individuals and Businesses

Here are some practical tips for individuals and businesses dealing with the PHP Euro exchange rate:

14.1. Stay Informed

Stay informed about economic news, central bank policies, and geopolitical events that could impact the PHP Euro exchange rate. Follow reputable news sources and consult with financial professionals.

14.2. Use Currency Alerts

Set up currency alerts to be notified when the PHP Euro exchange rate reaches a certain level. This can help you take advantage of favorable exchange rates.

14.3. Plan Ahead

Plan ahead for currency conversions, especially if you are involved in international trade or travel. This can help you avoid last-minute surprises and potentially save money.

14.4. Consider Hedging

Consider using hedging strategies to manage your exchange rate risk, especially if you have significant exposure to the PHP Euro exchange rate.

14.5. Consult with Experts

Consult with financial professionals, such as currency brokers or financial advisors, to get expert advice on managing your exchange rate risk.

15. Leveraging euro2.net for PHP Euro Insights

euro2.net provides a comprehensive platform for tracking and analyzing the PHP Euro exchange rate. Here’s how you can leverage our resources:

15.1. Real-Time Exchange Rates

Access real-time PHP Euro exchange rates to stay updated on the latest market movements.

15.2. Historical Data

Explore historical PHP Euro exchange rate data to identify trends and patterns.

15.3. Currency Converter

Use our currency converter to quickly convert PHP to EUR and vice versa.

15.4. Expert Analysis

Read our expert analysis and forecasts on the PHP Euro exchange rate to gain insights into potential future movements.

15.5. Customizable Alerts

Set up customizable alerts to be notified when the PHP Euro exchange rate reaches your desired level.

By utilizing euro2.net, you can stay informed, make informed decisions, and manage your currency risk effectively.

16. Conclusion: Mastering PHP Euro for Financial Success

Understanding and managing the PHP Euro exchange rate is crucial for individuals and businesses involved in international trade, investments, and travel. By staying informed, using the available tools and resources, and implementing effective risk management strategies, you can navigate the complexities of the foreign exchange market and achieve your financial goals. Visit euro2.net today for the latest updates, expert analysis, and practical tools to empower your financial decisions. Whether you’re an investor in New York, a business owner in the Philippines, or a traveler planning a European vacation, euro2.net is your go-to source for all things PHP Euro.

Are you ready to take control of your financial future? Visit euro2.net now to track the PHP Euro exchange rate, read in-depth analysis, and use our powerful currency conversion tools. Don’t let currency fluctuations impact your bottom line – empower yourself with the knowledge and resources you need to succeed. Contact us today at Address: 33 Liberty Street, New York, NY 10045, United States, Phone: +1 (212) 720-5000, or visit our website at euro2.net to learn more. Let euro2.net be your trusted partner in navigating the world of currency exchange!