How Much is 99.00 EUR to USD? A Complete Guide

Is 99.00 Eur To Usd on your mind? At euro2.net, we provide a comprehensive breakdown of the Euro to US Dollar exchange rate, offering real-time conversions and expert insights to help you make informed financial decisions. Navigate the complexities of currency exchange with ease.

1. Understanding the 99.00 EUR to USD Exchange Rate

What does it mean when we talk about the exchange rate between 99.00 EUR to USD? It signifies the value of the Euro in terms of the US Dollar, indicating how many US Dollars you would receive for 99.00 Euros. This rate fluctuates constantly based on various economic factors. Keep in mind that exchange rates are dynamic, influenced by market conditions, economic indicators, and geopolitical events.

1.1. What Factors Influence the EUR to USD Exchange Rate?

Several factors can influence the EUR to USD exchange rate:

- Economic Indicators: Data releases such as GDP growth, inflation rates, and employment figures in both the Eurozone and the United States can significantly impact the exchange rate. Strong economic data in the US, for instance, often strengthens the US Dollar. According to the International Monetary Fund (IMF), economic growth forecasts play a crucial role in currency valuation.

- Interest Rates: The interest rate policies of the European Central Bank (ECB) and the Federal Reserve (the Fed) are major drivers. Higher interest rates in the US can attract foreign investment, increasing demand for the US Dollar and strengthening it against the Euro.

- Geopolitical Events: Political instability, trade tensions, and major global events can create volatility in the currency markets. For example, the Brexit referendum in 2016 had a significant impact on the Euro’s value.

- Market Sentiment: Overall market sentiment and investor confidence can also play a role. Risk-on sentiment often favors the US Dollar as a safe-haven currency during times of uncertainty.

1.2. Why Is the EUR to USD Rate Important?

The EUR to USD exchange rate is one of the most closely watched currency pairs globally due to the size and influence of the Eurozone and US economies. It affects:

- International Trade: Businesses engaged in importing and exporting goods and services between the Eurozone and the US need to monitor the exchange rate to manage costs and pricing strategies.

- Investment Decisions: Investors considering investments in either the Eurozone or the US need to factor in the exchange rate as it can impact returns.

- Tourism: Travelers exchanging Euros to US Dollars or vice versa are directly affected by the prevailing exchange rate.

- Central Bank Policies: Central banks use the exchange rate as one of the indicators to formulate monetary policies.

2. Converting 99.00 EUR to USD: A Step-by-Step Guide

How can you convert 99.00 EUR to USD accurately? Follow these steps for a smooth conversion process. Knowing how to convert EUR to USD is essential whether you’re planning a trip, making an investment, or conducting business.

2.1. Finding the Current Exchange Rate

Where can you find the most up-to-date EUR to USD exchange rate? Reliable sources include:

- Financial Websites: Websites like euro2.net provide real-time exchange rates.

- Currency Converters: Online currency converters offer quick and easy conversions.

- Financial News Outlets: Major news outlets like Bloomberg and Reuters provide exchange rate information.

- Bank and Brokerage Platforms: Banks and brokerage firms offer exchange rates for their customers.

2.2. Using a Currency Converter on euro2.net

euro2.net offers a user-friendly currency converter for quick and accurate conversions. Simply enter the amount in Euros (99.00 EUR) and select USD as the target currency to see the converted amount instantly. Our tool uses real-time data to ensure you get the most accurate conversion possible.

2.3. Manual Calculation

How can you calculate the conversion manually? Use the following formula:

Amount in USD = Amount in EUR x Exchange Rate

For example, if the exchange rate is 1 EUR = 1.08 USD:

Amount in USD = 99.00 EUR x 1.08 = 106.92 USD

So, 99.00 EUR is equivalent to 106.92 USD at this exchange rate.

2.4. Factors Affecting the Final Amount

What additional costs should you be aware of? Keep in mind that the final amount you receive may vary due to:

- Fees and Commissions: Banks and exchange services often charge fees or commissions for currency conversion.

- Exchange Rate Markups: The exchange rate offered by a bank or exchange service may include a markup over the mid-market rate.

- Transaction Costs: Additional transaction costs may apply, especially for international transfers.

3. Historical Analysis of EUR to USD Exchange Rates

How has the EUR to USD exchange rate performed over time? Analyzing historical data can provide valuable insights. Examining past trends can help you understand potential future movements.

3.1. Past Trends and Fluctuations

What historical trends have shaped the EUR to USD exchange rate? Since the Euro’s introduction in 1999, the EUR to USD exchange rate has experienced significant fluctuations:

- Early Years (1999-2002): The Euro initially weakened against the US Dollar, reaching a low of around 0.83 USD in 2000.

- Mid-2000s (2003-2008): The Euro strengthened significantly, peaking at around 1.60 USD in 2008.

- Global Financial Crisis (2008-2009): The crisis led to increased volatility, with the Euro weakening as investors sought the safety of the US Dollar.

- European Debt Crisis (2010-2012): The Eurozone debt crisis put downward pressure on the Euro, as concerns about the stability of the Eurozone increased.

- Recent Years (2013-Present): The EUR to USD rate has remained relatively stable, fluctuating between 1.05 and 1.25 USD, influenced by monetary policies and economic conditions.

3.2. Key Events That Influenced the Exchange Rate

Which specific events have had a major impact on the EUR to USD exchange rate? Consider these examples:

- ECB’s Quantitative Easing (QE): The ECB’s QE program, launched in 2015, aimed to stimulate the Eurozone economy but put downward pressure on the Euro.

- US Federal Reserve Rate Hikes: The US Federal Reserve’s decisions to raise interest rates have generally strengthened the US Dollar.

- Political Uncertainty: Events like Brexit and political developments in Italy and Greece have caused volatility in the EUR to USD rate.

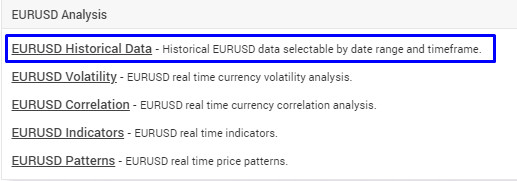

3.3. Where to Find Historical EUR to USD Data

If you’re looking for historical forex exchange rates, you can find it in our market section, by clicking the desired symbol and scrolling down to the historical data link.

EURUSD Forex History Data

EURUSD Forex History Data

3.4. Using Historical Data for Forecasting

How can historical data help you predict future exchange rate movements? Analyzing past trends can provide insights, but it’s important to remember that:

- Past Performance Is Not Indicative of Future Results: While historical data can be informative, it’s not a guarantee of future performance.

- Technical Analysis: Traders use technical analysis tools to identify patterns and trends in historical data.

- Fundamental Analysis: Analyzing economic indicators and geopolitical events is crucial for making informed forecasts.

4. Factors Affecting Currency Exchange Rates

What broader factors influence currency exchange rates beyond specific events? A range of economic and political elements are in play. Understanding these factors can help you make more informed decisions.

4.1. Economic Indicators

Which economic indicators should you monitor? Key indicators include:

- GDP Growth: Higher GDP growth in a country tends to strengthen its currency.

- Inflation Rates: Lower inflation rates generally lead to a stronger currency.

- Employment Figures: Strong employment figures can boost investor confidence and strengthen a currency.

- Trade Balance: A trade surplus (exports exceeding imports) can positively impact a currency’s value.

4.2. Political Stability

How does political stability affect currency exchange rates? Political stability is crucial:

- Uncertainty: Political instability can create uncertainty and lead to capital flight, weakening a currency.

- Government Policies: Government policies on fiscal and monetary matters can influence exchange rates.

- Geopolitical Risks: Events like wars and international tensions can impact currency valuations.

4.3. Interest Rates

Why are interest rates so important? They influence investment flows:

- Higher Rates: Higher interest rates can attract foreign investment, increasing demand for a currency.

- Central Bank Policies: Central bank decisions on interest rates can have a significant impact on exchange rates.

4.4. Market Sentiment

What role does market sentiment play? It can drive short-term fluctuations:

- Risk-On/Risk-Off: Market sentiment can shift between risk-on (investors willing to take risks) and risk-off (investors seeking safety).

- Speculation: Speculative trading can cause rapid and unpredictable movements in exchange rates.

5. Tips for Getting the Best EUR to USD Exchange Rate

How can you maximize the value when converting EUR to USD? Here are some practical tips to help you get the best possible exchange rate. Smart planning can save you money.

5.1. Compare Exchange Rates

Why is comparison essential? Different providers offer different rates:

- Banks vs. Exchange Services: Compare rates from banks, credit unions, and specialized exchange services.

- Online Platforms: Online platforms often offer more competitive rates than traditional banks.

- euro2.net: Use euro2.net to find and compare the best available rates.

5.2. Avoid Airport and Hotel Exchange Services

Why should you avoid these services? They typically offer unfavorable rates:

- Convenience Comes at a Cost: Airport and hotel exchange services are convenient but usually have high fees and poor exchange rates.

- Plan Ahead: Exchange your currency before you travel to avoid these expensive options.

5.3. Use Credit Cards Wisely

How can credit cards be used effectively? Be aware of fees:

- Foreign Transaction Fees: Check if your credit card charges foreign transaction fees.

- Choose Cards with No Fees: Some credit cards offer no foreign transaction fees, making them a good option for international transactions.

- Dynamic Currency Conversion (DCC): Avoid DCC, which allows merchants to convert the transaction to your home currency at a poor exchange rate.

5.4. Consider a Forex Broker

Why might a forex broker be a good option? They offer competitive rates:

- Lower Spreads: Forex brokers often offer lower spreads (the difference between the buying and selling price) compared to banks.

- Advanced Tools: Forex brokers provide advanced trading tools and platforms.

- Regulation: Choose a regulated broker to ensure the safety of your funds.

5.5. Time Your Exchange

How can timing impact your exchange? Monitor market trends:

- Monitor Exchange Rates: Keep an eye on exchange rate movements and try to exchange when the rate is favorable.

- Set Rate Alerts: Use rate alerts to be notified when the exchange rate reaches your desired level.

- Avoid Peak Times: Exchange rates can fluctuate throughout the day, so avoid exchanging during peak times when spreads may be wider.

6. Common Mistakes to Avoid When Exchanging Currency

What pitfalls should you watch out for when exchanging currency? Avoiding these common mistakes can save you money and hassle. Knowledge is your best defense.

6.1. Ignoring Fees and Commissions

Why is it important to pay attention to fees? They can significantly reduce your final amount:

- Hidden Costs: Be aware of hidden fees and commissions that can eat into your exchange amount.

- Ask for a Breakdown: Always ask for a detailed breakdown of all fees and charges before proceeding with the transaction.

6.2. Using Unreliable Exchange Services

How can you ensure you’re using a reliable service? Do your research:

- Check Reviews: Read reviews and check the reputation of the exchange service.

- Regulation: Use regulated exchange services to ensure the safety of your funds.

- Avoid Unlicensed Services: Avoid using unlicensed or unregulated exchange services, as they may be scams.

6.3. Not Planning Ahead

Why is planning essential? Last-minute exchanges are often costly:

- Avoid Last-Minute Exchanges: Plan ahead and exchange your currency before you travel to avoid expensive airport and hotel exchange services.

- Monitor Rates: Monitor exchange rates in advance and exchange when the rate is favorable.

6.4. Falling for Scams

How can you protect yourself from scams? Be cautious and informed:

- Be Wary of Unsolicited Offers: Be wary of unsolicited offers or deals that seem too good to be true.

- Verify the Source: Always verify the legitimacy of the exchange service before providing any personal or financial information.

- Report Suspicious Activity: Report any suspicious activity to the authorities.

7. The Impact of Brexit on EUR to USD

How has Brexit influenced the EUR to USD exchange rate? Brexit has had a notable impact on currency markets. Understanding this impact is crucial for anyone dealing with EUR and USD.

7.1. Initial Reaction

What was the immediate impact of the Brexit vote? Uncertainty prevailed:

- Volatility: The Brexit vote in June 2016 caused significant volatility in currency markets.

- Euro Weakening: The Euro initially weakened against the US Dollar as investors sought safe-haven assets.

7.2. Long-Term Effects

What are the long-term consequences of Brexit? The effects are still unfolding:

- Economic Uncertainty: Brexit has created ongoing economic uncertainty in both the UK and the Eurozone.

- Trade Relations: Changes in trade relations between the UK and the EU have impacted the Euro.

- Monetary Policy: The ECB’s monetary policy responses to Brexit have influenced the Euro’s value.

7.3. Future Outlook

What can we expect in the future? Continued uncertainty is likely:

- Ongoing Negotiations: Ongoing negotiations between the UK and the EU will continue to impact the EUR to USD exchange rate.

- Economic Performance: The economic performance of the UK, the Eurozone, and the US will play a key role in shaping future exchange rate movements.

8. How to Send Money from the US to the Eurozone

What are the best ways to transfer funds from the US to the Eurozone? Knowing your options can help you choose the most cost-effective method. Secure and efficient transfers are essential.

8.1. Bank Transfers

What are the pros and cons of bank transfers? They are a traditional option:

- Familiarity: Bank transfers are a familiar and reliable way to send money internationally.

- Fees and Exchange Rates: However, they can be expensive due to fees and less favorable exchange rates.

8.2. Online Money Transfer Services

Why are online services popular? They offer convenience and competitive rates:

- Convenience: Online money transfer services like Wise (formerly TransferWise), Remitly, and Xoom offer convenient and competitive options for sending money internationally.

- Lower Fees: These services often have lower fees and better exchange rates compared to traditional banks.

8.3. Cryptocurrency Transfers

What are the advantages and disadvantages of using cryptocurrencies? They are a newer option:

- Fast Transfers: Cryptocurrency transfers can be fast and relatively low-cost.

- Volatility: However, the volatility of cryptocurrencies can be a risk.

8.4. Factors to Consider

What factors should you consider when choosing a transfer method? Cost, speed, and security are key:

- Fees and Exchange Rates: Compare fees and exchange rates from different providers.

- Transfer Time: Consider how quickly the money needs to arrive.

- Security: Ensure the service is secure and regulated.

9. Understanding Eurozone Economic Policy

How do Eurozone economic policies affect the EUR to USD exchange rate? These policies play a crucial role. Understanding them is essential for predicting currency movements.

9.1. The Role of the European Central Bank (ECB)

What is the ECB’s mandate? Price stability is key:

- Monetary Policy: The ECB is responsible for setting monetary policy in the Eurozone.

- Interest Rates: The ECB’s interest rate decisions can have a significant impact on the Euro’s value.

- Quantitative Easing (QE): The ECB’s QE programs can also influence the Euro.

- ECB Official Website: For detailed information, refer to the European Central Bank’s official website.

9.2. Fiscal Policies

How do fiscal policies impact the Euro? Government spending and taxation matter:

- Government Spending: Government spending and taxation policies can affect economic growth and inflation, which in turn can influence the Euro.

- Debt Levels: High levels of government debt can put downward pressure on the Euro.

9.3. Economic Stability and Growth

Why is economic stability important? It supports the Euro:

- GDP Growth: Strong GDP growth in the Eurozone can strengthen the Euro.

- Inflation: Controlling inflation is crucial for maintaining the Euro’s value.

- Unemployment: Lower unemployment rates can boost investor confidence and support the Euro.

10. Real-World Scenarios: 99.00 EUR to USD in Action

How can knowing the EUR to USD exchange rate be useful in real-life situations? Here are some practical examples. These scenarios highlight the importance of understanding currency exchange.

10.1. Traveling to the United States

How does the exchange rate affect your travel budget? Planning is crucial:

- Budgeting: Knowing the EUR to USD exchange rate helps you budget your trip accurately.

- Expenses: You can estimate the cost of accommodation, food, and activities in US Dollars.

10.2. Online Shopping

How does the exchange rate impact online purchases? Consider these factors:

- Pricing: The EUR to USD exchange rate affects the final price of products purchased from US-based online stores.

- Comparison: Compare prices in Euros and US Dollars to find the best deals.

10.3. Investing in US Stocks

How does the exchange rate affect your investment returns? It’s a key consideration:

- Returns: The EUR to USD exchange rate can impact the returns on investments in US stocks.

- Currency Risk: Currency risk is an important factor to consider when investing in foreign markets.

10.4. Sending Money to Family in the US

How does the exchange rate affect the amount your family receives? It’s a crucial factor:

- Transfer Amount: The EUR to USD exchange rate determines the amount of US Dollars your family will receive.

- Timing: Monitor the exchange rate and transfer when it’s favorable.

11. Advanced Strategies for Currency Exchange

What advanced strategies can you use to optimize your currency exchange? These techniques are for more experienced users. Informed decisions can maximize your returns.

11.1. Hedging Currency Risk

How can you protect yourself from currency fluctuations? Hedging is a valuable tool:

- Forward Contracts: Use forward contracts to lock in an exchange rate for a future transaction.

- Options: Use options to protect against adverse exchange rate movements while still benefiting from favorable movements.

11.2. Using Stop-Loss Orders

How can stop-loss orders protect your investments? They limit potential losses:

- Automatic Selling: Set stop-loss orders to automatically sell your currency if the exchange rate moves against you.

11.3. Technical Analysis

How can technical analysis help you time your exchanges? It identifies trends:

- Chart Patterns: Use chart patterns and technical indicators to identify potential entry and exit points.

- Trend Lines: Use trend lines to identify the direction of the exchange rate.

11.4. Fundamental Analysis

How does fundamental analysis provide a broader view? It considers economic factors:

- Economic Indicators: Analyze economic indicators and geopolitical events to make informed decisions about when to exchange currency.

- News Events: Stay informed about news events that could impact the EUR to USD exchange rate.

12. The Future of EUR to USD Exchange Rates

What does the future hold for the EUR to USD exchange rate? Predicting the future is challenging, but here are some potential trends. Staying informed is crucial.

12.1. Potential Economic Shifts

What economic shifts could influence the exchange rate? Consider these factors:

- US Economic Growth: Strong US economic growth could strengthen the US Dollar.

- Eurozone Recovery: A robust recovery in the Eurozone could support the Euro.

- Global Trade Tensions: Trade tensions and geopolitical risks could create volatility in currency markets.

12.2. Central Bank Policies

How will central bank policies shape the future? They are a key driver:

- ECB Actions: The ECB’s monetary policy decisions will continue to influence the Euro.

- Federal Reserve Policies: The US Federal Reserve’s policies will impact the US Dollar.

12.3. Technological Advancements

How could technology impact currency exchange? New tools are emerging:

- Digital Currencies: The rise of digital currencies could disrupt traditional currency exchange markets.

- AI and Machine Learning: AI and machine learning could be used to predict exchange rate movements.

13. Navigating Currency Exchange in the Digital Age

How has the digital age transformed currency exchange? The internet has made it easier and more accessible than ever. Embrace the tools available.

13.1. Online Platforms

Why are online platforms so popular? They offer convenience and competitive rates:

- Accessibility: Online platforms make currency exchange accessible to anyone with an internet connection.

- Comparison: Online platforms allow you to easily compare exchange rates from different providers.

13.2. Mobile Apps

How do mobile apps simplify currency exchange? They offer on-the-go access:

- Convenience: Mobile apps allow you to exchange currency on the go, from anywhere in the world.

- Real-Time Rates: Mobile apps provide real-time exchange rates and alerts.

13.3. Cybersecurity Considerations

What security measures should you take when exchanging currency online? Protect your information:

- Secure Connections: Use secure connections (HTTPS) when exchanging currency online.

- Strong Passwords: Use strong, unique passwords for your online accounts.

- Two-Factor Authentication: Enable two-factor authentication for added security.

14. Tools and Resources for EUR to USD Conversion

What tools and resources can help you with EUR to USD conversion? These can simplify the process. Take advantage of available resources.

14.1. Currency Converters

Why are currency converters essential? They provide quick and accurate conversions:

- Online Converters: Use online currency converters like the one on euro2.net for quick and easy conversions.

- Mobile Apps: Use mobile apps for on-the-go conversions.

14.2. Exchange Rate Trackers

How can exchange rate trackers keep you informed? They provide real-time updates:

- Real-Time Data: Use exchange rate trackers to monitor the EUR to USD exchange rate in real-time.

- Alerts: Set up alerts to be notified when the exchange rate reaches your desired level.

14.3. Financial News Websites

Why are financial news websites important? They provide expert analysis:

- Market Analysis: Read articles and reports from financial news websites like Bloomberg and Reuters to stay informed about market trends.

- Expert Opinions: Follow expert opinions and forecasts on the EUR to USD exchange rate.

15. Tax Implications of Currency Exchange

What are the tax implications of currency exchange? Be aware of the rules and regulations. Compliance is essential.

15.1. Reporting Requirements

What transactions must be reported to the IRS? Understand your obligations:

- Large Transactions: Report large currency exchange transactions to the IRS.

- Foreign Accounts: Report foreign bank accounts and investments to the IRS.

15.2. Capital Gains Taxes

How are capital gains from currency exchange taxed? Be aware of the rules:

- Taxable Gains: Capital gains from currency exchange may be taxable.

- Record Keeping: Keep accurate records of your currency exchange transactions for tax purposes.

15.3. Consult a Tax Professional

Why is professional advice important? Tax laws can be complex:

- Expert Guidance: Consult a tax professional for guidance on the tax implications of currency exchange.

16. Common EUR to USD Conversion Questions Answered

What are some frequently asked questions about EUR to USD conversion? Here are some answers to help you navigate the process. Informed decisions are key.

16.1. What is the current EUR to USD exchange rate?

The current EUR to USD exchange rate fluctuates constantly. You can find the most up-to-date rate on euro2.net, financial websites, and currency converters.

16.2. How do I convert 99.00 EUR to USD?

To convert 99.00 EUR to USD, multiply 99.00 by the current exchange rate. For example, if the exchange rate is 1 EUR = 1.08 USD, then 99.00 EUR = 99.00 x 1.08 = 106.92 USD.

16.3. Where can I find the best EUR to USD exchange rate?

You can find the best EUR to USD exchange rate by comparing rates from different providers, including banks, credit unions, and online exchange services. euro2.net offers tools to help you compare rates.

16.4. What fees should I expect when exchanging EUR to USD?

Expect to pay fees and commissions when exchanging EUR to USD. These fees can vary depending on the provider. Always ask for a detailed breakdown of all fees before proceeding.

16.5. How can I avoid high fees when exchanging EUR to USD?

To avoid high fees, compare rates from different providers, avoid airport and hotel exchange services, use credit cards wisely, and consider a forex broker.

16.6. Is it better to exchange currency before or after traveling?

It’s generally better to exchange currency before traveling to avoid the high fees and poor exchange rates at airports and hotels.

16.7. What are the tax implications of exchanging EUR to USD?

The tax implications of exchanging EUR to USD depend on the size and nature of the transaction. Consult a tax professional for guidance on reporting requirements and capital gains taxes.

16.8. How do economic events affect the EUR to USD exchange rate?

Economic events such as GDP growth, inflation rates, and employment figures can significantly impact the EUR to USD exchange rate.

16.9. What is the role of the European Central Bank (ECB) in influencing the EUR to USD exchange rate?

The European Central Bank (ECB) sets monetary policy for the Eurozone, and its decisions on interest rates and quantitative easing can influence the Euro’s value.

16.10. How can I stay updated on the latest EUR to USD exchange rate trends?

Stay updated on the latest EUR to USD exchange rate trends by monitoring financial news websites, using exchange rate trackers, and following expert opinions.

17. Understanding Exchange Rate Jargon

What are some common terms used when discussing exchange rates? Familiarize yourself with the lingo. Knowledge is power.

17.1. Spot Rate

What is the spot rate? It’s the current exchange rate:

- Current Price: The spot rate is the current price at which a currency can be bought or sold for immediate delivery.

17.2. Bid and Ask

What do “bid” and “ask” mean? These terms are essential for understanding trading:

- Bid Price: The bid price is the price at which a buyer is willing to purchase a currency.

- Ask Price: The ask price is the price at which a seller is willing to sell a currency.

- Spread: The difference between the bid and ask prices is known as the spread.

17.3. Pip

What is a “pip”? It’s a unit of measurement:

- Point in Percentage: A pip (point in percentage) is the smallest unit of measurement in the foreign exchange market, typically 0.0001 for most currency pairs.

17.4. Volatility

What does “volatility” refer to? It measures price fluctuations:

- Price Swings: Volatility refers to the degree of price swings in a currency pair.

- Risk: Higher volatility indicates higher risk.

18. Future Trends in Currency Exchange Technology

How will technology continue to shape currency exchange? Innovations are constantly emerging. Stay ahead of the curve.

18.1. Blockchain Technology

How could blockchain revolutionize currency exchange? It offers potential benefits:

- Decentralization: Blockchain technology could decentralize currency exchange, reducing the role of intermediaries.

- Transparency: Blockchain could increase transparency and reduce fraud.

18.2. Artificial Intelligence (AI)

How can AI improve currency exchange? It offers advanced analysis:

- Predictive Analytics: AI can be used to predict exchange rate movements and optimize trading strategies.

- Automation: AI can automate currency exchange processes, reducing costs and increasing efficiency.

18.3. Mobile Payments

How are mobile payments changing currency exchange? They offer convenience and accessibility:

- Seamless Transactions: Mobile payments make it easier to exchange currency on the go.

- Global Reach: Mobile payments can facilitate cross-border transactions, making it easier to send and receive money internationally.

19. Maintaining Financial Security During Currency Exchange

What steps can you take to ensure your financial security when exchanging currency? Protect your assets. Safety first.

19.1. Secure Online Practices

What online habits can protect you from fraud? Be vigilant:

- Strong Passwords: Use strong, unique passwords for your online accounts.

- Two-Factor Authentication: Enable two-factor authentication for added security.

- Phishing Awareness: Be aware of phishing scams and avoid clicking on suspicious links.

19.2. Choosing Reputable Services

Why is reputation so important? It ensures legitimacy:

- Regulation: Choose regulated exchange services to ensure the safety of your funds.

- Reviews: Read reviews and check the reputation of the exchange service.

19.3. Monitoring Transactions

How can you detect and prevent fraud? Stay informed:

- Regularly Check Accounts: Regularly check your bank and credit card accounts for unauthorized transactions.

- Set Alerts: Set up alerts to be notified of any suspicious activity.

20. Taking Action: Convert Your EUR to USD Today

Ready to convert your EUR to USD? Take the next step with confidence. Use the resources and knowledge you’ve gained to make informed decisions.

20.1. Visit euro2.net

Why should you visit euro2.net? We offer comprehensive tools and information:

- Real-Time Rates: Get real-time EUR to USD exchange rates.

- Currency Converter: Use our easy-to-use currency converter.

- Expert Analysis: Read expert analysis and insights on the currency markets.

20.2. Compare Rates

Why is comparison essential? Find the best deal:

- Shop Around: Compare rates from different providers to find the best deal.

20.3. Make Informed Decisions

How can you ensure you’re making the right choice? Use your knowledge:

- Use Resources: Use the resources and knowledge you’ve gained to make informed decisions about when and how to exchange your currency.

By understanding the nuances of the EUR to USD exchange rate, you can confidently navigate the world of currency exchange. Visit euro2.net today to stay informed, access powerful tools, and make smart financial decisions. Whether you’re a seasoned investor, a business owner, or a traveler, euro2.net is your trusted resource for all things Euro to USD.

Address: 33 Liberty Street, New York, NY 10045, United States

Phone: +1 (212) 720-5000

Website: euro2.net