Euro vs Dollar: Analyzing the Shifting Dynamics of Global Currency Dominance

The global financial landscape is dominated by two major currencies: the US dollar and the euro. Understanding the intricate dynamics between the euro vs dollar is crucial for assessing the future of international finance and the strategic autonomy of the European Union. While the dollar has historically held the top position, the euro has emerged as a significant contender, prompting ongoing debates about the potential for a multi-polar currency system.

The inquiry into the global significance of the euro is not merely an academic exercise. For the EU, bolstering the international role of its currency is intrinsically linked to strengthening its strategic autonomy on the world stage. In a world increasingly characterized by geopolitical tensions and rapid technological advancements, the euro’s international standing becomes a key factor in the EU’s economic and political influence.

Several factors influence the internationalization of a currency. These include the size and strength of the underlying economy, the depth and liquidity of its financial markets, and the overall confidence in the currency as a store of value. While the dollar benefits from the vastness and robustness of the US economy and its financial markets, the euro area, despite being a major economic bloc, faces unique challenges that hinder its currency’s global reach.

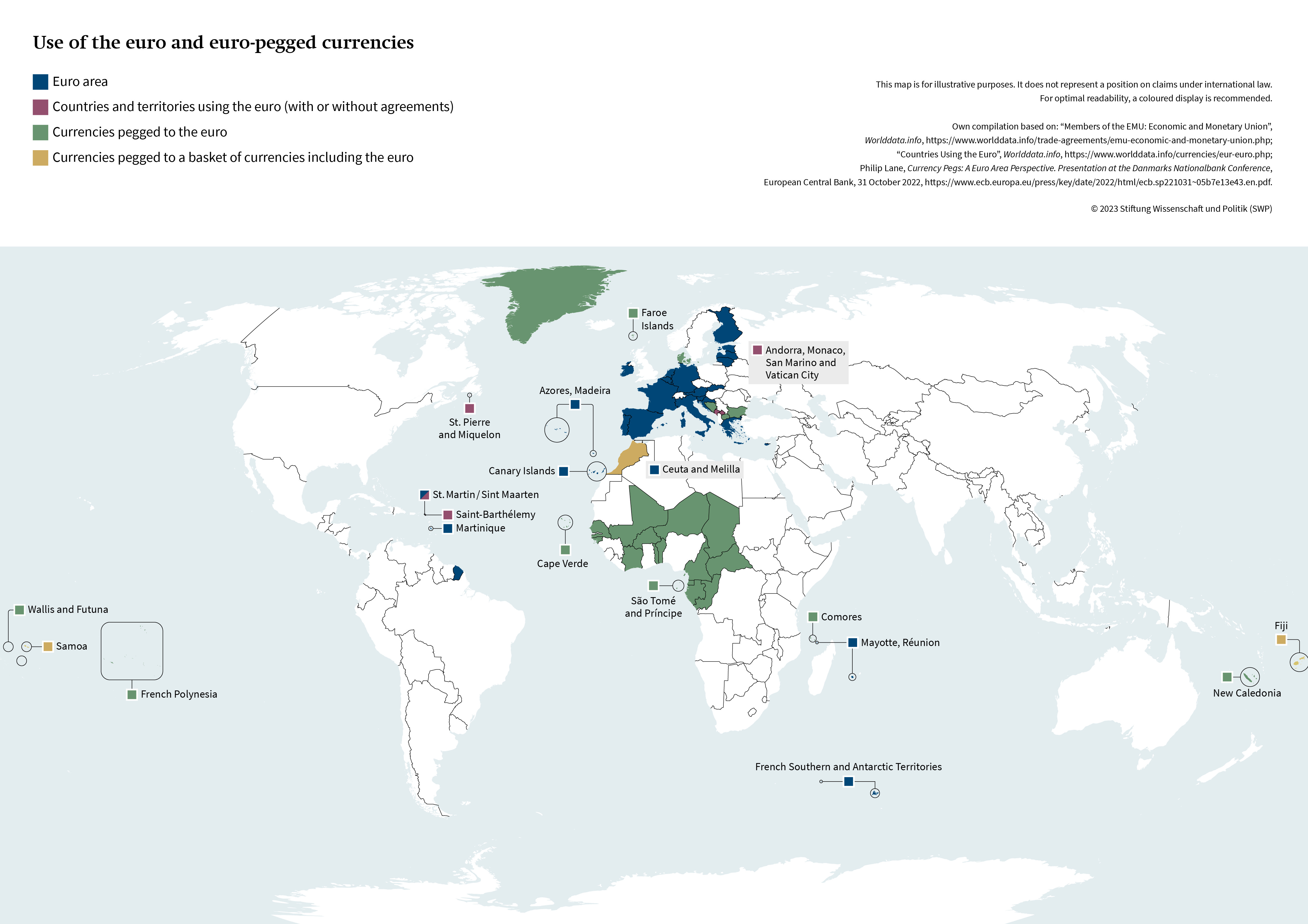

Map showing the use of Euro and Euro-pegged currencies globally, highlighting Eurozone countries and CFA Franc zone.

Map showing the use of Euro and Euro-pegged currencies globally, highlighting Eurozone countries and CFA Franc zone.

The euro’s journey to international prominence began with its inception in 1999. Initially conceived to foster price stability and deepen integration within the European single market, the euro’s potential as a global currency was quickly recognized. The early years saw a steady increase in the euro’s share of global foreign exchange reserves, challenging the long-standing dominance of the US dollar.

The euro’s status as a reserve currency is a critical indicator of its international acceptance. Central banks worldwide hold reserves in different currencies to manage exchange rate risks and meet international payment obligations. While the US dollar remains the leading reserve currency, the euro consistently holds the second position. Fluctuations in these shares reflect shifts in global economic power, confidence in different economies, and geopolitical considerations.

The international debt markets also provide a crucial battleground for the euro vs dollar dominance. The currency in which bonds are issued and held reflects investor confidence and borrowing costs. The dollar currently dominates international debt issuance, but the euro plays a significant role, particularly within Europe and increasingly in green bond markets. The fragmented nature of European debt markets, however, presents a challenge compared to the unified US market.

In the realm of trade invoicing, the euro vs dollar competition is evident in the currencies used for international transactions. While the dollar remains the preferred currency for global commodities and a significant portion of international trade, the euro is widely used within Europe and in trade with European partners. Interestingly, even within the EU, a substantial portion of imports are still invoiced in dollars, indicating the entrenched global dominance of the US currency.

The foreign exchange market, the world’s largest and most liquid market, overwhelmingly favors the dollar. The dollar is involved in nearly 90% of all foreign exchange transactions. While the euro holds the second position, its share is significantly lower, reflecting the dollar’s role as the primary vehicle currency in global trade and finance.

SWIFT, the global payment messaging system, provides another perspective on the euro vs dollar usage in international financial transactions. While the dollar leads in SWIFT payments, the euro is a strong second. Changes in SWIFT usage can reflect shifts in global trade patterns, financial flows, and even geopolitical events, such as sanctions that can impact currency usage for certain transactions.

The benefits of internationalizing a currency are manifold. For the euro area, a stronger international role could translate to lower borrowing costs, increased seigniorage revenues (profit from issuing currency), and reduced vulnerability to external financial shocks. Furthermore, it enhances the EU’s geopolitical influence and provides greater autonomy in pursuing its economic and monetary policies. However, this also entails responsibilities, including acting as a stabilizer in the global financial system and managing potential risks like currency appreciation and external constraints on monetary policy.

Despite the potential benefits, the internationalization of the euro faces significant obstacles. The heterogeneity of the euro area economies, with varying economic structures and fiscal policies, poses a challenge to the currency’s stability and attractiveness. Structural problems within some eurozone member states, including high public debt and competitiveness issues, further complicate the picture. The incomplete nature of the Eurozone’s monetary union, particularly the lack of fiscal union and a fully integrated capital market, also hinders the euro’s global ascent against the dollar.

Political diversity and the lack of a unified sovereign entity behind the euro are arguably the most significant impediments. Unlike the dollar, backed by the United States, the euro is managed by a multi-national entity, the Eurozone, comprising diverse political interests and priorities. This political complexity makes it challenging to achieve the level of coordination and unified representation necessary to truly challenge the dollar’s dominance.

To strengthen the international role of the euro in the face of dollar dominance, the EU is actively pursuing several key strategies. The Capital Markets Union (CMU) project aims to create a more integrated and deeper financial market within Europe, enhancing liquidity and attracting global investors to euro-denominated assets. Digitization, particularly the exploration of a digital euro, offers the potential to modernize payments systems, increase efficiency, and expand the euro’s reach in the digital economy. Furthermore, positioning the euro as a currency for green finance, leveraging Europe’s leadership in sustainable investing, could attract environmentally conscious investors and boost the euro’s international appeal.

Looking ahead, the euro vs dollar dynamic will continue to evolve within a changing global order. While the dollar’s dominance is unlikely to vanish soon, the trend towards a more multipolar world and the rise of regional currency blocs suggest a gradual shift. The increasing geopolitical rivalry, the rise of digital currencies, and the growing importance of platform companies in the global economy will all shape the future international monetary system. The euro’s ability to capitalize on these trends, address its internal challenges, and strategically leverage its strengths will determine its success in becoming a more prominent force alongside the dollar in the global currency landscape.