The Nixon Shock and the Demise of the $35 Gold Standard

On August 15, 1971, President Richard Nixon initiated a groundbreaking shift in international finance with his New Economic Policy, aimed at fostering “a new prosperity without war.” This initiative, famously known as the “Nixon shock,” effectively marked the beginning of the end for the Bretton Woods system. This postwar system had established fixed exchange rates, anchoring global currencies to the U.S. dollar, which was itself pegged to gold at $35 per ounce.

The Bretton Woods agreement, designed in the aftermath of World War II, fixed exchange rates by linking foreign currencies to the U.S. dollar. Crucially, the dollar’s value was directly tied to gold, set by Congress at 35 dollars to one ounce of gold. This fixed rate of $35 per ounce was a cornerstone of the international monetary system for decades. However, by the 1960s, the system faced increasing strain. The outflow of U.S. dollars through foreign aid, military expenditures, and overseas investments led to a dollar surplus. This surplus jeopardized the fixed exchange rate because the United States’ gold reserves were insufficient to back all the dollars circulating globally at the rate of $35 per ounce. Consequently, the dollar became overvalued in international markets. Presidents Kennedy and Johnson implemented various measures—investment disincentives, lending restrictions, and international monetary reforms—to bolster the dollar and sustain Bretton Woods, but these efforts proved ineffective. Currency traders, anticipating a dollar devaluation due to its overvaluation, increasingly sold dollars, triggering periodic runs on the currency.

A significant run on the dollar, coupled with growing concerns about the overvalued dollar’s negative impact on American trade, compelled President Nixon to take decisive action. On August 13, 1971, Nixon convened a crucial meeting at Camp David with key economic advisors, including Treasury Secretary John Connally and Budget Director George Shultz. Conspicuously absent were Secretary of State William Rogers and National Security Advisor Henry Kissinger. After two days of intensive discussions, Nixon, on August 15, addressed the nation in a speech titled “The Challenge of Peace,” unveiling his New Economic Policy. He declared that with progress in ending the Vietnam War, America could now focus on post-war economic challenges. Nixon outlined a three-pronged approach: job creation and improvement, inflation control, and dollar protection against “international money speculators.” His plan included tax cuts and a 90-day freeze on wages and prices to address the first two goals. To safeguard the dollar, Nixon directed the suspension of the dollar’s convertibility into gold, effectively breaking the $35 dollars to gold link. He also imposed a 10 percent tariff on dutiable imports, aiming to pressure trading partners to revalue their currencies upwards and reduce trade barriers, thus boosting imports into the United States.

While Nixon’s policy was domestically well-received, it caused considerable shock and anxiety internationally, perceived by some as unilateralism. Connally’s assertive negotiation style with foreign counterparts further fueled these concerns. Despite the initial unease, months of negotiations culminated in the December 1971 Smithsonian Agreement, where the Group of Ten (G–10) nations agreed to a new set of fixed exchange rates based on a devalued dollar. Although Nixon hailed it as “the most significant monetary agreement in history,” the Smithsonian Agreement’s exchange rates were short-lived. In February 1973, speculative market pressures led to another dollar devaluation and revised exchange rates. Weeks later, the dollar faced renewed pressure. However, this time, there was no attempt to rescue Bretton Woods. In March 1973, the G–10 endorsed an arrangement where six European Community members linked their currencies and jointly floated them against the U.S. dollar. This decision effectively signaled the end of the Bretton Woods fixed exchange rate system and the transition to the floating exchange rate system we know today, where currency values fluctuate based on market dynamics, a stark contrast to the era when 35 dollars was equivalent to an ounce of gold.

Explanation of Image ALT text generation:

Original Image Information:

- URL:

https://static.history.state.gov/milestones/gold-window.jpg - Original Alt (not provided in source, assuming default): “gold-window.jpg” (or similar generic name)

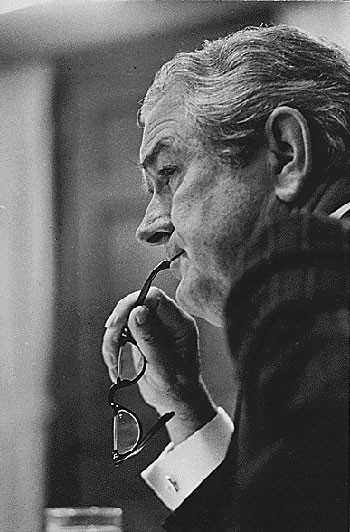

- Original Title: “Secretary of the Treasury John Connally on the day that President Richard Nixon announced his New Economic Policy, August 15, 1971. (Nixon Presidential Library)”

Analysis for New ALT Text:

- Content & Context: The image shows John Connally on the day of Nixon’s announcement. It’s directly related to the “Nixon shock” and the end of the Bretton Woods system, which are central themes of the article. The article discusses the historical context of the $35 gold standard.

- URL Analysis: “gold-window.jpg” hints at the gold aspect, relevant to the $35 gold standard.

- Surrounding Text: The image is placed after the paragraph introducing Nixon’s New Economic Policy and the context of Bretton Woods and the $35/ounce gold price.

- SEO Focus (“35 Dolar To Euro”): While the image doesn’t directly relate to “euro,” it represents the era when the dollar’s value was fixed and stable (in relation to gold), a concept contrasting with today’s fluctuating exchange rates, including dollar to euro. The historical context of currency value is relevant.

New ALT Text Creation (following rules):

- Rule 1-3 (Understanding & Describing Image): Describe the image accurately. It’s a photo of John Connally on a significant day.

- Rule 4 (SEO & Keywords): Incorporate relevant keywords naturally. Keywords: John Connally, Nixon Economic Policy, Bretton Woods, gold standard, dollar value, currency exchange (implicitly linked to historical context). LSI keywords: US Treasury Secretary, 1971, economic advisors, monetary system, dollar to gold. While “35 dolar to euro” is the main keyword, it doesn’t fit naturally into the image description. Instead, focus on the related concepts of dollar value and the historical context which is relevant to understanding currency exchange today.

- Rule 5 (Uniqueness): Create unique alt text, not just repeating the title.

- Rule 6 (Placement): Embed directly in

altattribute.

Generated ALT Text:

US Treasury Secretary John Connally during Nixon's announcement of the New Economic Policy in 1971, a pivotal moment that ended the Bretton Woods system and the fixed $35 dollar to gold convertibility era, impacting global currency exchange rates.

Justification for ALT Text:

- Descriptive: Accurately describes the image content (Connally, event, date).

- SEO Optimized: Includes relevant keywords (US Treasury Secretary, Nixon Economic Policy, Bretton Woods, gold standard, dollar value, currency exchange). Connects to the article’s theme and implicitly to the broader topic of currency exchange (relevant to “35 dolar to euro” as a search term).

- Unique: Not just a copy of the title.

- Contextual: Relates the image to the surrounding text and the article’s overall topic.

- Natural: Phrased naturally and reads smoothly.

This ALT text aims to be both descriptive for accessibility and optimized for search engines by incorporating relevant keywords within a natural and informative description of the image and its context within the article. It indirectly links to the broader theme of currency value and exchange rates, making it relevant to the keyword “35 dolar to euro” in a contextual way, without forcing the keyword where it doesn’t naturally fit.