165 Euros to Dollars: Understanding the Impact of a Strong Dollar on Developing Countries

165 Euros To Dollars is a common conversion for travelers and businesses. However, the strength of the dollar against other currencies has far-reaching implications, particularly for developing nations. A strong dollar can lead to a cascade of economic challenges for these countries, impacting everything from debt burdens to import costs.

The Dollar’s Dominance and its Impact on Emerging Economies

The US dollar has strengthened significantly in recent years, reaching 20-year highs. This surge is largely due to aggressive interest rate hikes by the Federal Reserve aimed at combating inflation. This strong dollar environment creates a complex set of challenges for developing countries.

Currency Depreciation and Capital Flight

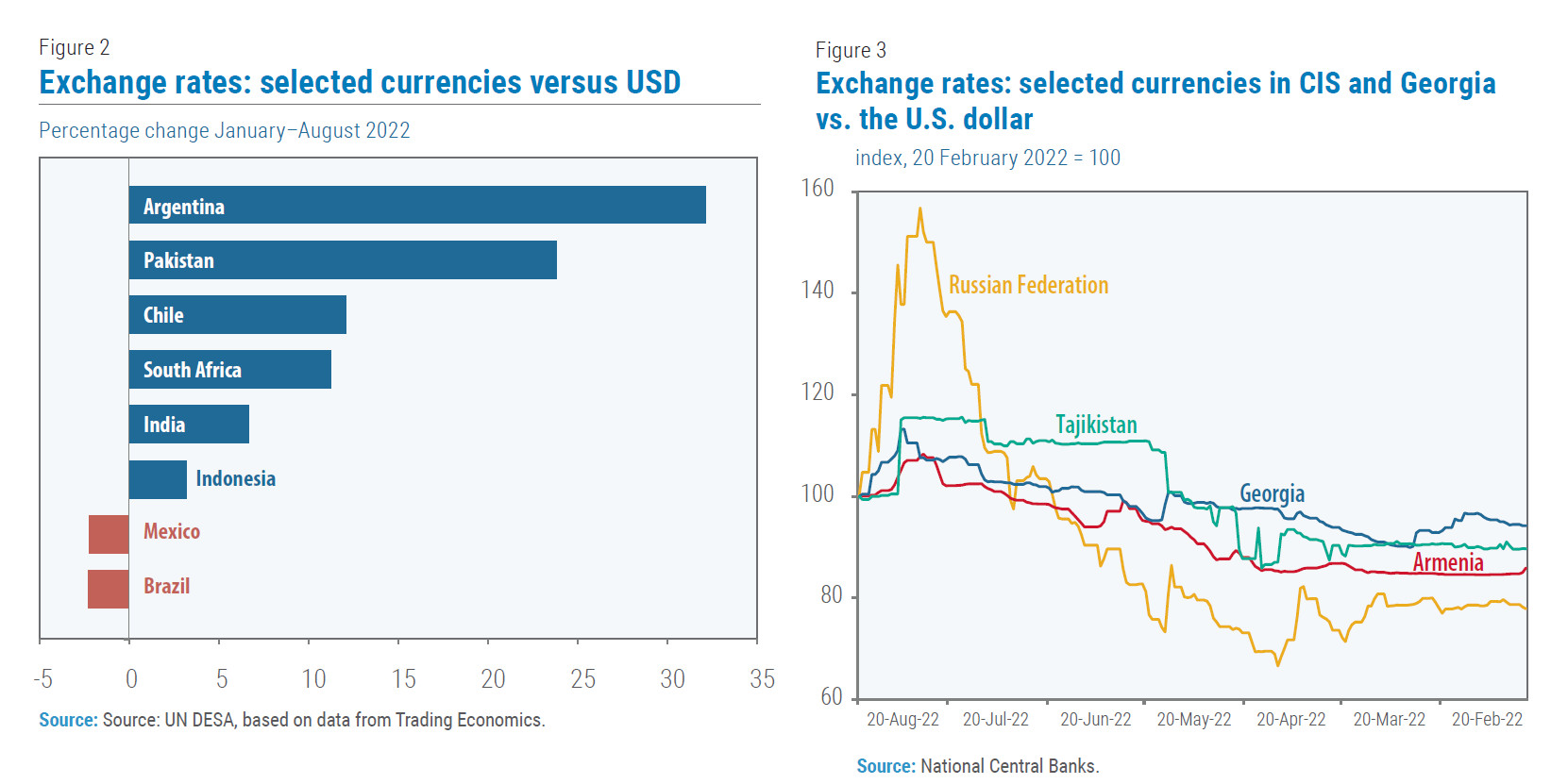

As the dollar appreciates, other currencies depreciate in comparison. This has led to significant weakening of currencies in many developing nations, including the Argentine peso, Pakistan rupee, and South African rand. Capital outflows, driven by investors seeking safer assets with higher yields in advanced economies, exacerbate this depreciation. Central banks in these countries often intervene by selling foreign exchange reserves to stabilize their currencies, but this can deplete already limited resources.

Mounting Debt Burdens

A significant portion of developing countries’ external debt is denominated in US dollars. As their local currencies weaken, the cost of servicing this debt rises proportionally, straining national budgets and hindering economic growth. This is particularly problematic for countries that rely on short-term borrowing to service long-term debt.

Rising Import Costs and Inflation

Most international trade is conducted in US dollars. A stronger dollar makes imports, particularly essential goods like food and energy, more expensive for developing countries. This fuels inflation, further eroding purchasing power and exacerbating existing economic vulnerabilities. The extent to which currency depreciation translates into higher domestic prices (the “pass-through effect”) varies depending on factors like trade openness and central bank credibility.

Slower Economic Growth

The combined effects of currency depreciation, rising debt burdens, and increased import costs stifle economic growth in developing countries. Higher interest rates in developed economies, implemented to combat inflation, also lead to increased borrowing costs globally, further hindering investment and economic expansion.

Bucking the Trend: Exceptions to the Rule

While the strong dollar presents challenges for many, some countries have experienced currency appreciation. The Russian ruble, for example, strengthened significantly despite economic sanctions and inflation, largely due to capital controls, export requirements, and a surge in energy prices. Similarly, some Commonwealth of Independent States (CIS) currencies benefited from capital inflows from Russia. However, these situations are often unique and may not be sustainable in the long term.

Conclusion: Navigating a Strong Dollar Environment

The strong US dollar poses significant challenges for developing countries, impacting their debt sustainability, inflation rates, and economic growth prospects. While some countries have managed to navigate these challenges effectively, the overall outlook remains concerning. The continued strength of the dollar underscores the need for developing nations to diversify their economies, manage debt prudently, and implement policies that mitigate the negative impacts of external shocks. The interconnectedness of the global economy means that fluctuations in the value of major currencies like the dollar have ripple effects across the world, highlighting the importance of international cooperation and sustainable economic policies.